- United States

- /

- Transportation

- /

- NasdaqCM:DSKE

Such Is Life: How Daseke (NASDAQ:DSKE) Shareholders Saw Their Shares Drop 53%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Even the best stock pickers will make plenty of bad investments. And there's no doubt that Daseke, Inc. (NASDAQ:DSKE) stock has had a really bad year. In that relatively short period, the share price has plunged 53%. Daseke hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Even worse, it's down 23% in about a month, which isn't fun at all.

View our latest analysis for Daseke

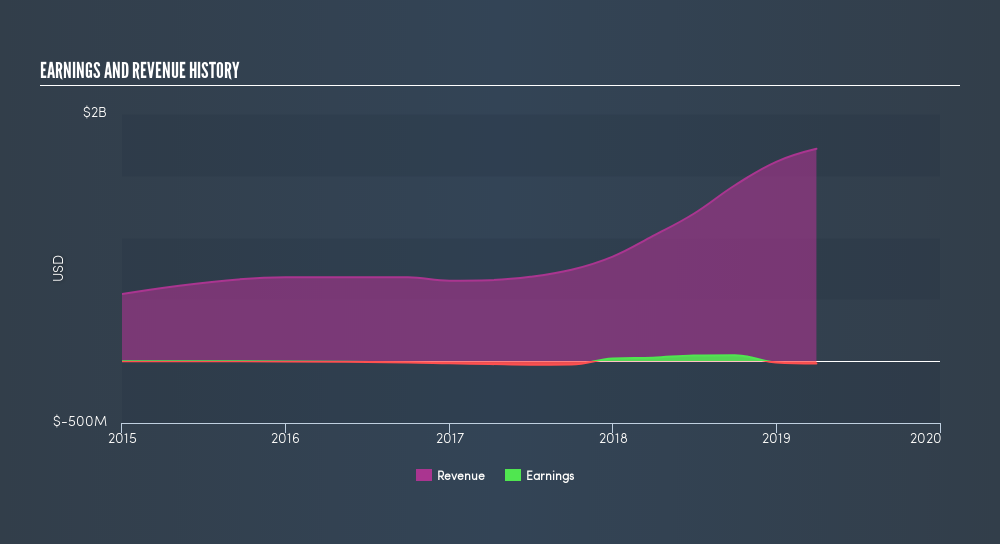

Daseke isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last twelve months, Daseke increased its revenue by 70%. That's well above most other pre-profit companies. In contrast the share price is down 53% over twelve months. Yes, the market can be a fickle mistress. This could mean hype has come out of the stock because the bottom line is concerning investors. Generally speaking investors would consider a stock like this less risky once it turns a profit. But when do you think that will happen?

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. If you are thinking of buying or selling Daseke stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

While Daseke shareholders are down 53% for the year, the market itself is up 1.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 2.7%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Daseke is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:DSKE

Daseke

Daseke, Inc. provides transportation and logistics solutions in the United States, Canada, and Mexico.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives