- United States

- /

- Airlines

- /

- NasdaqGS:AAL

Institutions are Quietly Growing Their Stake in American Airlines Group Inc. (NASDAQ:AAL)

Two years after arguably the most significant turbulence in the history of the airline business, American Airlines Group Inc. (NASDAQ: AAL) stock remains depressed.

With the travel sector recovering, the latest danger comes from spiking jet fuel prices due to record-high oil prices. Meanwhile, short interest remains in double-digits.

Check out our latest analysis for American Airlines Group

Bullish Case for Air Travel

Speaking at the J.P Morgan 2022 Industrials conference, CEO Doug Parker and CFO Derek Kerr gave an outlook of the industry's current state.

Mr.Parker (retiring at the end of this month) pointed out the recovering revenues, guiding at 83% of 2019 revenues. He stated that the pandemic made the airlines' industry more structurally sound, thus expecting it to resurge stronger than before as the adverse effects disappear.

The Impact of Oil prices

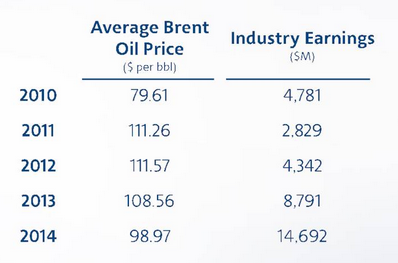

Looking back at the oil prices over a decade ago, they didn't pose a significant problem long-term. In 2010, the profits were about US$4.8b, with oil trading at US$100 in 2014, they were US$15b.

While there are short-term impacts, the industry has a long-term track record of adapting to those prices. Overall, in 2019 the cost of jet fuel was about 22% of the revenues.

The Current Ownership Structure of American Airlines

With a market capitalization of US$10b, American Airlines Group is relatively large. We'd expect to see institutional investors on the register. Companies of this size are usually well known to retail investors, too. In the chart below, we can see that institutions are noticeable on the share registry.

You can zoom in on the different ownership groups to learn more about American Airlines Group.

What Does The Institutional Ownership Tell Us About American Airlines Group?

Institutions typically measure themselves against a benchmark when reporting to their investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register.

We can see that American Airlines Group has institutional investors, and they hold a good portion of its stock. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They, too, get it wrong sometimes.

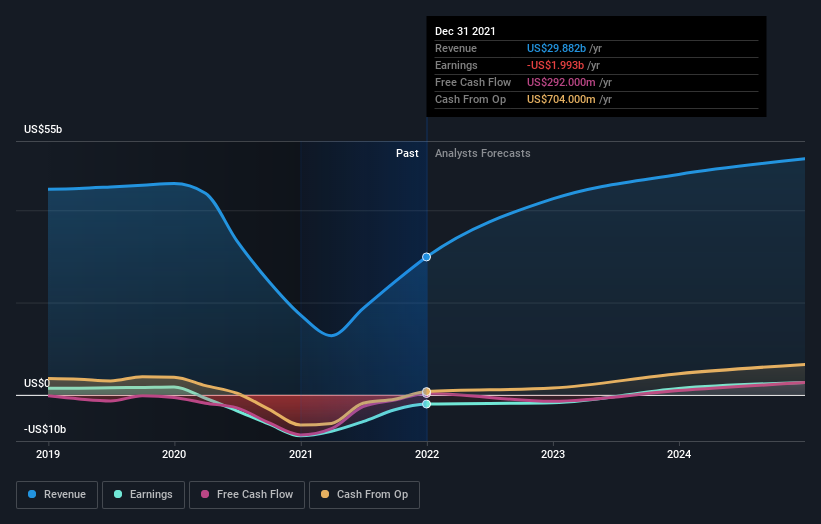

Thus, it is worth checking the past earnings trajectory of American Airlines Group (below).

Since institutional investors own more than half the issued stock, the board will likely have to pay attention to their preferences. We note that hedge funds don't have a meaningful investment in American Airlines Group. The Vanguard Group, Inc. is currently the largest shareholder, with 10% outstanding shares. With 6.3% and 5.5% of the shares outstanding, PRIMECAP Management Company and BlackRock, Inc. are the second and third largest shareholders.

Our studies suggest that the top 25 shareholders collectively control less than half of the company's shares, meaning that the shares are widely disseminated, and there is no dominant shareholder.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider and General Public Ownership

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Insider ownership is positive when it signals leadership thinking like its actual owners. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

We can see that insiders own shares in American Airlines Group Inc. The insiders have a meaningful stake worth US$111m. Most would say this shows a good alignment of interests between shareholders and the board. Still, it might be worth checking if those insiders have been selling.

On the other hand, the general public, including retail investors, owns a 45% stake in the company and can't easily be ignored. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Conclusion

Airlines are a cyclical industry and one that is due to different factors (high capital expenditures, high costs, low margins...) hard to invest in. Yet, they're a necessity. They might be frustrating for a long-term investor but an absolute joy for a short-term speculator.

While AAL's CEO believes the business has consolidated through the downturn and has clearer skies in front, institutional investors support his opinion. Looking into the ownership history, we can note that institutional investors have been slowly increasing their stake over the last 6 months while retail investors have been selling.

To truly gain insight, we need to consider other information, too. Consider, for instance, the ever-present specter of investment risk. We've identified 2 warning signs with American Airlines Group, and understanding them should be part of your investment process.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the previous date of the month the financial statement is dated. This may not be consistent with full-year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:AAL

American Airlines Group

Through its subsidiaries, operates as a network air carrier in the United States, Latin America, Atlantic, and Pacific.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives