Is AT&T Offering Long Term Value After Years of Share Price Declines?

Reviewed by Bailey Pemberton

How Has AT&T Stock Actually Performed?

Once you get past the dividend headline, AT&T's share price performance paints a more nuanced picture than many investors expect. While it has lagged some high growth tech names, the long term numbers still matter for anyone weighing income against capital appreciation.

Over the last year, the stock is up 12.3%, which is a solid positive turn for a mature telecom name. Year to date returns sit at 6.3%, suggesting that, despite recent volatility, the broader trend has been constructive rather than purely defensive.

Shorter time frames tell a slightly different story. The share price is down 0.1% over the past week and has slipped 5.2% across the last 30 days, reminding investors that even steady dividend names can see sentiment driven swings.

Looking further back, the picture gets more challenging, with the stock down an estimated 57.2% over three years and 52.0% over five years. That long term drawdown is exactly why so many investors are now asking whether the current price finally reflects enough pessimism, or if there is still more risk than reward baked in.

- For long term holders who have sat through multiple strategy resets, these returns may feel frustrating, but they also reset expectations and valuation anchors.

- For new investors, the combination of a still attractive yield and a historically weak multi year share price path raises an obvious question: is this a value opportunity or a value trap?

Find out why AT&T's 12.3% return over the last year is lagging behind its peers.

Approach 1: AT&T Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business is worth today by projecting all the cash it can generate in the future and then discounting those cash flows back to the present.

For AT&T, the model starts with last twelve month Free Cash Flow of about $21.8 billion, then applies a two stage Free Cash Flow to Equity framework. Analyst forecasts drive the first few years, with FCF expected to rise toward roughly $20.3 billion by 2029. Later years are extrapolated using modest growth rates by Simply Wall St to extend the cash flow curve out over a full decade.

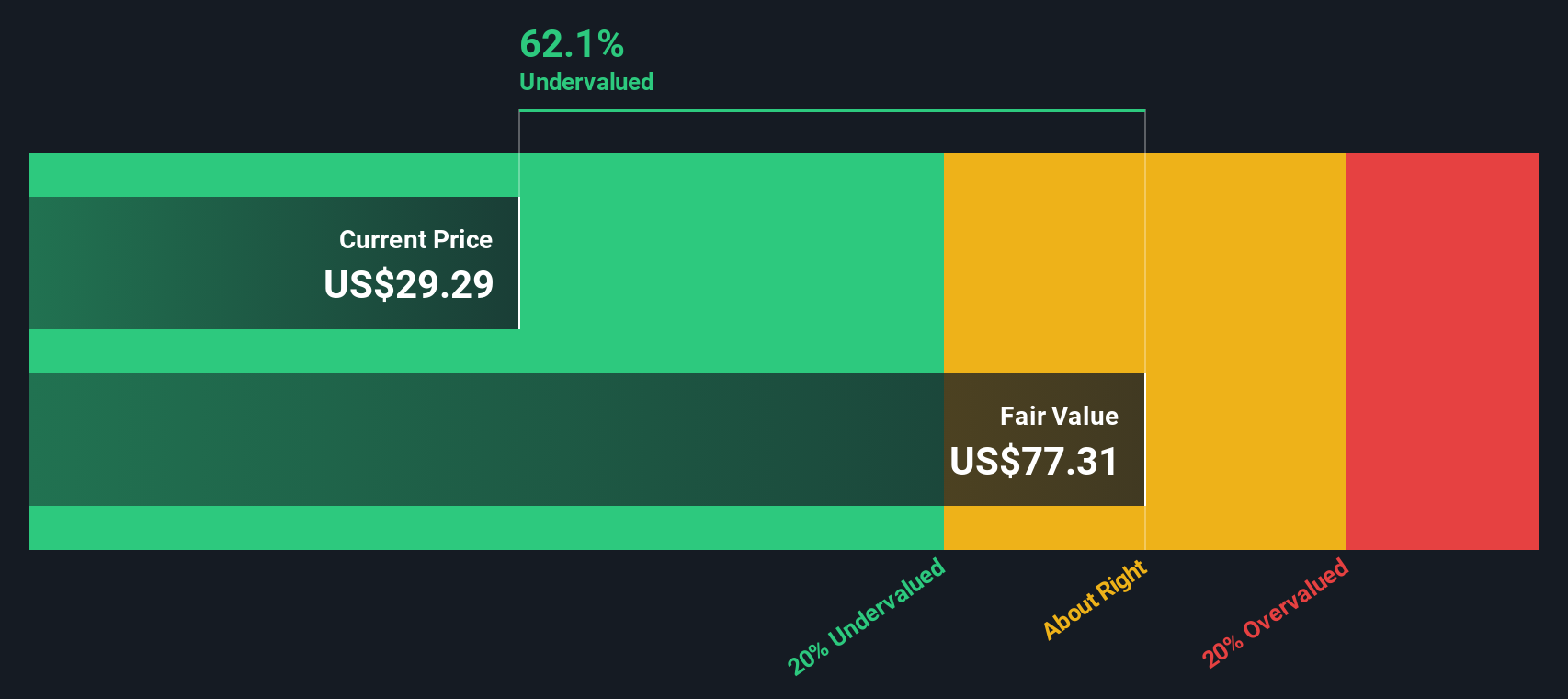

Bringing those projected cash flows back to today produces an estimated intrinsic value of $56.84 per share. This is roughly 57.3% above the current market price implied by this model and suggests investors are heavily discounting AT&T's future cash generation despite its sizeable and relatively stable cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AT&T is undervalued by 57.3%. Track this in your watchlist or portfolio, or discover 916 more undervalued stocks based on cash flows.

Approach 2: AT&T Price vs Earnings

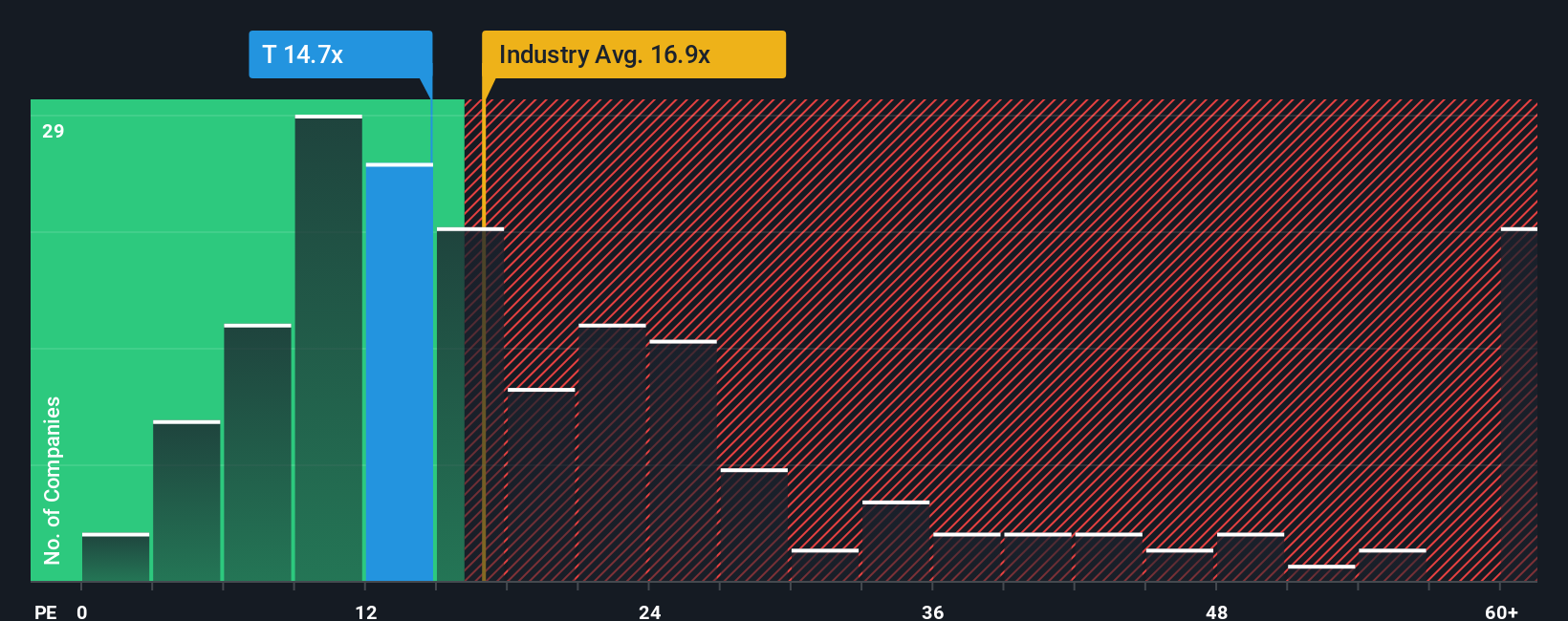

For profitable, established companies like AT&T, the Price to Earnings ratio is a straightforward way to gauge how much investors are willing to pay for each dollar of current profits. In general, businesses with stronger growth prospects and lower perceived risk can justify a higher, or more generous, PE multiple, while slower growth or higher uncertainty should translate into a lower, more cautious, PE.

AT&T currently trades on a PE of 7.76x, which is below both the Telecom industry average of about 15.93x and the peer group average of roughly 8.47x. Simply Wall St also calculates a proprietary Fair Ratio of 11.36x for AT&T, which represents the PE level the company might reasonably command given its specific blend of earnings growth, profit margins, size, sector positioning and risk profile. This Fair Ratio is more tailored than a simple peer or industry comparison because it adjusts for the company’s own fundamentals rather than assuming all telecoms deserve the same rating.

With the current PE sitting well below the Fair Ratio, AT&T appears undervalued on this earnings based lens.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1456 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose Your AT&T Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, which are simply the story you believe about a company, tied directly to your own assumptions for future revenue, earnings, margins and therefore fair value.

With Narratives on Simply Wall St, you start by describing how you think AT&T’s business will evolve. That story is translated into a financial forecast, and the platform then calculates a fair value that you can compare with today’s share price to decide whether it looks like a buy, hold, or sell.

They are built into the Community page, where millions of investors share and refine their perspectives. Each Narrative automatically updates when new information arrives, such as earnings results, major news, or changes to consensus estimates. This helps your view stay aligned with reality instead of becoming stale.

For example, one AT&T Narrative might assume the business can justify a higher fair value near $31 based on stronger growth and margins. Another more cautious Narrative might see fair value closer to $22 if competition, capital intensity and legal risks weigh more heavily on future performance. Comparing those to the current price can help you decide which story you find more reasonable and how you might act on it.

Do you think there's more to the story for AT&T? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:T

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion