- United States

- /

- Marine and Shipping

- /

- NasdaqGS:CCEC

Is CCEC’s (CCEC) Vessel Sale and Debt Repayment a Turning Point for Its Balance Sheet Strategy?

Reviewed by Sasha Jovanovic

- Capital Clean Energy Carriers Corp. recently announced the sale of the M/V Buenaventura Express, a 142,411 DWT, eco container vessel built in 2023, with the agreement signed in October 2025 and vessel delivery expected in early 2026.

- The expected book gain of US$4.4 million and focus on using cash proceeds to pay down US$84.4 million in debt underscore management’s efforts to strengthen the balance sheet and enhance financial flexibility.

- We’ll explore how this vessel sale and debt reduction may influence the company’s financial stability and long-term investment case.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Capital Clean Energy Carriers Investment Narrative Recap

To be a shareholder in Capital Clean Energy Carriers, you need to believe that the company’s specialized fleet and long-term clean energy shipping contracts will drive resilient growth, despite near-term industry volatility. The sale of the M/V Buenaventura Express and associated debt reduction is a positive, but it does not fundamentally change the most important short-term catalyst for the business: securing long-term charters for new specialized vessels. The biggest risk remains exposure to floating interest rates, which could still pressure margins even as debt falls.

Among recent announcements, the ongoing stream of quarterly dividends, such as the US$0.15 per share declared in October, shows a continued focus on returning value to shareholders, underpinned by stable earnings and contract backlog. This reliability is closely tied to the company’s core catalyst: the need for multi-year policy and industry support for clean fuel shipping, as new contracts and vessel employment drive future revenue growth.

However, while management’s balance sheet actions may offer some reassurance, investors should also be alert to the fact that a sizable portion of funding costs remains at floating interest rates…

Read the full narrative on Capital Clean Energy Carriers (it's free!)

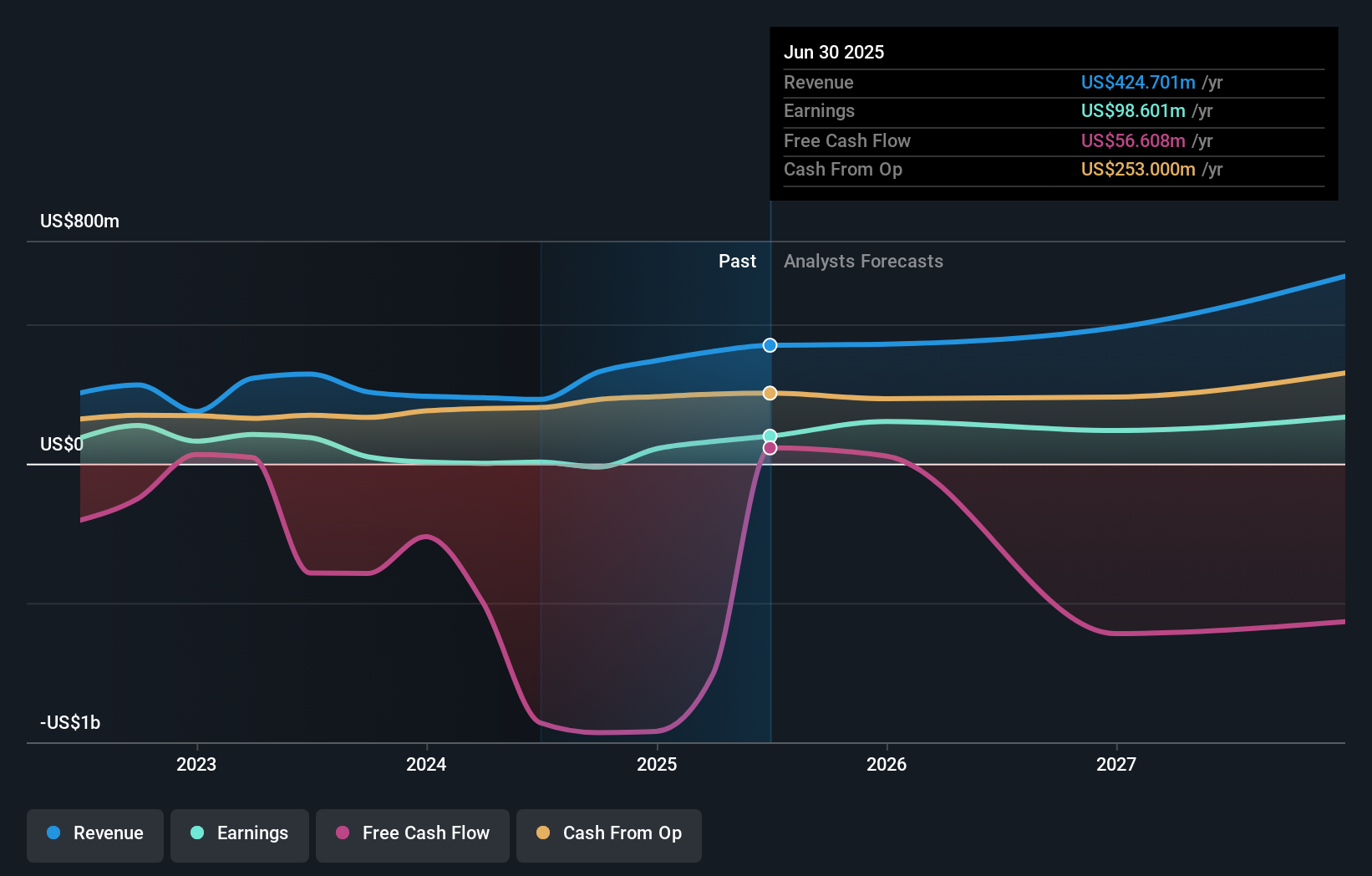

Capital Clean Energy Carriers is forecast to reach $683.8 million in revenue and $161.0 million in earnings by 2028. This outlook assumes a 17.2% annual revenue growth rate and a $62.4 million increase in earnings from the current level of $98.6 million.

Uncover how Capital Clean Energy Carriers' forecasts yield a $25.80 fair value, a 36% upside to its current price.

Exploring Other Perspectives

All ten fair value estimates from the Simply Wall St Community cluster at US$25.80, reflecting uniform optimism before the latest sale news. Yet with 80 percent of funding costs exposed to floating rates, your own outlook on interest rate moves may set you apart from the crowd.

Explore another fair value estimate on Capital Clean Energy Carriers - why the stock might be worth just $25.80!

Build Your Own Capital Clean Energy Carriers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capital Clean Energy Carriers research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Capital Clean Energy Carriers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capital Clean Energy Carriers' overall financial health at a glance.

No Opportunity In Capital Clean Energy Carriers?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCEC

Capital Clean Energy Carriers

A shipping company, provides marine transportation services in Greece.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026