- United States

- /

- Airlines

- /

- NasdaqGS:AAL

Assessing American Airlines (AAL) Valuation as Investors Navigate Recent Sector Volatility

Reviewed by Simply Wall St

See our latest analysis for American Airlines Group.

American Airlines Group’s shares have struggled for momentum this year, with a 28.9% decline in year-to-date share price return. This reflects broader concerns around the sector. Still, the 1-year total shareholder return of -5.8% hints that, despite challenges, some investors maintained confidence through recent volatility and shifting industry dynamics.

If you’re interested in expanding your search beyond airlines, now’s the perfect moment to discover fast growing stocks with high insider ownership.

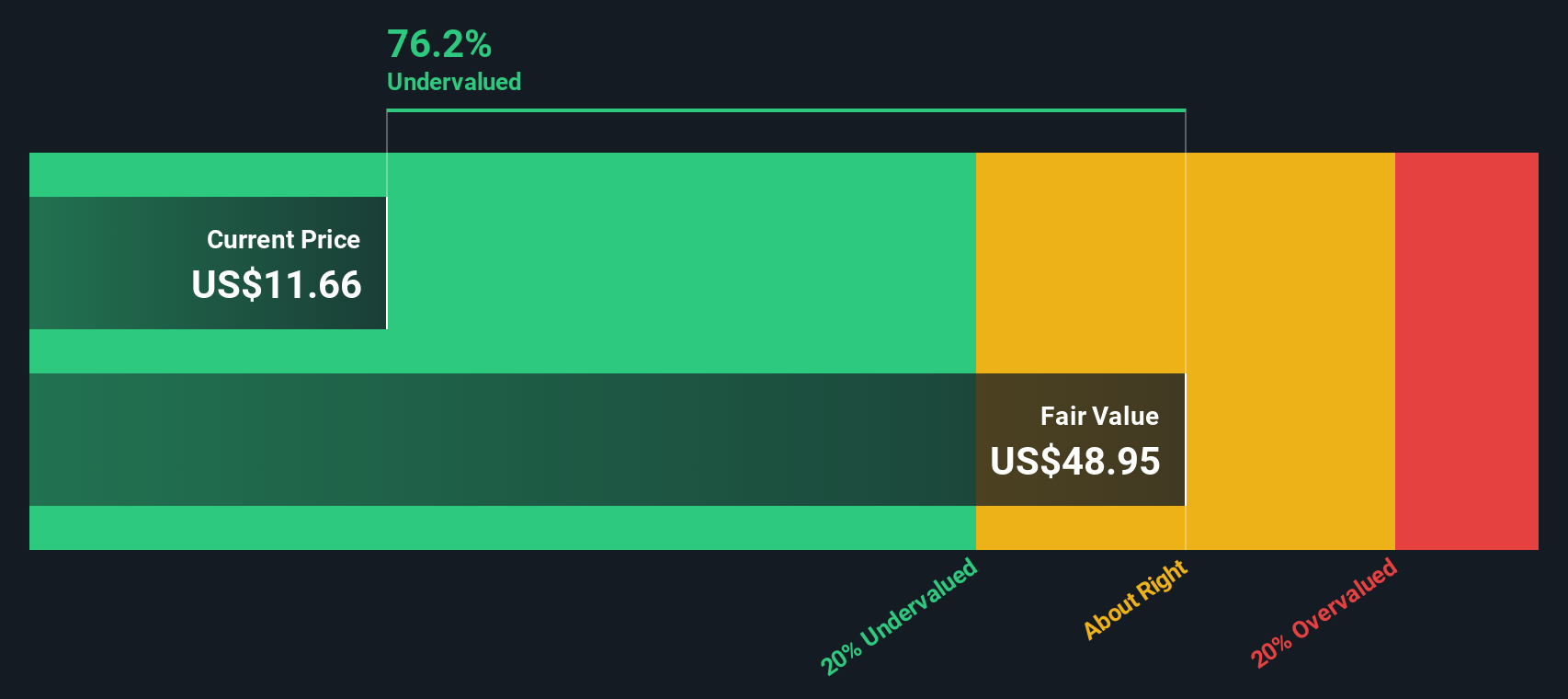

With American Airlines trading below analyst price targets and showing mixed long-term returns, the key question for investors now is whether the market is undervaluing the stock or if expectations for future growth are already reflected in the price.

Most Popular Narrative: 13.9% Overvalued

At $12.09, American Airlines Group's stock trades above the narrative’s fair value estimate of $10.61. This setup has ignited debate about whether markets are too optimistic about the company’s ability to deliver on certain key financial levers in a competitive environment.

*I fail to see why American might be an attractive investment proposition outside of the rosiest of economic outlooks, which is not what’s at hand right now. Now, you can survive and even generate decent returns with a precarious capital structure, but of course you are super-sensitive to any shock on the demand side of your business, hitting both revenues and margins. That is where the clouds gather on American.*

Curious what’s lurking under the hood of this valuation? Bold earnings, careful profit margins and a future profit multiple normally reserved for industry leaders form the foundation. The narrative teases a calculated bet that could surprise many. Find out which numbers shape this view and what might turn the tide.

Result: Fair Value of $10.61 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a shift in travel demand or improvements in American’s debt position could quickly challenge the current view of overvaluation.

Find out about the key risks to this American Airlines Group narrative.

Another View: SWS DCF Model Suggests Deep Undervaluation

Looking at American Airlines through the lens of our DCF model paints a very different picture. The SWS DCF model estimates a fair value of $46.40, which is significantly higher than today’s share price. This suggests the stock may be notably undervalued. Are markets overlooking potential upside, or are there risks not fully priced in?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out American Airlines Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own American Airlines Group Narrative

If you want a different take or enjoy examining the numbers hands-on, try building your own view in just a few minutes. Do it your way.

A great starting point for your American Airlines Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep their radar up for fresh opportunities. You could be missing out if you don’t check out other sectors where trends are accelerating, new leaders are emerging, and hidden gems are waiting to be spotted.

- Boost your search for steady income by checking out these 17 dividend stocks with yields > 3%, where attractive yields and robust cash flows set these picks apart.

- Tap into healthcare’s innovation engine and see what’s next in the industry with these 33 healthcare AI stocks, focused on companies using AI to reshape medical outcomes.

- Capitalize on tech’s fastest-growing frontier with these 27 quantum computing stocks, showcasing companies at the forefront of quantum computing breakthroughs and rapid market shifts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAL

American Airlines Group

Through its subsidiaries, operates as a network air carrier in the United States, Latin America, Atlantic, and Pacific.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives