- United States

- /

- Transportation

- /

- NasdaqGS:CAR

Should Avis Budget Group’s (CAR) Premium Launch Signal a Shift in Its Long-Term Brand Strategy?

Reviewed by Sasha Jovanovic

- Avis Budget Group recently launched Avis First, a premium concierge-style car rental service, at major European airports including Rome Fiumicino, Geneva International, and Zurich Kloten, providing travelers with personalized service and guaranteed high-end BMW vehicles.

- This marks a significant step in the company's focus on innovation and premium customer experiences, with plans to expand Avis First to additional European and global locations in the near future.

- We'll now explore how the introduction of seamless, high-touch premium service with Avis First could reshape Avis Budget Group's investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Avis Budget Group Investment Narrative Recap

Owning shares in Avis Budget Group means believing the company can successfully differentiate itself by targeting premium, higher-margin segments and building a digital, tech-enabled mobility platform. While the launch of Avis First signals renewed efforts to capture value from premiumization trends and could support near-term optimism on revenue opportunities, the most pressing catalyst remains the upcoming Q3 earnings report. Near-term risks such as operational challenges or aggressive competitive responses in the premium car rental niche have not shifted materially as a result of this announcement.

The recently announced partnership with Waymo to manage autonomous ride-hailing fleets in Dallas offers an intriguing complement to Avis First by expanding the brand’s exposure to technology-driven mobility solutions. This aligns closely with market expectations for operational innovation and potential new revenue streams outside of the traditional rental model, positioning Avis to participate early in the emerging autonomous ecosystem.

However, in contrast to these opportunities, investors should be aware that the pace of digital transformation and execution risks could still...

Read the full narrative on Avis Budget Group (it's free!)

Avis Budget Group's outlook anticipates $12.2 billion in revenue and $1.0 billion in earnings by 2028. This scenario assumes annual revenue growth of 1.4% and a $3.2 billion increase in earnings from the current loss of $-2.2 billion.

Uncover how Avis Budget Group's forecasts yield a $148.00 fair value, in line with its current price.

Exploring Other Perspectives

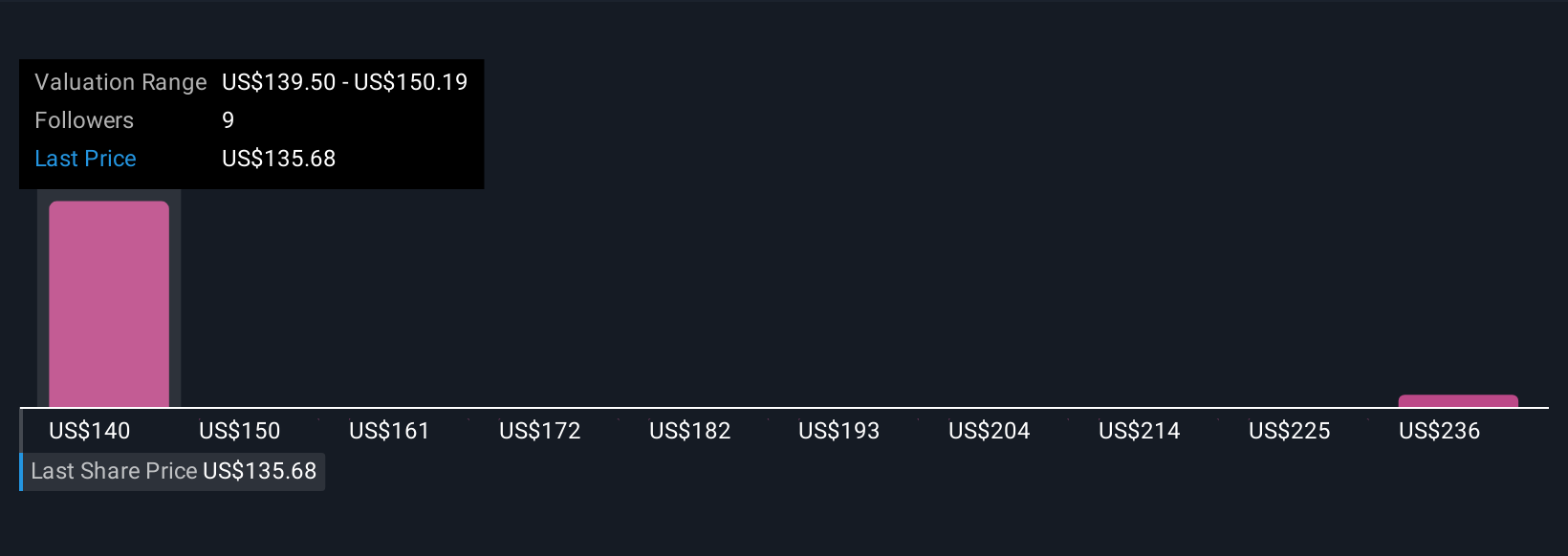

Private investors in the Simply Wall St Community value Avis Budget Group anywhere from US$148 to US$246.44 based on two unique analyses. While optimism centers on innovation and premiumization, views differ widely so consider how execution risk and competition could affect future returns.

Explore 2 other fair value estimates on Avis Budget Group - why the stock might be worth as much as 62% more than the current price!

Build Your Own Avis Budget Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avis Budget Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Avis Budget Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avis Budget Group's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CAR

Avis Budget Group

Provides car and truck rentals, car sharing, and ancillary products and services to businesses and consumers in the Americas, Europe, the Middle East and Africa, Asia, and Australasia.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives