- United States

- /

- Logistics

- /

- NasdaqGS:CHRW

Should C.H. Robinson’s (CHRW) New AI Logistics Platform Change Investors’ Views on Its Trade Lane Strategy?

Reviewed by Simply Wall St

- C.H. Robinson Worldwide recently launched an AI-powered cross-border logistics service that combines freight consolidation in Mexico, customs brokerage, bonded warehousing, and optimized delivery across the US and Canada, offering shippers substantial cost savings and up to 48 hours earlier freight visibility.

- This new service addresses long-standing inefficiencies at the US-Mexico border by enabling cost-effective less-than-truckload consolidation and providing tariff mitigation benefits for industries facing elevated trade barriers.

- Next, we'll assess how this AI-driven logistics platform could reshape C.H. Robinson's competitive position, especially in complex North American trade lanes.

Find companies with promising cash flow potential yet trading below their fair value.

C.H. Robinson Worldwide Investment Narrative Recap

To be a shareholder in C.H. Robinson Worldwide, you need to believe in the company's ability to deliver sustained efficiency gains and margin improvements through its ongoing investment in AI-driven and integrated logistics solutions. The recent launch of its AI-powered cross-border logistics service directly targets cost savings and freight visibility, two important short-term catalysts, while also reinforcing its competitive advantages in high-complexity trade environments. However, if rivals rapidly close the technology gap, the competitive moat created by these innovations may narrow faster than expected. The company's earlier rollout of the Always-on Logistics Planner, a premium service blending AI workforce automation with continuous execution quality, is especially relevant. Both this and the new cross-border platform demonstrate management's belief that embedding advanced digital capabilities is key to unlocking incremental profit growth and resisting margin pressure from increased competition. On the other hand, investors should be aware that if trade policy uncertainty lifts and tariffs ease, the valuable high-margin customs revenue stream could quickly...

Read the full narrative on C.H. Robinson Worldwide (it's free!)

C.H. Robinson Worldwide's outlook anticipates $18.4 billion in revenue and $677.2 million in earnings by 2028. This is based on a forecast annual revenue growth rate of 2.6% and an increase in earnings of $142.9 million from the current $534.3 million.

Uncover how C.H. Robinson Worldwide's forecasts yield a $118.88 fair value, a 13% downside to its current price.

Exploring Other Perspectives

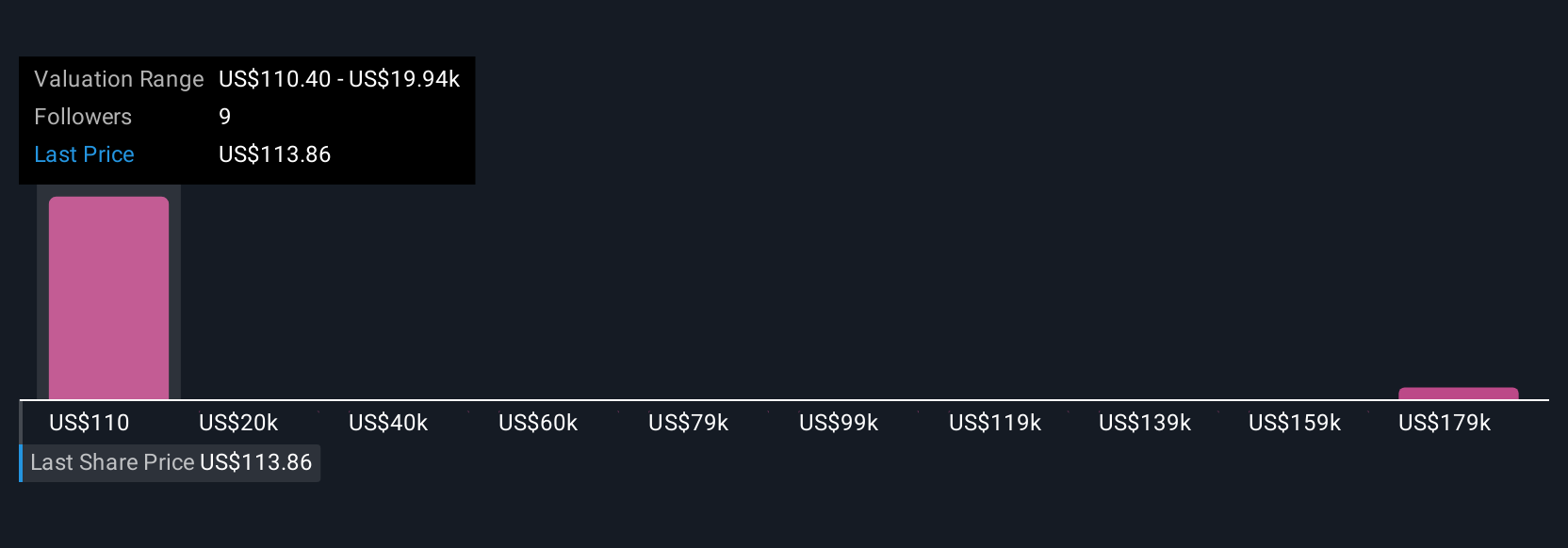

Three unique fair value estimates from the Simply Wall St Community range from US$118.88 to an outlier of US$198,416.56. While some investors see extreme upside, remember expanding AI logistics may not shield earnings if trade conditions simplify, explore how others view these risks and opportunities.

Explore 3 other fair value estimates on C.H. Robinson Worldwide - why the stock might be worth 13% less than the current price!

Build Your Own C.H. Robinson Worldwide Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your C.H. Robinson Worldwide research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free C.H. Robinson Worldwide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate C.H. Robinson Worldwide's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHRW

C.H. Robinson Worldwide

Provides freight transportation and related logistics and supply chain services in the United States and internationally.

Solid track record established dividend payer.

Market Insights

Community Narratives