- United States

- /

- Airlines

- /

- NasdaqGS:ALGT

Is Allegiant Travel’s (ALGT) Accelerated Debt Repayment Strengthening Its Case for Greater Financial Flexibility?

Reviewed by Sasha Jovanovic

- On October 15, 2025, Allegiant Travel Company repaid US$120.0 million of its senior secured notes due August 2027 and has now prepaid approximately US$301.34 million of debt principal through early voluntary repayments, excluding scheduled payments.

- This substantial debt reduction indicates deliberate balance sheet management and could help lower future interest expenses for Allegiant Travel.

- We'll examine how Allegiant's accelerated debt prepayment could strengthen its investment narrative and potential focus on financial flexibility.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Allegiant Travel Investment Narrative Recap

To be a shareholder in Allegiant Travel, you need to believe in the resilience of value-focused leisure travel even as demand signals remain mixed and the airline sector faces cost challenges. The recent US$120.0 million early debt repayment underscores Allegiant's commitment to financial flexibility, but given persistent demand uncertainty and ongoing earnings volatility, the biggest short-term catalyst, securing profitable load factors during peak periods, remains unchanged, as does the pressing risk around uneven profitability and discretionary travel trends.

Allegiant's recent revenue guidance increase for third quarter 2025 is particularly relevant as it directly ties to load factors and cost management, both central to evaluating whether the company can offset revenue risks and maintain momentum into upcoming quarters. This guidance, alongside debt repayment, will be closely watched as third-quarter financial results approach, giving investors more clues about the effectiveness of Allegiant’s current strategies.

Yet for those tracking Allegiant, it is important to contrast recent balance sheet improvement with the reality that airline profitability remains highly sensitive to...

Read the full narrative on Allegiant Travel (it's free!)

Allegiant Travel's narrative projects $3.1 billion revenue and $267.8 million earnings by 2028. This requires 6.0% yearly revenue growth and a $553.9 million increase in earnings from the current $-286.1 million.

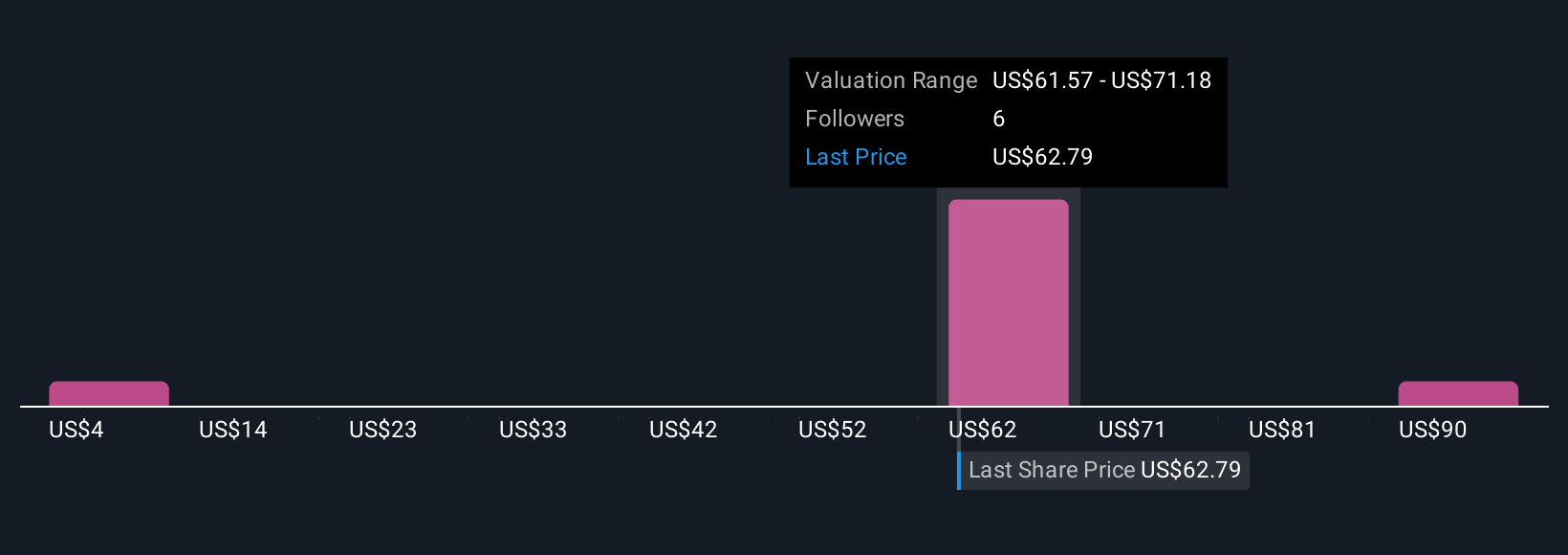

Uncover how Allegiant Travel's forecasts yield a $67.67 fair value, in line with its current price.

Exploring Other Perspectives

All 1 fair value estimate from the Simply Wall St Community places Allegiant at US$67.67 per share, showing unified sentiment. However, many continue to watch uneven profitability and discretionary travel demand as key factors that may shape outcomes for those holding airline stocks.

Explore another fair value estimate on Allegiant Travel - why the stock might be worth just $67.67!

Build Your Own Allegiant Travel Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allegiant Travel research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Allegiant Travel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allegiant Travel's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALGT

Allegiant Travel

A leisure travel company, provides travel and leisure services and products to residents of under-served cities in the United States.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives