- United States

- /

- Airlines

- /

- NasdaqGS:AAL

Will Weaker Guidance and Soft Demand Shift American Airlines’ (AAL) Outlook on Profitability?

Reviewed by Simply Wall St

- American Airlines Group recently issued its third-quarter and full-year 2025 guidance, projecting third-quarter revenue to range from a 2% decline to a 1% increase year-over-year and outlining expectations for a possible loss per share between US$0.10 and US$0.60 for the quarter.

- A key insight is that, despite posting record second-quarter revenue and ongoing international demand, challenges such as high debt, rising labor costs, and cautious demand expectations are weighing on the company’s earnings outlook and financial flexibility.

- We will examine how American's expectation of a potential quarterly loss and soft domestic demand trends impact its future investment case.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

American Airlines Group Investment Narrative Recap

To hold American Airlines Group shares, an investor must believe in a sustained recovery for US airline demand and the company’s ability to manage costs despite structural headwinds. The recent guidance update, with a forecast for possible Q3 losses and tepid revenue growth, directly impacts the outlook for domestic recovery, a near-term catalyst, while reaffirming ongoing margin pressures from labor expenses as a key risk. If the company’s outlook for improving domestic demand does not materialize, the risk profile could escalate, but this news mainly confirms existing challenges without a material shift to either side.

American’s announcement of a planned delivery of 50 new aircraft this year is particularly relevant, reinforcing its ongoing commitment to fleet renewal. This expansion aligns directly with both its cost-management efforts for newer, more efficient planes and its longer-term strategies for capturing incremental demand, but it also amplifies near-term financial strain given high capital needs alongside uncertain earnings.

In contrast, investors should be aware that high debt levels and capital commitments could quickly amplify downside risk if...

Read the full narrative on American Airlines Group (it's free!)

American Airlines Group's outlook anticipates $61.7 billion in revenue and $1.8 billion in earnings by 2028. This projection is based on an annual revenue growth rate of 4.4% and an earnings increase of $1.2 billion from current earnings of $567 million.

Uncover how American Airlines Group's forecasts yield a $13.36 fair value, a 14% upside to its current price.

Exploring Other Perspectives

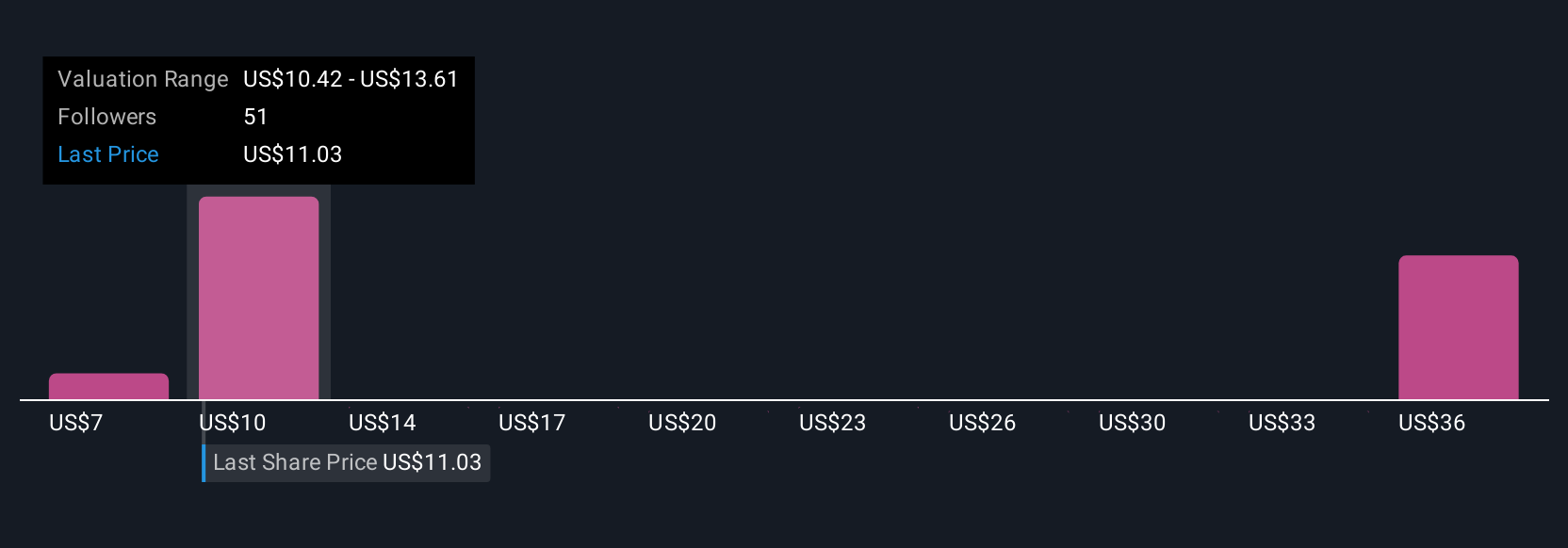

Twelve Simply Wall St Community members estimate AAL’s fair value from US$7.23 to US$35.36 per share. Against this wide range, margin pressure from labor costs continues to influence most market conversations about future upside or downside. Explore these viewpoints for fresh ideas.

Explore 12 other fair value estimates on American Airlines Group - why the stock might be worth over 3x more than the current price!

Build Your Own American Airlines Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Airlines Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free American Airlines Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Airlines Group's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAL

American Airlines Group

Through its subsidiaries, operates as a network air carrier in the United States, Latin America, Atlantic, and Pacific.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives