- United States

- /

- Airlines

- /

- NasdaqGS:AAL

Can American Airlines (AAL) Balance Modest Profits and Cautious Outlook With Enhanced Loyalty Ambitions?

Reviewed by Simply Wall St

- American Airlines Group reported mixed second-quarter results in July 2025, with revenue and earnings per share both up slightly from last year, but net income falling to US$599 million from US$717 million, and the company also issued cautious guidance for the upcoming quarter.

- An enhanced long-term partnership with Mastercard aims to improve American's AAdvantage® program and overall customer experience using advanced payment technologies and real-time analytics.

- We'll examine how the combination of stronger-than-expected earnings and lowered forward guidance impacts American Airlines' investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

American Airlines Group Investment Narrative Recap

To own a piece of American Airlines Group, you need to believe the company can deliver consistent demand growth, manage costs, and maintain financial stability in a competitive, economically sensitive industry. The recent earnings release revealed modest revenue improvement, but profit pressures and a cautious outlook reinforce that American’s near-term trajectory remains closely tethered to overall travel demand and cost management. These results leave the short-term catalyst, international demand trends, intact, while the biggest risk remains exposure to domestic pricing and rising non-fuel costs; neither has materially shifted after this update.

Among the recent announcements, the extended partnership with Mastercard is the most relevant, as it aims to strengthen American’s AAdvantage® loyalty program with enhanced payments technology and analytics. While not an immediate catalyst, growing and monetizing loyalty revenue is a critical lever for improving margin resilience and supporting future growth, especially as traditional avenues face pressure from cost and competition.

Yet, despite international strength, persistent headwinds tied to rising domestic expenses could leave investors exposed if...

Read the full narrative on American Airlines Group (it's free!)

American Airlines Group's outlook projects $61.3 billion in revenue and $1.7 billion in earnings by 2028. This is based on an expected annual revenue growth rate of 4.2% and an increase in earnings of roughly $1.0 billion from current earnings of $685.0 million.

Uncover how American Airlines Group's forecasts yield a $13.70 fair value, a 18% upside to its current price.

Exploring Other Perspectives

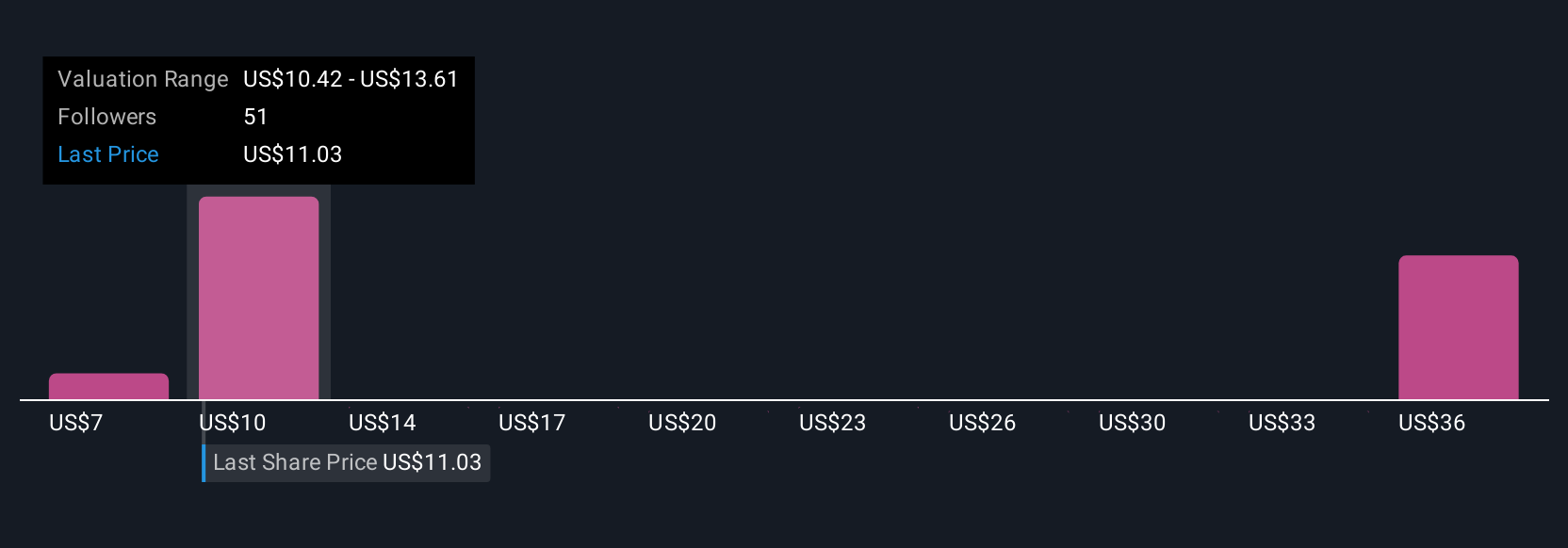

Ten members of the Simply Wall St Community estimate American Airlines’ fair value between US$7.23 and US$19.57 per share. Several see stronger cost-saving initiatives as a key offset to operational pressures, which could shape future performance in different ways depending on demand trends you expect, consider all viewpoints before making decisions.

Explore 10 other fair value estimates on American Airlines Group - why the stock might be worth 38% less than the current price!

Build Your Own American Airlines Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Airlines Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free American Airlines Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Airlines Group's overall financial health at a glance.

No Opportunity In American Airlines Group?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAL

American Airlines Group

Through its subsidiaries, operates as a network air carrier in the United States, Latin America, Atlantic, and Pacific.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives