- United States

- /

- Logistics

- /

- NYSE:EXPD

Should You Be Worried About Insider Transactions At Expeditors International of Washington, Inc. (NASDAQ:EXPD)?

We often see insiders buying up shares in companies that perform well over the long term. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So we'll take a look at whether insiders have been buying or selling shares in Expeditors International of Washington, Inc. (NASDAQ:EXPD).

What Is Insider Selling?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, rules govern insider transactions, and certain disclosures are required.

Insider transactions are not the most important thing when it comes to long-term investing. But it is perfectly logical to keep tabs on what insiders are doing. For example, a Columbia University study found that 'insiders are more likely to engage in open market purchases of their own company’s stock when the firm is about to reveal new agreements with customers and suppliers'.

Check out our latest analysis for Expeditors International of Washington

The Last 12 Months Of Insider Transactions At Expeditors International of Washington

In the last twelve months, the biggest single sale by an insider was when President Jeffrey Musser sold US$2.3m worth of shares at a price of US$75.95 per share. That means that even when the share price was slightly below the current price of US$76.20, an insider wanted to cash in some shares. While sellers have a variety of reasons for selling, this isn't particularly great to see. As a general rule we consider it to be discouraging when insiders are selling below the current price. We note that the biggest single sale was only 19.2% of Jeffrey Musser's holding.

In the last twelve months insiders netted US$4.0m for 52.83k shares sold. In total, Expeditors International of Washington insiders sold more than they bought over the last year. The sellers received a price of around US$74.89, on average. It's not particularly great to see insiders were selling shares around current prices. But we don't put too much weight on the insider selling, since sellers could have personal reasons. You can see the insider transactions (by individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: insiders have been buying them).

Expeditors International of Washington Insiders Are Selling The Stock

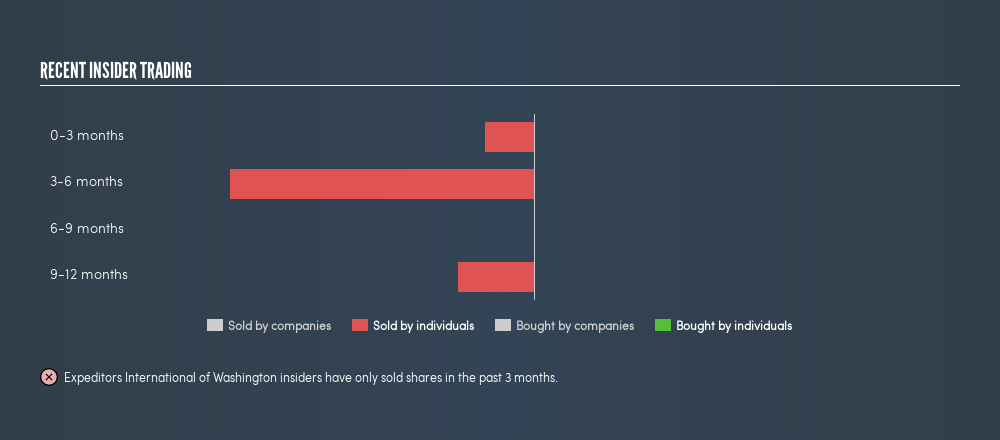

Over the last three months, we've seen significant insider selling at Expeditors International of Washington. In total, insiders dumped US$460k worth of shares in that time, and we didn't record any purchases whatsoever. This may suggest that some insiders think that the shares are not cheap.

Insider Ownership

For a common shareholder, it is worth checking how many shares are held by company insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Expeditors International of Washington insiders own about US$80m worth of shares. That equates to 0.6% of the company. We've certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

What Might The Insider Transactions At Expeditors International of Washington Tell Us?

Insiders sold Expeditors International of Washington shares recently, but they didn't buy any. Looking to the last twelve months, our data doesn't show any insider buying. On the plus side, Expeditors International of Washington makes money, and is growing profits. While insiders do own shares, they don't own a heap, and they have been selling. We'd think twice before buying! Of course, the future is what matters most. So if you are interested in Expeditors International of Washington, you should check out this freereport on analyst forecasts for the company.

Of course Expeditors International of Washington may not be the best stock to buy. So you may wish to see this freecollection of high quality companies.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:EXPD

Expeditors International of Washington

Provides logistics services in the Americas, North Asia, South Asia, Europe, and MAIR.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives