- United States

- /

- Marine and Shipping

- /

- NasdaqGS:CCEC

Assessing the Valuation of Capital Clean Energy Carriers (CCEC) Following Martin Houston’s Appointment to the Board

Reviewed by Kshitija Bhandaru

Capital Clean Energy Carriers (NasdaqGS:CCEC) just made a move that is getting investors’ attention, even if it is not a splashy acquisition or earnings surprise. At its Annual Meeting, the company welcomed Martin Houston to its Board of Directors. Houston is a heavyweight in the global energy space, with decades at the helm of leading energy companies and a track record of guiding corporate strategy across industries and continents. His appointment marks a changing of the guard and signals CCEC’s intent to strengthen its leadership as the clean transport sector continues to evolve.

The market’s response has been measured but notable. After a mixed few months, the stock has jumped over 5% in the past month, recouping ground from a dip in the quarter and adding to a 24% gain so far this year. Houston’s arrival follows CCEC’s inclusion in the S&P Global BMI Index and a year in which the stock has returned 26%, reinforcing steady momentum. For investors, this blend of stable governance shifts and growth signals is likely top of mind as they weigh the coming quarters.

So the question for investors now is this: does Martin Houston’s arrival set the stage for even greater upside, or has the market already anticipated future gains in CCEC’s current price?

Most Popular Narrative: 12% Undervalued

According to the most widely followed narrative, Capital Clean Energy Carriers is currently viewed as undervalued, with its fair value estimate exceeding the latest share price by double digits. This outlook centers around strong growth expectations and solidified long-term contracts that underpin forward-looking earnings forecasts.

"The company is set to benefit from strong multi-year policy support for clean energy transportation and heightened demand for LNG and other low or zero-carbon fuels. This is evidenced by a surge in new long-term sale and purchase agreements (SPAs) and live tenders out to 2028, which underpin future revenue growth and earnings visibility."

Want to know why the consensus sees upside here? The secret sauce could be aggressive assumptions around revenue momentum and operating margins. Ever wondered what future profit profile justifies such a bullish target for a shipping stock? The details behind this calculation may surprise you, especially the bold projections that drive that premium fair value.

Result: Fair Value of $25.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a heavy reliance on floating-rate debt and the need for new long-term contracts could quickly challenge this upbeat outlook if market conditions shift.

Find out about the key risks to this Capital Clean Energy Carriers narrative.Another View: Industry Comparison

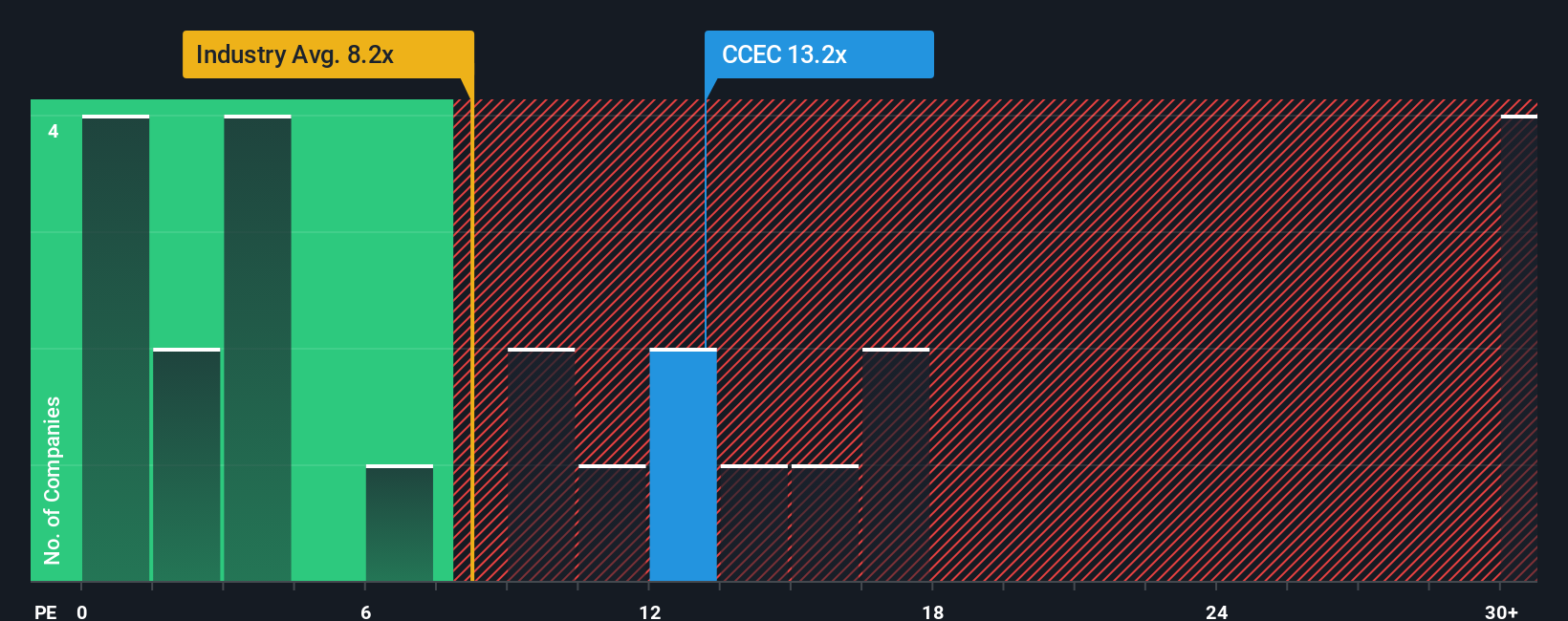

Taking a step back, one common industry yardstick suggests CCEC might not be a bargain right now. Its valuation looks high compared to typical US shipping stocks. Could this premium be justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Capital Clean Energy Carriers Narrative

If our perspective does not align with your own, or you would rather dive into the numbers firsthand, you can craft your own investment narrative in just minutes. Do it your way

A great starting point for your Capital Clean Energy Carriers research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Break out of your usual watchlist and get ahead of emerging market trends. These smart filters can help uncover hidden gems and fast-movers you do not want to miss.

- Capitalize on strong financials by seeking penny stocks with strong financials. These companies are powering innovation and growth in overlooked corners of the market.

- Spot the leaders of tomorrow in tech by scanning AI penny stocks. These firms are transforming industries with artificial intelligence breakthroughs.

- Catch untapped potential by targeting undervalued stocks based on cash flows trading at attractive prices before they receive mainstream attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCEC

Capital Clean Energy Carriers

A shipping company, provides marine transportation services in Greece.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives