- United States

- /

- Transportation

- /

- NasdaqGS:ARCB

ArcBest (ARCB) Valuation Update as Board Changes and Lowered Estimates Draw Focus Ahead of Q3 2025 Results

Reviewed by Simply Wall St

ArcBest (ARCB) is set to announce its third quarter 2025 results, following recent board changes and lowered earnings estimates for both this year and next. Investors are watching closely as these developments unfold.

See our latest analysis for ArcBest.

ArcBest’s share price has faced headwinds this year, with a year-to-date decline of 22.4% and a total shareholder return of -31.0% over the past twelve months. These figures reflect shifting sentiment as leadership changes and softening expectations have come to the fore. While the short-term momentum is clearly fading, long-term investors have still seen a strong 97% total return over five years. This serves as a reminder that perspective matters even when the near-term outlook feels uneasy.

If you’re interested in broadening your view beyond ArcBest, now’s a great time to discover fast growing stocks with high insider ownership

With ArcBest trading well below analyst price targets and sentiment at a low point, the question remains: does the current share price reflect all the recent challenges, or is there an overlooked opportunity for future growth?

Most Popular Narrative: 19.5% Undervalued

ArcBest’s most followed narrative places its fair value at $88.67, which stands well above the last closing price of $71.39. This gap has fueled debate among investors about whether the market is missing something in the company’s evolving outlook.

The company is seeing strong success capturing new core LTL customers and expanding its pipeline, particularly through investments in sales and integrated logistics solutions. These efforts set the stage for future shipment growth and top-line revenue acceleration as e-commerce and domestic supply chain complexity increase.

Wondering why this new fair value towers above today’s price? It’s not just about old-school growth rates. The narrative is built on bold assumptions about margin resilience and a future profit multiple that could surprise even the bulls. Find out which fundamental shifts are turning heads among the narrative followers.

Result: Fair Value of $88.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing freight market weakness and persistent labor cost pressures could quickly undermine the optimism supporting the current undervalued narrative for ArcBest.

Find out about the key risks to this ArcBest narrative.

Another View: Multiples Tell a Different Story

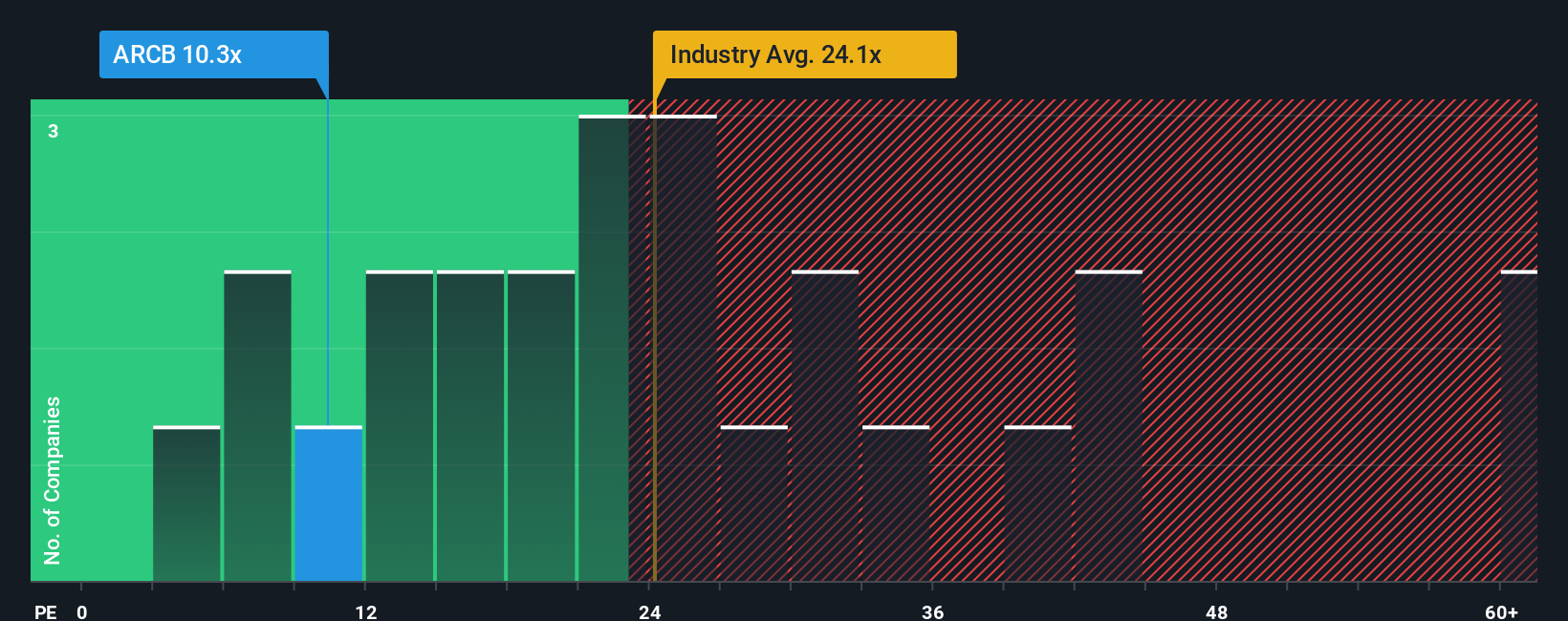

Looking at ArcBest’s valuation through the lens of its price-to-earnings ratio, the picture shifts. While currently trading at 10.3 times earnings, this is much lower than both the industry average of 27x and the peer average of 42.5x. However, it is still above the fair ratio analysts say the market could move toward, which is 9x. So, although ArcBest looks inexpensive next to its competitors, there is a risk the market will not reward the stock with a higher multiple until fundamentals improve further. Will investors wait for that turning point, or is the discount set to persist?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ArcBest Narrative

If you want to dig deeper or challenge the story, you can shape your own ArcBest outlook using our tools in just a few minutes. Do it your way

A great starting point for your ArcBest research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t just stop with ArcBest when your next portfolio winner might be right around the corner. Check out these standout stock ideas many investors overlook:

- Capitalize on market inefficiencies by targeting value deals through these 840 undervalued stocks based on cash flows before the crowd catches on.

- Benefit from regular income streams by zeroing in on these 20 dividend stocks with yields > 3% that consistently deliver strong yields over 3%.

- Ride the early wave of innovation by tapping into these 26 AI penny stocks working at the forefront of artificial intelligence advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARCB

ArcBest

An integrated logistics company, provides ground, air, and ocean transportation solutions worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives