- United States

- /

- Telecom Services and Carriers

- /

- OTCPK:SNRE.Y

Sunrise Communications (OTCPK:SNRE.Y): Evaluating Valuation After Marked Profitability Improvement in Latest Results

Reviewed by Simply Wall St

Sunrise Communications (OTCPK:SNRE.Y) has just reported its third-quarter and nine-month results. The company highlighted a sharp drop in net losses, even as sales dipped slightly compared to last year. Investors are eyeing these improved bottom-line numbers closely.

See our latest analysis for Sunrise Communications.

Despite the year kicking off with a surge, Sunrise Communications' share price has pulled back recently, delivering a 23.32% year-to-date share price return and a 19.93% total shareholder return over the past twelve months. This mix of solid long-term gains and some short-term choppiness suggests that investor sentiment is still evolving as the company’s profitability improves.

If this momentum shift has you curious about broader market standouts, now is a smart time to discover fast growing stocks with high insider ownership.

With profitability metrics sharply improving and the stock still trading at a notable discount to analyst price targets, the central question now emerges: is there untapped value here, or is the market already factoring in future growth?

Price-to-Sales Ratio of 1x: Is it justified?

At a last close price of $53.36, Sunrise Communications trades at a Price-to-Sales (P/S) ratio of 1x, putting it slightly below the US Telecom industry average of 1.2x. This suggests the stock is valued at a discount relative to its sector peers, catching the attention of value-focused investors looking for bargains in the space.

The price-to-sales ratio compares a company’s market capitalization to its revenue, providing a straightforward way to assess how much investors are willing to pay for each dollar of sales. In the telecom sector, where profits can be volatile due to investment cycles, P/S is often used as a sanity check for valuation instead of focusing on pure earnings multiples. Sunrise’s low P/S ratio may reflect investor wariness regarding its recent unprofitability or slower growth projections, as the market prefers peers with stronger profit records or clearer growth stories.

Against the industry backdrop, Sunrise’s P/S of 1x stands out as good value, given the industry average P/S is 1.2x and its peer average is also 1.2x. When compared to the estimated fair P/S of 1x, however, the stock appears closer to what would be considered a justifiable valuation, suggesting only a modest re-rating potential unless profitability improves significantly.

Explore the SWS fair ratio for Sunrise Communications

Result: Price-to-Sales of 1x (UNDERVALUED)

However, Sunrise’s recent unprofitability and relatively slow revenue growth may temper enthusiasm, particularly if these trends continue in the coming quarters.

Find out about the key risks to this Sunrise Communications narrative.

Another View: Discounted Cash Flow (DCF) Perspective

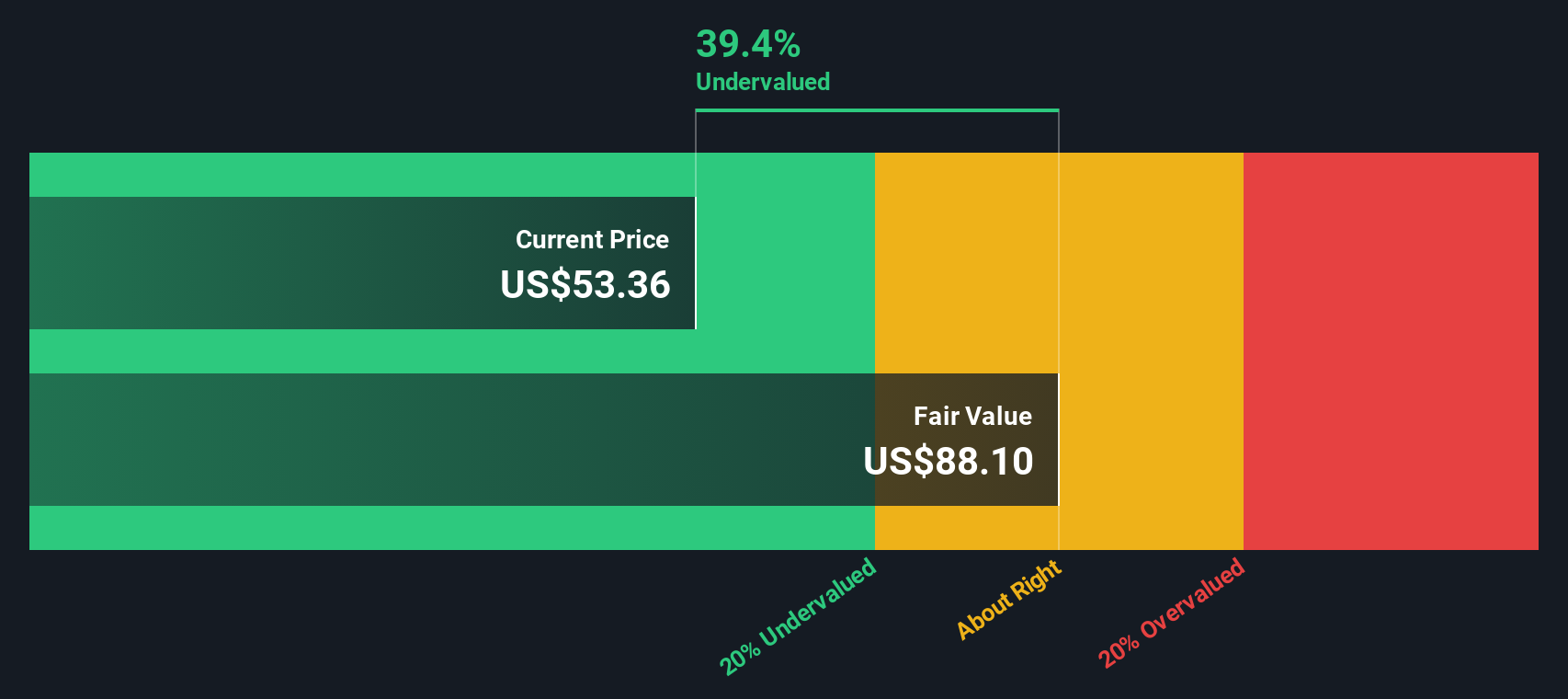

Looking at Sunrise Communications through our DCF model offers a contrasting picture. Based on the SWS DCF model, the stock is trading almost 39% below its intrinsic fair value. This points to potential undervaluation that is much larger than the discount suggested by sales multiples. Could the market be missing something significant here, or is the risk still too great?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sunrise Communications for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sunrise Communications Narrative

If you want to dig deeper or take a different view of Sunrise Communications, you can quickly analyze the numbers and craft your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Sunrise Communications.

Looking for More Investment Ideas?

Set yourself up for smarter investing by exploring high-potential companies that might just be flying under your radar. Give your portfolio an edge and don’t miss these trends.

- Capitalize on market mispricings by tapping into these 877 undervalued stocks based on cash flows, which offers compelling opportunities based on strong cash flow analysis.

- Generate steady returns with these 16 dividend stocks with yields > 3%, featuring companies with attractive yields exceeding 3 percent for consistent income seekers.

- Seize the technology advantage with these 25 AI penny stocks to find breakthrough businesses at the forefront of artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:SNRE.Y

Sunrise Communications

Provides telecommunications services to residential and business customers in Switzerland.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives