AT&T (NYSE:T) Partners With Carbyne For APEX Continuity Emergency Solution For PSAPs

Reviewed by Simply Wall St

AT&T (NYSE:T) recently announced a partnership with Carbyne to launch APEX Continuity, an emergency backup solution, a move that aligns with the company's focus on infrastructure and service reliability. During the last quarter, AT&T's stock rose by 7.48%, a performance in line with broader market trends, which saw a 12% increase over the past year. The collaboration with Carbyne, along with the nationwide launch of SurgePays on AT&T’s network and solid earnings growth, likely reinforced investors' confidence, contributing to the aligned upward stock movement amid a generally positive market environment.

Every company has risks, and we've spotted 3 possible red flags for AT&T you should know about.

AT&T's recent partnership with Carbyne to launch APEX Continuity fits well within its narrative of investing in 5G and fiber to support network reliability. This strategic alliance is likely to enhance service reliability, potentially boosting investor confidence in the company's growth trajectory. Over a period of five years, AT&T's total shareholder return, which includes both share price appreciation and dividends, was 71.09%. This indicates strong performance when viewed over a longer horizon, even though recent earnings have faced some challenges.

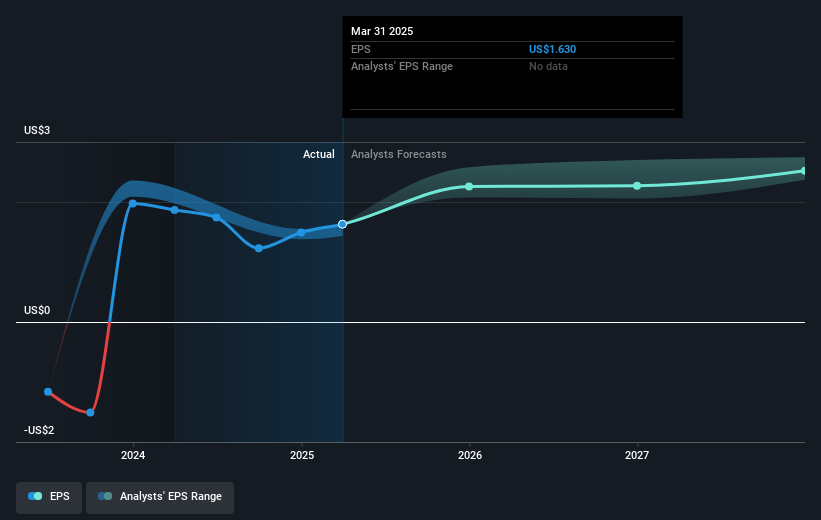

In terms of more recent performance, AT&T's shares have returned more than the US market over the past year, demonstrating resilience in a competitive industry. The collaboration with Carbyne could positively influence revenue and earnings forecasts by augmenting AT&T's service offerings and potentially increasing its customer base. While the company's focus on modernizing through network convergence might exert short-term cost pressures, it holds promise for improving margins in the longer term.

Despite a recent share price of US$27.5, current analyst consensus suggests a fair price target of US$29.22, indicating room for upside. The price target also reflects expectations tied to AT&T's efficiency gains from ongoing infrastructure investments. With these strategic moves, AT&T aims to leverage its core strengths to pursue revenue growth, albeit the company will need to carefully manage the competitive and regulatory challenges ahead.

Evaluate AT&T's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:T

Good value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives