- United States

- /

- Telecom Services and Carriers

- /

- NYSE:LUMN

Lumen Technologies, Inc. (NYSE:LUMN) Surges 385% Yet Its Low P/S Is No Reason For Excitement

Lumen Technologies, Inc. (NYSE:LUMN) shares have had a really impressive month, gaining 385% after a shaky period beforehand. The annual gain comes to 192% following the latest surge, making investors sit up and take notice.

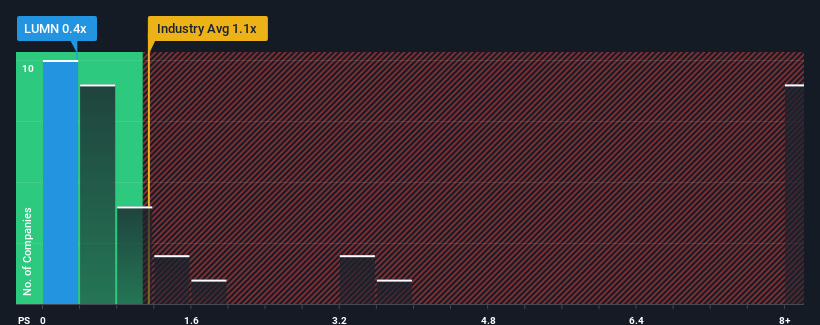

In spite of the firm bounce in price, Lumen Technologies' price-to-sales (or "P/S") ratio of 0.4x might still make it look like a buy right now compared to the Telecom industry in the United States, where around half of the companies have P/S ratios above 1.1x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Lumen Technologies

What Does Lumen Technologies' Recent Performance Look Like?

Lumen Technologies has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market isn't expecting future revenue performance to improve, which has kept the P/S suppressed. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Lumen Technologies will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Lumen Technologies?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Lumen Technologies' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 31% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue growth is heading into negative territory, declining 4.2% per annum over the next three years. That's not great when the rest of the industry is expected to grow by 235% per annum.

With this in consideration, we find it intriguing that Lumen Technologies' P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Lumen Technologies' stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Lumen Technologies' P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Lumen Technologies' poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Lumen Technologies that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUMN

Lumen Technologies

A networking company, provides integrated products and services to business and mass customers in the United States and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives