- United States

- /

- Logistics

- /

- NasdaqCM:CRGO

3 Promising Penny Stocks With Market Caps Under $200M

Reviewed by Simply Wall St

The United States stock market has recently closed on a high note, with major indices like the Nasdaq, S&P 500, and Dow Jones Industrial Average posting solid weekly and monthly gains. For investors willing to explore beyond the well-known giants, penny stocks—often representing smaller or newer companies—continue to offer intriguing opportunities. Despite being an older term, these stocks can present significant growth potential when backed by strong financials and sound fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.84 | $394.32M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.76 | $636.53M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.045 | $179.57M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $4.835 | $811.03M | ✅ 4 ⚠️ 2 View Analysis > |

| Global Self Storage (SELF) | $4.9599 | $56.24M | ✅ 5 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $2.08 | $25.98M | ✅ 4 ⚠️ 2 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.9601 | $6.97M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.39 | $76.81M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.90 | $11.33M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 363 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Freightos (CRGO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Freightos Limited operates a vendor-neutral booking and payment platform for international freight, with a market cap of $180.62 million.

Operations: The company's revenue is derived from two main segments: Platform, contributing $9.27 million, and Solutions, generating $17.88 million.

Market Cap: $180.62M

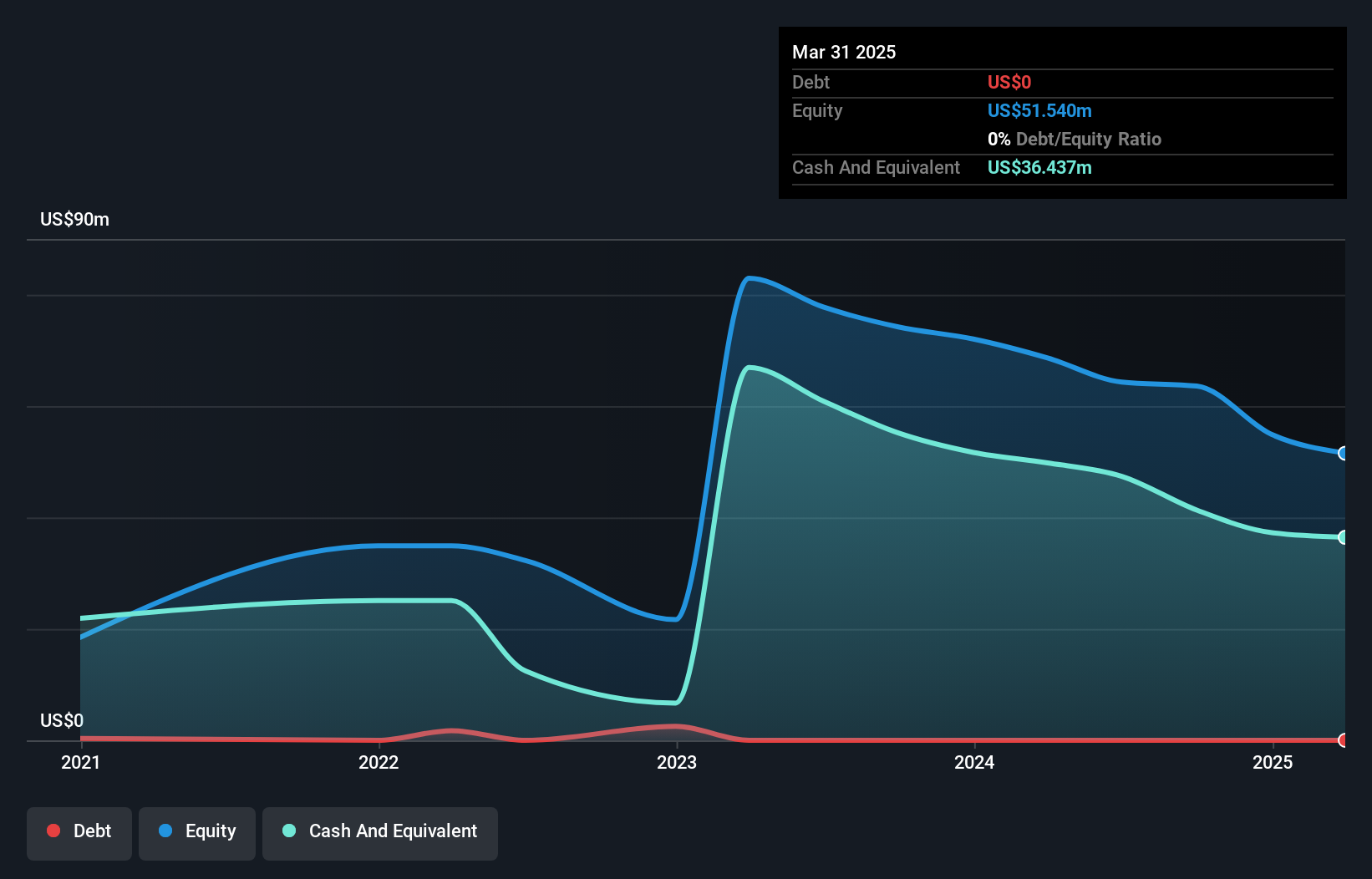

Freightos has shown promise in the volatile penny stock market, with a market cap of US$180.62 million and a diversified revenue stream from its Platform and Solutions segments. Despite being unprofitable, Freightos has reduced losses over the past five years and maintains a strong cash runway for over three years. Recent strategic partnerships with major players like Nippon Express and YTO Cargo Airlines enhance its digital freight solutions' reach globally. The management team is experienced, though the board's tenure suggests recent changes aimed at strengthening expertise in logistics technology, as evidenced by recent board appointments.

- Get an in-depth perspective on Freightos' performance by reading our balance sheet health report here.

- Gain insights into Freightos' future direction by reviewing our growth report.

PodcastOne (PODC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PodcastOne, Inc. operates as a podcast platform and publisher with a market cap of $59.16 million.

Operations: The company generates revenue of $53.95 million from its Internet Information Providers segment.

Market Cap: $59.16M

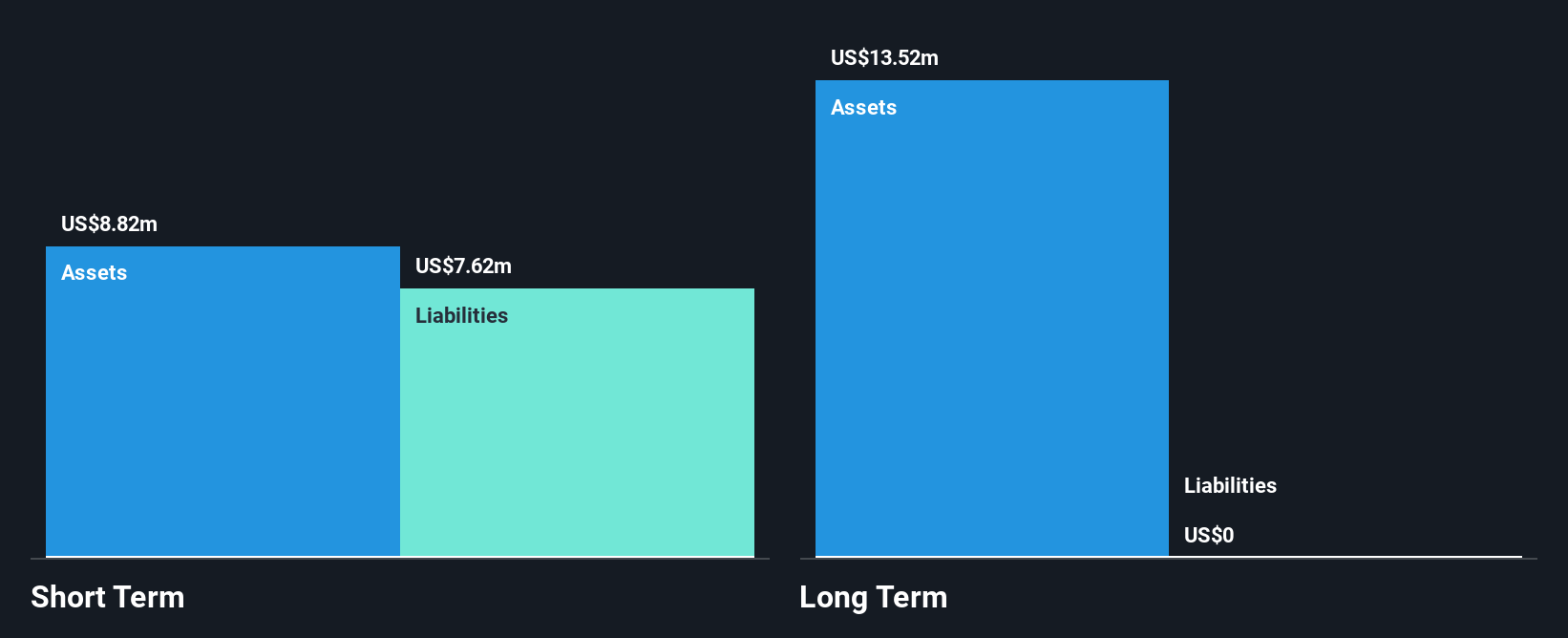

PodcastOne, Inc. navigates the penny stock landscape with a market cap of US$59.16 million and annual revenue of US$53.95 million from its podcast platform operations. Despite being unprofitable with increasing losses over five years, it maintains a positive cash flow and has no debt or long-term liabilities, ensuring a cash runway exceeding three years. Recent strategic agreements for exclusive sales rights to popular shows like "Beach Too Sandy, Water Too Wet" bolster its diverse content offerings across comedy and sports genres, potentially driving future revenue growth as it continues expanding its network of over 200 shows.

- Jump into the full analysis health report here for a deeper understanding of PodcastOne.

- Learn about PodcastOne's future growth trajectory here.

NameSilo Technologies (URLO.F)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NameSilo Technologies Corp. operates through its subsidiaries to offer domain name registration services across the United States, various regions in Asia, Australasia, and internationally, with a market cap of $101.07 million.

Operations: The company's revenue is primarily generated from domain registration and related services, totaling CA$61.25 million.

Market Cap: $101.07M

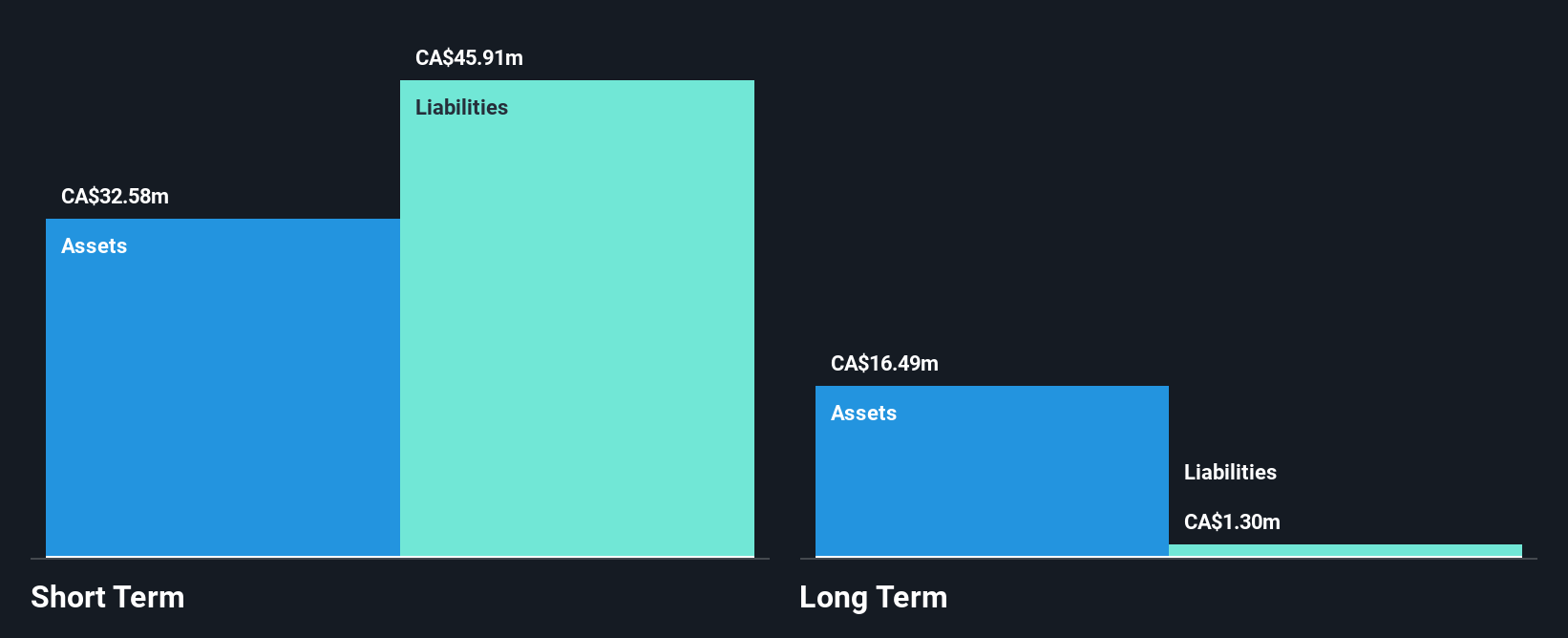

NameSilo Technologies Corp. stands out in the penny stock arena with a market cap of CA$101.07 million, driven by robust domain registration services generating CA$61.25 million in revenue. Recent earnings reveal improved net profit margins, with second-quarter sales climbing to CA$16.13 million from the previous year’s CA$13.18 million and net income reaching CA$0.81 million, up from CA$0.01 million a year ago. The company benefits from reduced debt levels and strong cash flow coverage of its liabilities, although short-term liabilities exceed short-term assets slightly, indicating potential liquidity challenges that need monitoring as it grows internationally.

- Dive into the specifics of NameSilo Technologies here with our thorough balance sheet health report.

- Gain insights into NameSilo Technologies' historical outcomes by reviewing our past performance report.

Key Takeaways

- Discover the full array of 363 US Penny Stocks right here.

- Contemplating Other Strategies? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CRGO

Freightos

Operates a vendor-neutral booking and payment platform for international freight.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives