- United States

- /

- Marine and Shipping

- /

- NasdaqGS:CCEC

Assessing Capital Clean Energy Carriers (CCEC) Valuation Following Dividend, Reinvestment Plan, and Fleet Expansion

Reviewed by Simply Wall St

Capital Clean Energy Carriers (NasdaqGS:CCEC) just declared a $0.15 per share cash dividend for the third quarter, accompanied by the launch of a Dividend Reinvestment Plan. These moves highlight a focus on steady shareholder value and disciplined capital management.

See our latest analysis for Capital Clean Energy Carriers.

Alongside its dividend announcement and reinvestment plan, Capital Clean Energy Carriers has quietly built up momentum, with its 21.2% year-to-date share price return far outpacing most sector peers. Multi-year total shareholder return remains impressive at 73% over three years and 257% over five. News of an expanding vessel fleet, steady debt reduction from recent asset sales, and a board refresh have further reinforced optimism about its growth trajectory and evolving valuation picture.

If you’re curious about what other companies are showing strong growth and management alignment, it’s worth exploring fast growing stocks with high insider ownership.

With shares now trading about 16% below consensus analyst targets, the question for investors is whether Capital Clean Energy Carriers is currently undervalued or if its future growth is already fully reflected in the price.

Most Popular Narrative: 14.2% Undervalued

With the most widely followed narrative setting a fair value target of $25.80, Capital Clean Energy Carriers’ latest closing price of $22.15 suggests meaningful upside. This perspective is grounded in forecasts for brisk revenue expansion and a growing earnings base over the next few years.

The firm's ongoing investment in next-generation, ESG-compliant LNG and multi-gas carriers positions it to access a larger institutional investor pool and secure attractive financing. This supports capital flexibility and lowers average funding costs, which could have a positive impact on net margins over time as rates decline.

Want to know why this clean shipping pioneer is priced for growth? The secret behind its current valuation is a bold bet on margin expansion, premium charter rates, and stronger future profit multiples. If you’re curious which assumptions turn this forecast into a compelling opportunity, the full narrative lays out the surprising details that inform the consensus fair value.

Result: Fair Value of $25.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising interest rates and possible contract delays could compress margins. This may challenge the optimistic outlook for Capital Clean Energy Carriers’ future earnings progression.

Find out about the key risks to this Capital Clean Energy Carriers narrative.

Another View: Peer and Industry Comparisons

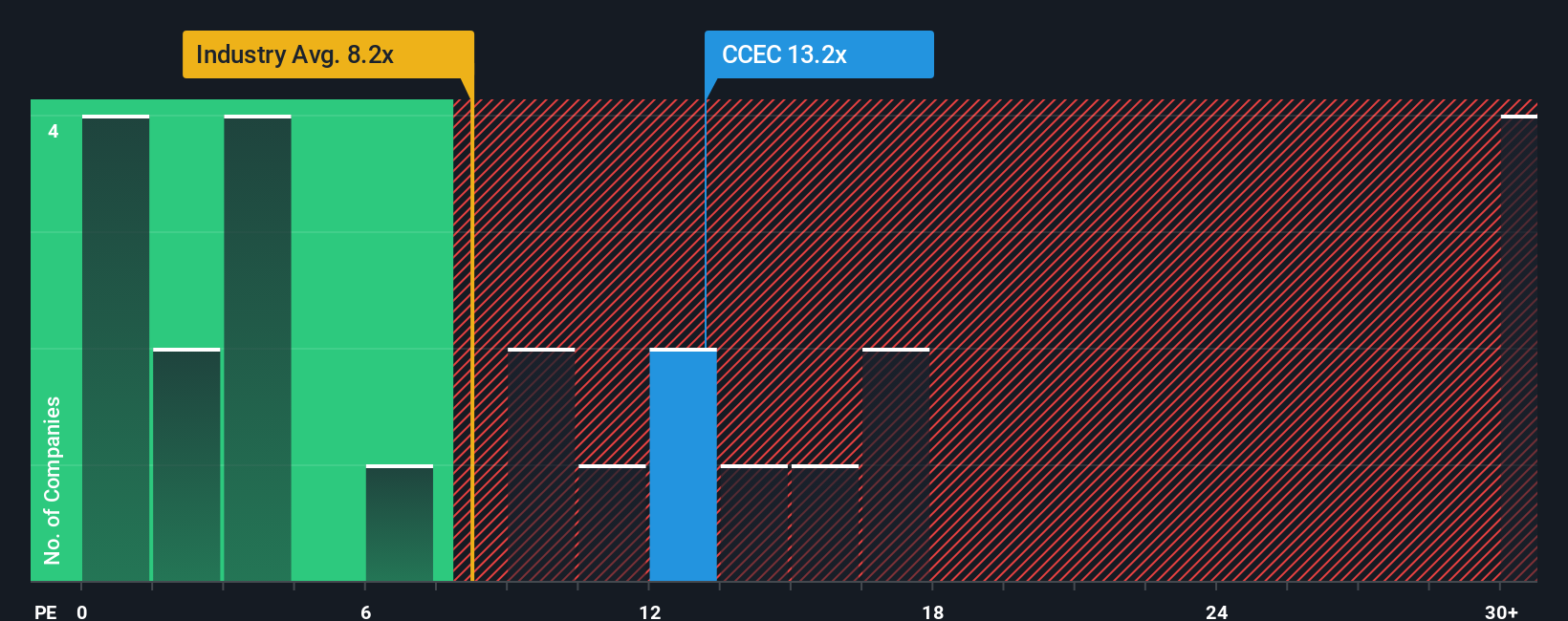

Looking at valuation using the price-to-earnings ratio, Capital Clean Energy Carriers is trading at 13.2x earnings. This stands above the US Shipping industry average of 7.1x and the peer group average of 3.7x, and it is also higher than its own fair ratio of 11.5x. These gaps suggest that while some investors expect sustained growth, the stock carries more valuation risk if industry or company momentum slows. Will the market maintain this optimism, or could multiples contract if growth expectations fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Capital Clean Energy Carriers Narrative

If you want to dive deeper or would rather piece together your own perspective, you can build a custom narrative in under three minutes. Do it your way.

A great starting point for your Capital Clean Energy Carriers research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Act now to uncover new opportunities. Missing these hand-picked choices could mean leaving potential returns on the table. Let your next smart move start here.

- Tap into the growth wave of artificial intelligence by reviewing these 27 AI penny stocks, which are shaping breakthroughs across industries.

- Boost your portfolio's income with steady payers found through these 17 dividend stocks with yields > 3%, offering robust yields and stability.

- Harness undervalued gems positioned for strong cash flow upside by evaluating these 881 undervalued stocks based on cash flows before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCEC

Capital Clean Energy Carriers

A shipping company, provides marine transportation services in Greece.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives