Verizon (VZ): Margin Rebound Doubles Earnings, Underscoring Value Investor Narratives

Reviewed by Simply Wall St

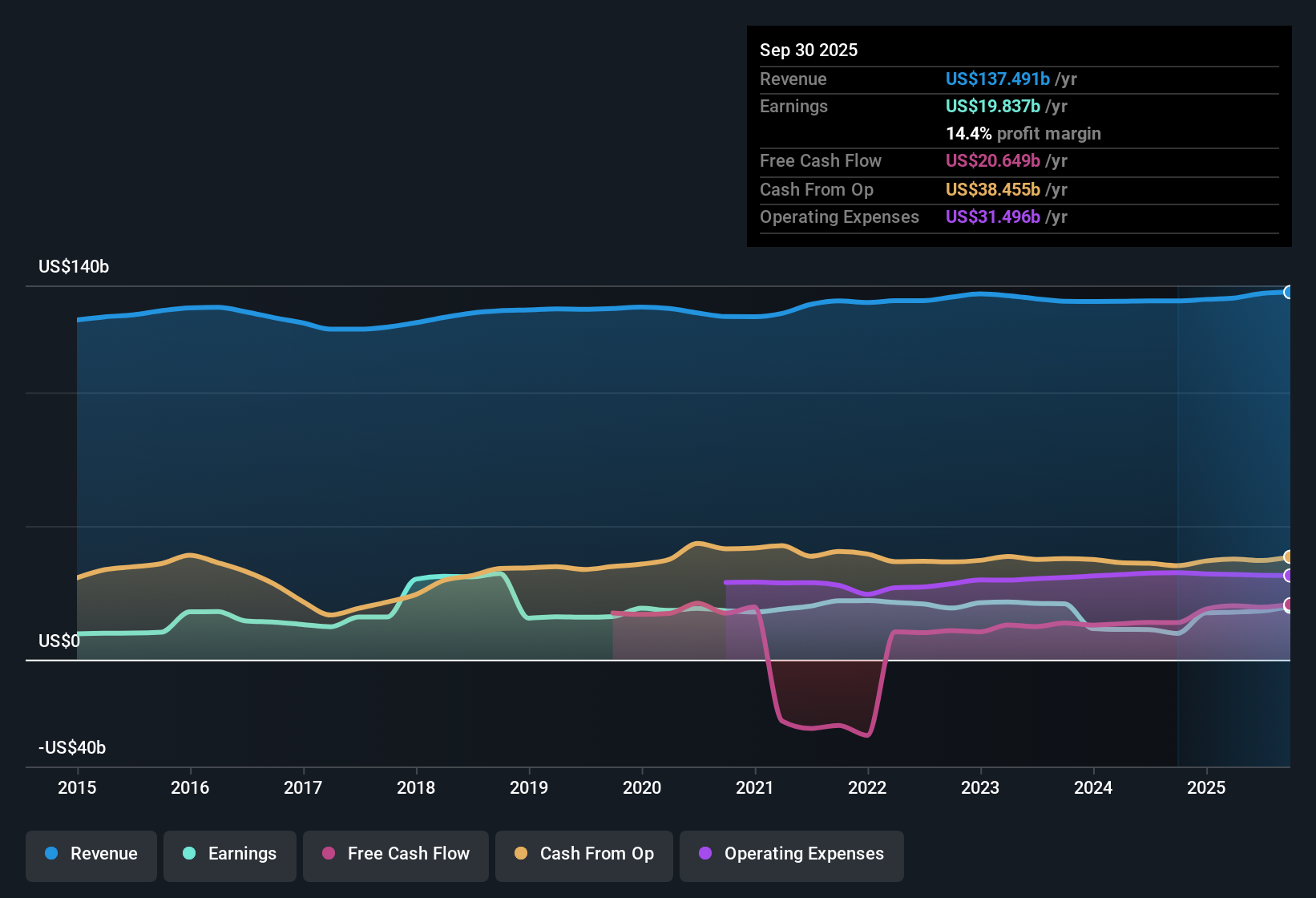

Verizon Communications (VZ) posted a net profit margin of 14.4%, doubling from 7.3% the previous year, while earnings reversed a five-year decline with an impressive 102.5% growth over the past twelve months. With earnings forecast to rise 3.19% per year and revenue projected at 1.5% annual growth, investors have plenty to consider as the company’s share price trades at a Price-To-Earnings ratio of 8.3x, well below both the global telecom average and peers. Strong profitability, attractive dividends, and a valuation below fair value estimates are keeping Verizon in focus for value-oriented investors.

See our full analysis for Verizon Communications.The next section puts these headline numbers up against market narratives and investor stories, highlighting where expectations hold up and where perceptions might need to shift.

See what the community is saying about Verizon Communications

Margins Lift as Cost Discipline Pays Off

- Profit margins sit at 14.4%, rebounding sharply from 7.3% last year, reflecting a turnaround after five years of falling earnings. This improvement may not guarantee continued outsized improvement going forward.

- Analysts' consensus view notes margin expansion is being driven by cost optimizations such as voluntary separation programs and network streamlining, which helps free up cash flow for growth investments and supports more stable earnings.

- This aligns with ongoing advice that cost efficiency—from AI-powered process automation to decommissioning legacy infrastructure—acts as a driver of improving operating leverage.

- However, some caution that future growth will need to deliver on the promise of new digital solutions, as reliance on cost controls alone could eventually plateau.

- For a full breakdown of how these profitability trends stack up against broader industry forces, see where the numbers fit in the main market narrative. 📊 Read the full Verizon Communications Consensus Narrative.

Leverage and Investment: Double-Edged Sword

- With $116 billion in net unsecured debt and persistently high capital expenditures for network rollouts and acquisitions, Verizon’s ability to maintain margin gains depends on strong execution and continued monetization of new technologies.

- Analysts' consensus view highlights heavy investment in 5G and fiber as both an advantage and a risk, noting that while network scale enables premium offerings and higher ARPU, the sheer scale of spending and borrowing leaves the company exposed to interest rate shifts and limits flexibility.

- What is surprising is that, despite these headwinds, profit margins and cash flow show resilience. Any slip in new subscriber or enterprise adoption could quickly flip the picture given high fixed costs.

- Critics remain wary that if next-generation service launches or enterprise contracts do not ramp up fast enough, returns on invested capital and net margins could face renewed pressure.

Valuation Gap: Discount Persists Despite Recovery

- Verizon shares trade at a PE ratio of 8.3x, a significant discount versus the global telecom industry average of 16.8x and peers at 21.4x, with a current share price of $38.96 compared to the analyst price target of $47.53.

- Analysts' consensus view sees the low multiple and price below target as a reflection of cautious expectations around mature wireless growth and heavy debt. At the same time, it also argues that improving margins and recurring cash flow strengthen the case for value-oriented investors.

- The depressed valuation offers upside should the company maintain or grow margins and deliver even slow but steady top-line growth.

- However, persistent industry headwinds and capital intensity explain why some investors are hesitant to assign Verizon a higher multiple, despite signals of operational progress.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Verizon Communications on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique perspective on these figures? Share your own interpretation in just a few minutes to shape the conversation. Do it your way

A great starting point for your Verizon Communications research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite recovering profitability, Verizon’s heavy debt load and the pressure of sustained high capital expenditures leave its financial flexibility and long-term resilience in question.

If you’re seeking companies with stronger balance sheets, steadier cash flow, and less debt risk, check out solid balance sheet and fundamentals stocks screener (1986 results) to find safer choices for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VZ

Verizon Communications

Through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

Very undervalued 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives