Is Verizon Offering Value After a 7.5% Gain and Network Investment News in 2025?

Reviewed by Bailey Pemberton

- Wondering if Verizon Communications is underappreciated or overheated? You are not alone, as many investors are watching this classic telecom for clues about its real value.

- The stock moved up 3.2% over the last week and sits 7.5% higher than this time last year. This hints at renewed optimism after some ups and downs in recent years.

- Much of the recent price action can be traced to broad sector shifts and growing investor focus on resilient dividends in uncertain markets. News outlets have highlighted increasing competition in wireless and Verizon’s aggressive network investments. These developments keep the company in the spotlight and influence sentiment.

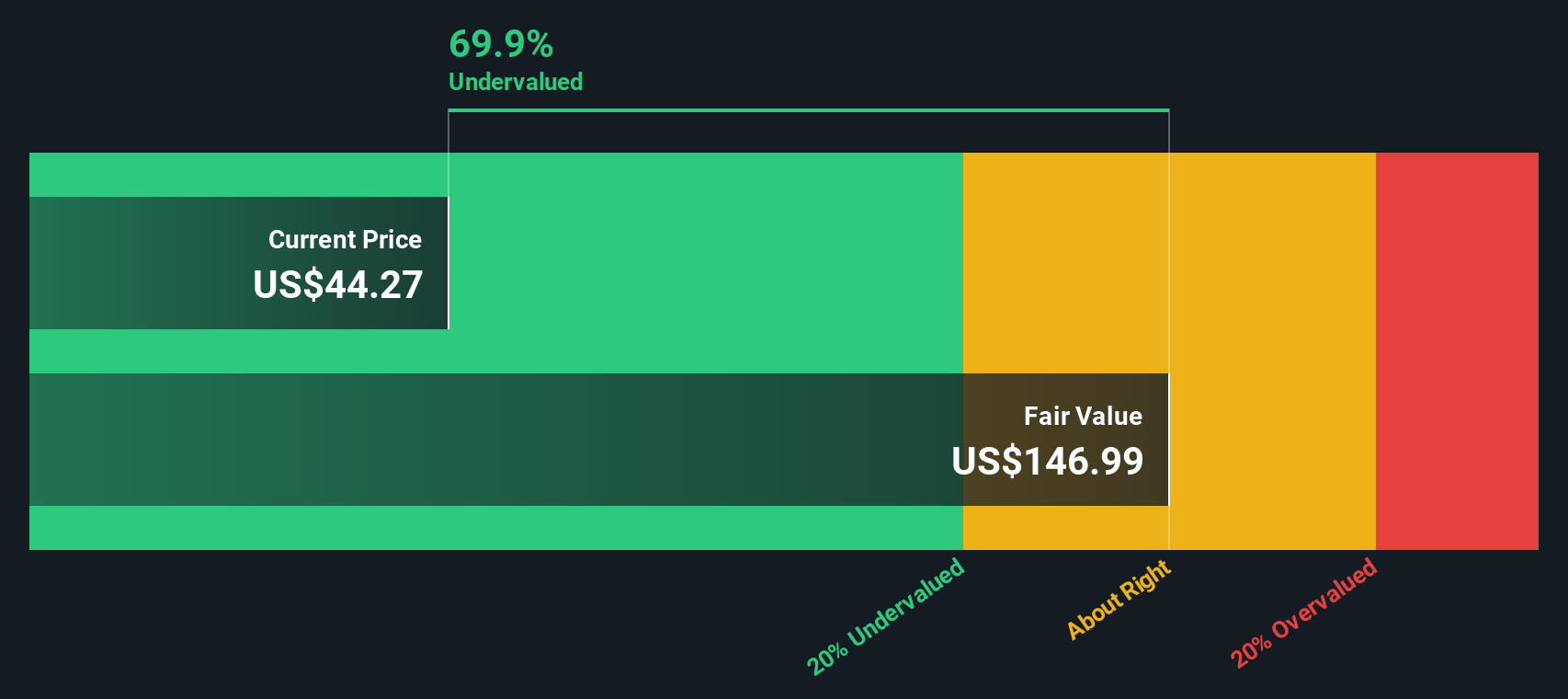

- On our valuation checks, Verizon scores a solid 4 out of 6. This indicates there could be real value in play. We will dig into how traditional models weigh up that score and share a smarter angle on valuation later in the article.

Find out why Verizon Communications's 7.5% return over the last year is lagging behind its peers.

Approach 1: Verizon Communications Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting those flows back to today’s dollars. This lets investors see if the market price reflects the company’s likely long-term profitability and growth.

For Verizon Communications, the model starts with its current Free Cash Flow, which is $17.04 Billion. Analysts have provided forecasts for the next several years, expecting growth in Free Cash Flow to $23.70 Billion by 2029. Beyond analyst estimates, Simply Wall St extrapolates further growth, with projections reaching above $28 Billion in the decade ahead. These figures are all in US dollars.

Using this method, Verizon’s estimated intrinsic value comes in at $106.05 per share. This represents a 61.2% difference below where the market currently prices the stock, suggesting the shares are significantly undervalued according to this model’s assumptions.

The DCF approach points to meaningful upside for investors who believe the cash flow trajectory will hold up or improve from here.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Verizon Communications is undervalued by 61.2%. Track this in your watchlist or portfolio, or discover 872 more undervalued stocks based on cash flows.

Approach 2: Verizon Communications Price vs Earnings

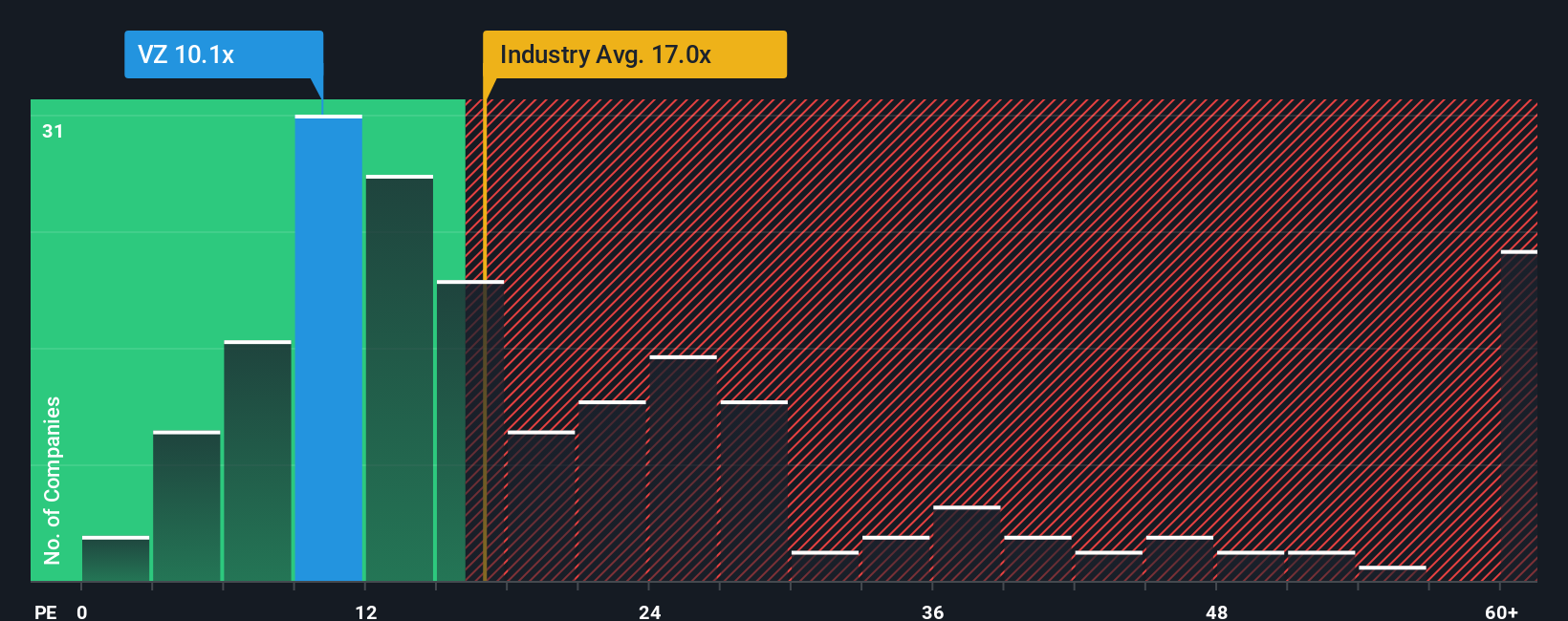

The Price-to-Earnings (PE) ratio is a preferred metric for valuing companies like Verizon Communications because it connects the market price directly to the company’s actual earnings, making it especially relevant for established, profitable firms. A lower PE can indicate an undervalued stock, while a higher one might suggest built-in growth expectations or reflect perceived risk.

What counts as a "normal" or "fair" PE ratio depends on several factors. Companies expected to grow faster typically warrant a higher PE, as investors are willing to pay more for future profits. Conversely, higher risk or slower growth can justify a lower PE. Industry averages offer useful context. Verizon’s current PE is 8.74x, below the Telecom sector average of 16.13x and just above the peer group average of 8.50x.

To provide deeper context, Simply Wall St calculates a “Fair Ratio” of 13.65x for Verizon. Unlike a basic comparison to industry or peers, this Fair Ratio factors in Verizon’s expected earnings growth, its risk profile, profit margins, industry dynamics, and market capitalization. Because it blends these elements, the Fair Ratio offers a tailored benchmark for Verizon specifically, helping investors see the bigger picture.

Comparing Verizon’s actual PE of 8.74x to its Fair Ratio of 13.65x suggests the stock is meaningfully undervalued on this basis, implying potential for price appreciation if the underlying fundamentals hold.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1401 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Verizon Communications Narrative

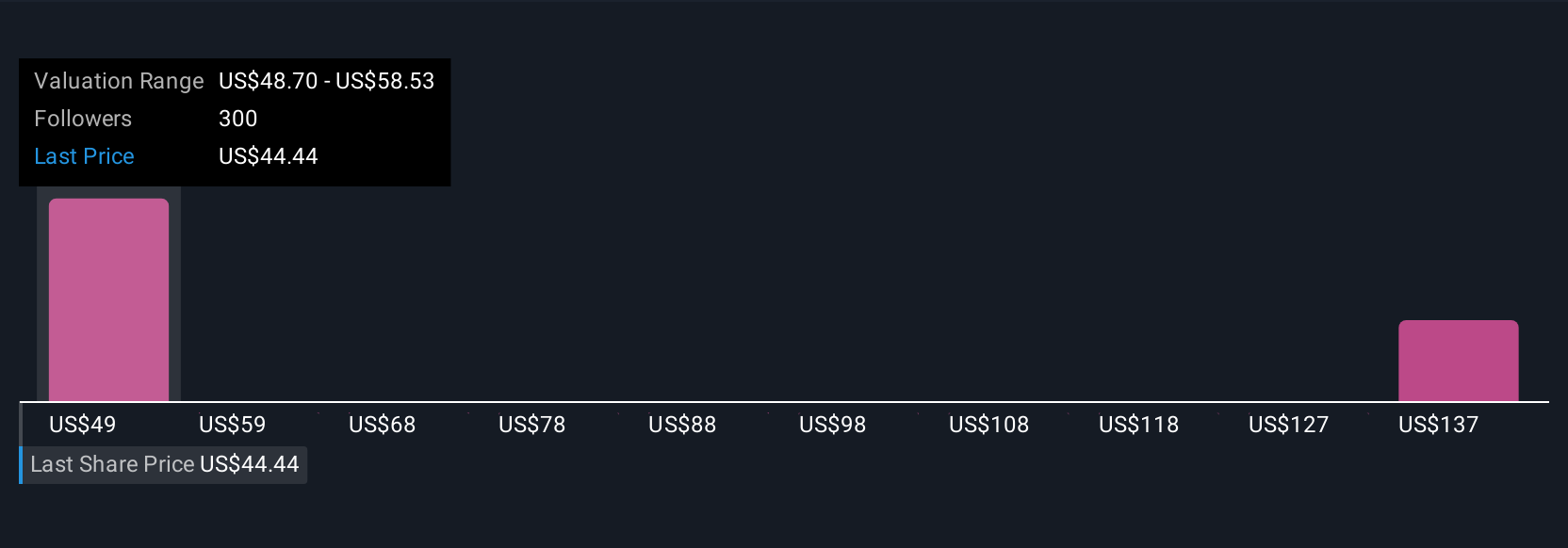

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, yet powerful tool that lets you tell your own story behind the numbers, connecting your perspective on a company’s future (like forecasts for revenue, earnings, and margins) to its fair value. Narratives bridge the gap between a company’s story, its financial forecasts, and what you believe is a “fair” price, making investment decisions more personal and relevant.

Available to everyone on Simply Wall St’s Community page, Narratives are easy to use and trusted by millions of investors. They help you decide when to buy or sell by clearly comparing fair value (based on your assumptions) to the live market price. Plus, Narratives update automatically when news or earnings releases change the outlook, so your view always reflects the latest information.

For example, two Verizon investors might have very different Narratives. One may be confident about 5G expansion and set a fair value near $58 per share, while another might be wary of competition and cost pressures, aiming for just $42. Narratives let you see these different perspectives, sense-check your own expectations, and make smarter, more transparent investment choices.

Do you think there's more to the story for Verizon Communications? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VZ

Verizon Communications

Through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives