- United States

- /

- Airlines

- /

- NasdaqGS:AAL

Is American Airlines Ready for Takeoff After Recent 3% Stock Rebound in 2025?

Reviewed by Bailey Pemberton

If you have American Airlines Group on your radar, you are not alone. Many investors are trying to figure out whether this battered airline stock is a bumpy ride or just about to take off. After a pretty volatile year, the stock saw a modest 3% lift last week, but still sits over 30% lower year-to-date. That is a major dip, even for an industry well-known for turbulence. Over both one year and longer three- and five-year periods, American Airlines Group has posted negative total returns, keeping cautious investors on their toes.

Much of the recent volatility has tracked with big swings in oil prices and shifting sentiment about travel demand in the US. As broader market uncertainty flares up, airline stocks often get caught in the crosswinds. American Airlines is no exception. This see-saw in price can send mixed messages, but sometimes, it creates openings for long-term investors.

So, is American Airlines Group a bargain hiding in plain sight, or is the market simply recognizing ongoing risks? When we run the stock through six key valuation checks, the company is undervalued in four of them, with a valuation score of 4 out of 6. That is solid, but what does it actually mean for your portfolio?

Let’s break down how each valuation approach paints a picture of American Airlines Group’s potential and why some investors choose to dig even deeper than the usual methods before making a move.

Why American Airlines Group is lagging behind its peers

Approach 1: American Airlines Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation method that estimates what a company's shares should be worth today based on projections of its future cash flows, which are then discounted back into today's dollars. This approach looks ahead by forecasting how much cash the company is expected to generate, taking into account both analyst estimates and longer-term projections, and calculates their present value.

For American Airlines Group, the current Free Cash Flow stands at approximately $1.48 Billion. Analyst estimates provide projections up to 2028, where free cash flow is anticipated to reach $1.58 Billion. Beyond that, Simply Wall St extends the forecast out to 2035, with extrapolated figures that climb past $4 Billion. All estimates are given in US dollars and show a trajectory of consistent growth over the next decade.

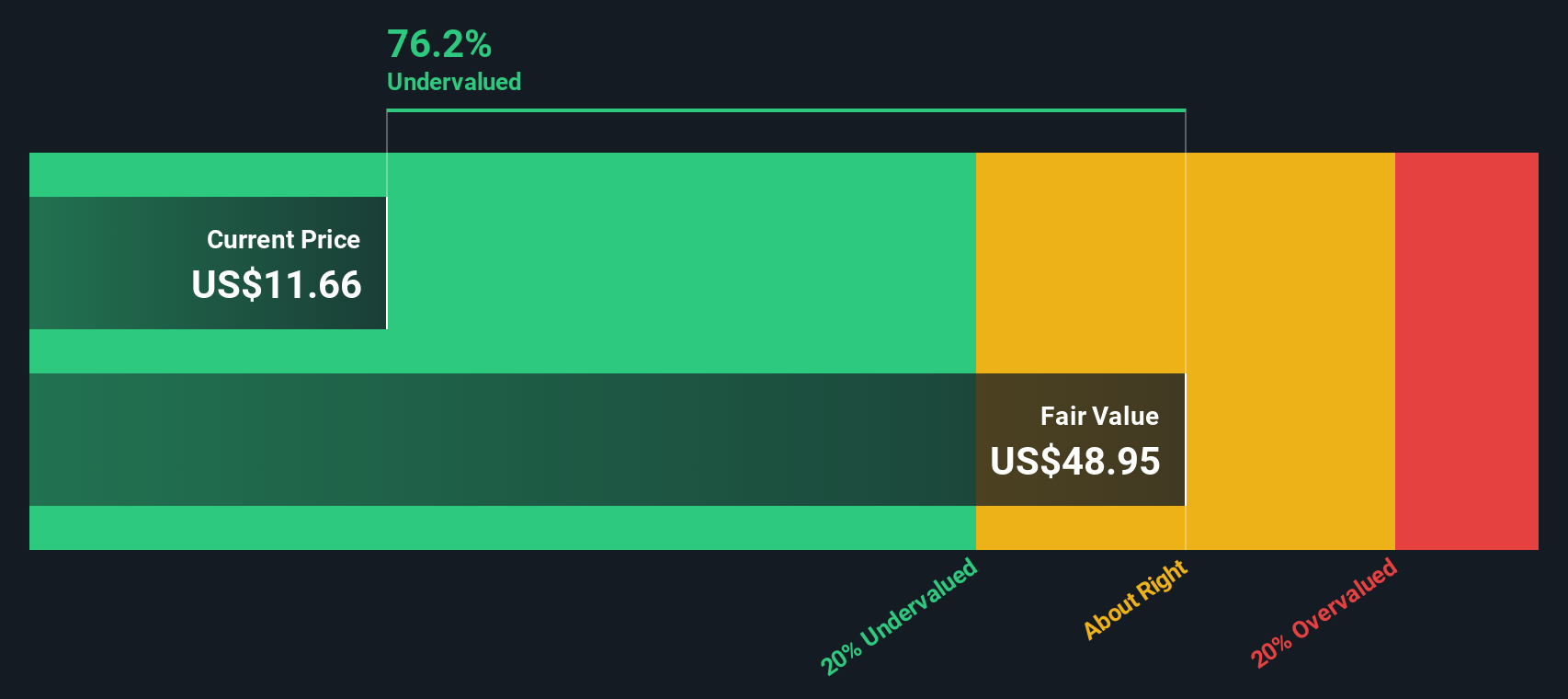

Based on these cash flow trends and the 2 Stage Free Cash Flow to Equity model, the DCF analysis arrives at an intrinsic fair value of $46.40 per share. Compared to recent trading levels, this suggests the stock may be undervalued by about 74.4%, meaning the market could be discounting the company significantly below its underlying cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests American Airlines Group is undervalued by 74.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: American Airlines Group Price vs Earnings

The price-to-earnings (PE) ratio is a widely used valuation metric for companies that are currently turning a profit, because it allows investors to gauge how much they are paying for each dollar of earnings. This approach gives a quick sense of whether a stock is priced attractively relative to what it earns, which can be especially telling for airlines as profitability can sometimes be unpredictable.

The "right" PE ratio for a business depends on both its future growth outlook and the level of risk investors associate with those earnings. Companies expected to grow rapidly or generate high-quality profits tend to trade at higher PE ratios, while more cyclical or higher-risk businesses often receive a discount from the market.

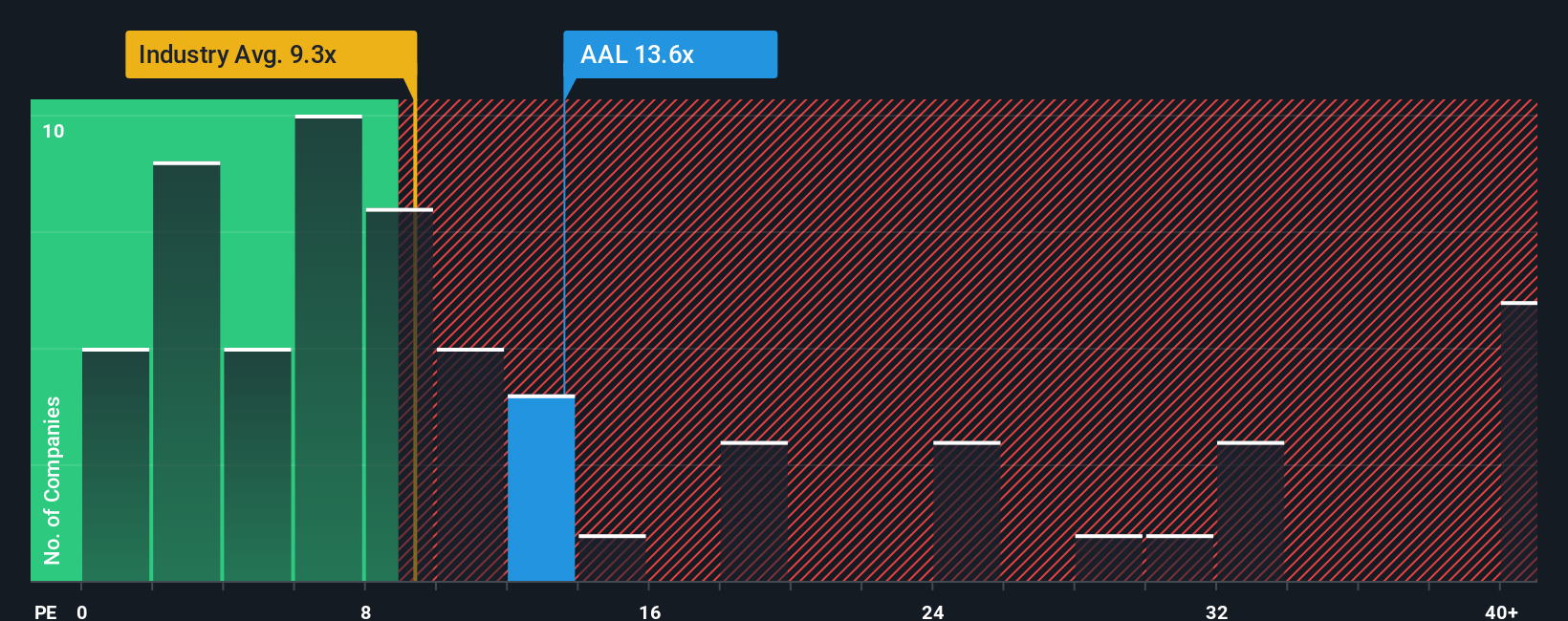

American Airlines Group currently trades at a PE ratio of 13.8x. That is above the industry average of 9.7x, but below the peer average of 20.1x. Simply Wall St’s proprietary Fair Ratio for American Airlines, which factors in the company's unique growth prospects, profit margin, business risks, market cap and its spot within the Airlines industry, is 23.7x. This tailored benchmark goes further than a simple peer or industry average, as it is designed to reflect what the company’s multiple should reasonably be given its specific situation.

Putting these figures side by side, American Airlines is trading at a notable discount to its Fair Ratio. This signals that, even after accounting for risks and market conditions, the stock is currently undervalued based on earnings expectations.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your American Airlines Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are an easy, accessible tool that allows investors to shape a story—your perspective—about a company like American Airlines Group and directly connect it to financial forecasts and fair value estimates.

Rather than just relying on standard ratios, a Narrative links the facts about a business (like expected revenue and margin trends) to your own view of how its future will play out, producing a fair value built around your unique story. Narratives are available for millions of investors on Simply Wall St’s Community page, letting you use updated forecasts and fair value calculations that adjust automatically as new news or earnings come in.

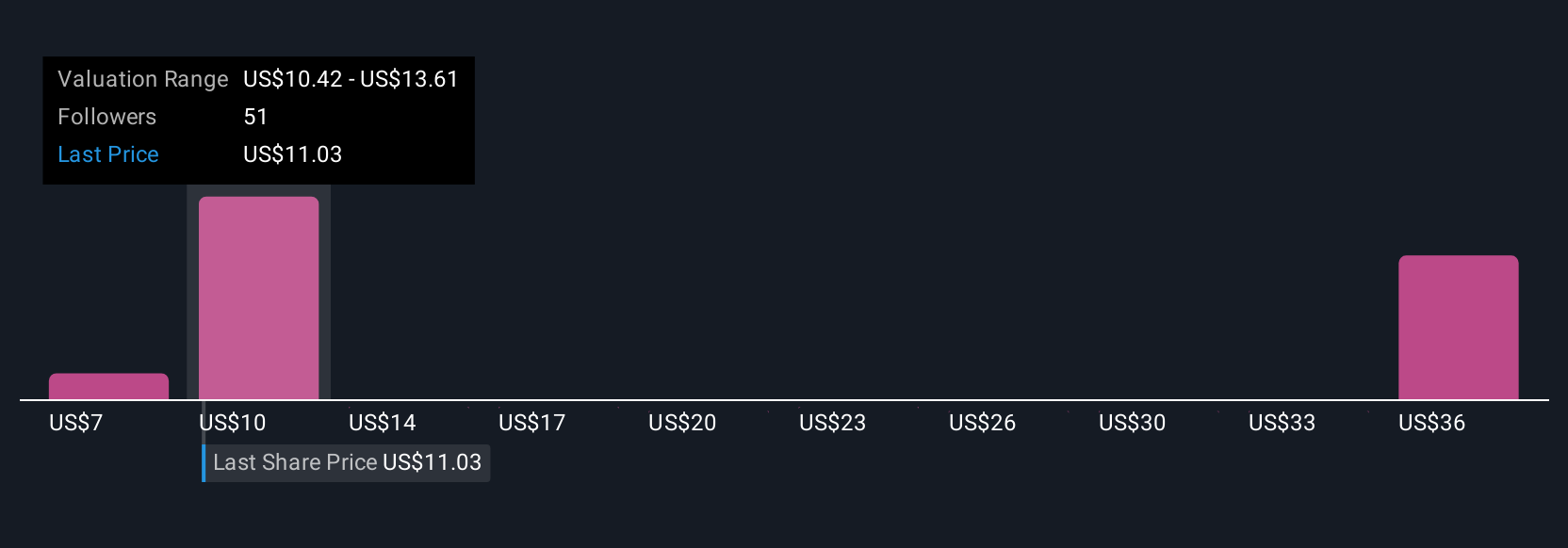

This approach empowers you to act on your convictions, deciding whether American Airlines Group aligns with your investment perspective by directly comparing your narrative’s fair value to the current share price. And because every investor interprets data differently, you will see a range of narratives. For instance, one bullish investor may forecast a fair value as high as $14.23, while the most cautious could see it as low as $10.61. This clarity enables smarter, more personalized investment choices built on real analysis rather than market noise.

For American Airlines Group, we will make it very easy for you with previews of two leading American Airlines Group Narratives:

🐂 American Airlines Group Bull Case

Fair Value: $14.23

Undervalued by: 16.7%

Expected Revenue Growth: 4.38%

- Domestic market strength and premium service upgrades are supporting demand recovery, customer retention, and improved profit margins.

- Loyalty program growth, new partnerships, and more efficient aircraft contribute to long-term earnings stability and positive cash flows.

- Key risks include high labor costs, a heavy debt burden, and operational challenges. Analyst consensus sees current prices as fairly valued given future prospects.

🐻 American Airlines Group Bear Case

Fair Value: $10.61

Overvalued by: 11.8%

Expected Revenue Growth: 2.5%

- American Airlines faces significant balance sheet risk, with high debt levels and negative equity compared to industry peers.

- The company is uniquely sensitive to demand shocks and could struggle as competition intensifies and travel demand softens.

- Profitability improvements depend on successful execution in Premium Economy and favorable refinancing conditions. Overall, risk and reward remain unattractive relative to rivals.

Do you think there's more to the story for American Airlines Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAL

American Airlines Group

Through its subsidiaries, operates as a network air carrier in the United States, Latin America, Atlantic, and Pacific.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives