- United States

- /

- Telecom Services and Carriers

- /

- NYSE:LUMN

Is Lumen Technologies a Hidden Opportunity After Recent Leadership Changes and 87.9% Rally?

Reviewed by Bailey Pemberton

- Ever wondered if Lumen Technologies stock is trading well below its true value? You are definitely not alone in asking that question.

- After a few rough years, the share price has jumped 60.7% in the past month and is now up an impressive 87.9% so far this year. This hints at renewed growth potential and a shift in investor sentiment.

- Big moves like these often follow headline-making news. Lumen has been in the spotlight lately with recent leadership changes and strategic partnerships drawing attention. These developments add new possibilities and fuel ongoing debate about the company's future direction.

- On our valuation checklist, Lumen Technologies scores a 5 out of 6. This suggests some notable undervaluation. Stay tuned as we explore what drives that score and consider not just traditional valuation methods for Lumen, but also a compelling perspective you may want to consider by the end of this article.

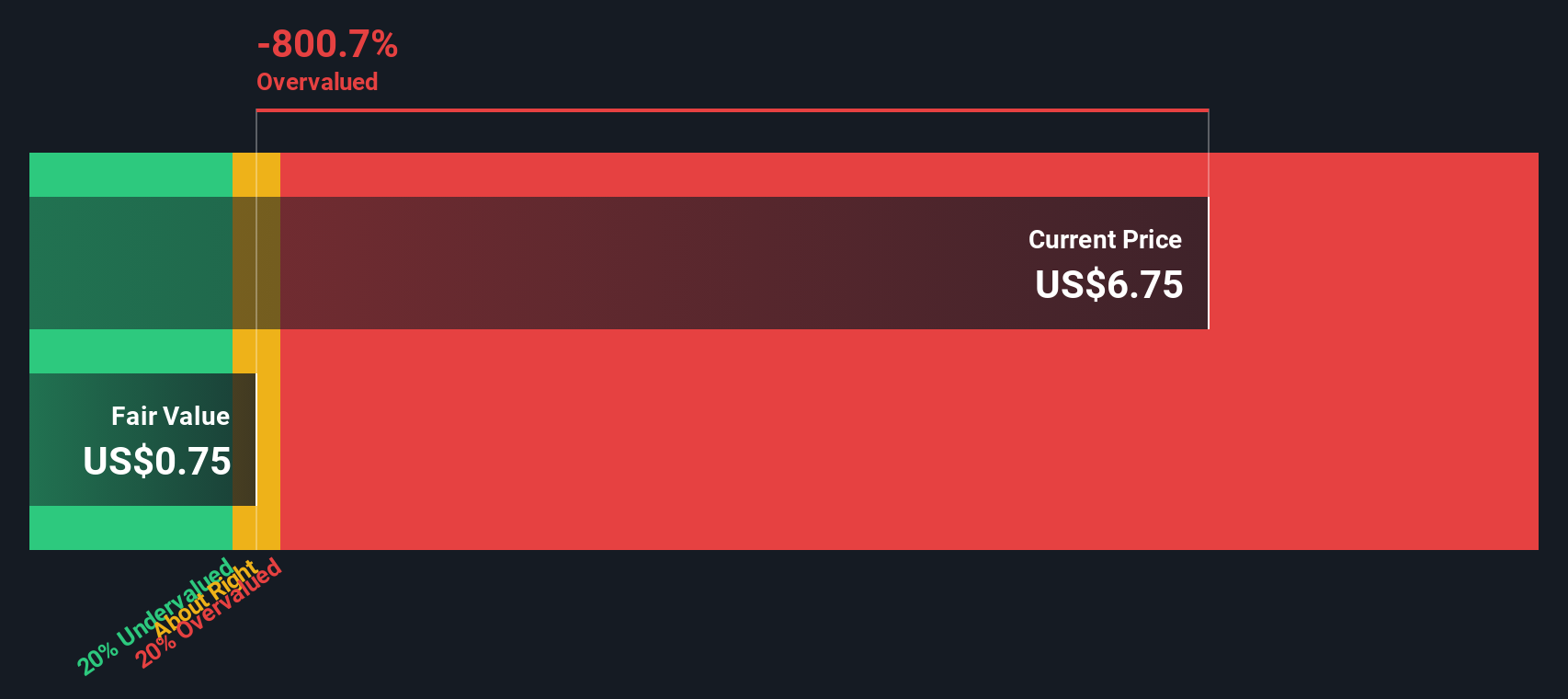

Approach 1: Lumen Technologies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This method offers a grounded approach, focusing on the company’s ability to generate real, ongoing cash for shareholders.

For Lumen Technologies, the current Free Cash Flow stands at $1.79 Billion, highlighting strong underlying cash generation. Analysts have provided estimates out to 2029, projecting Free Cash Flow to reach $606 Million that year. Further projections beyond those years are based on company trends.

This two-stage Free Cash Flow to Equity model compiled all annual forecasts and discounted them appropriately to determine today’s value of these future cash flows. The result is an estimated intrinsic value per share of $18.61.

Compared to the current share price, this DCF valuation suggests that Lumen Technologies stock is trading at a 43.4% discount. This indicates substantial undervaluation at present levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lumen Technologies is undervalued by 43.4%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

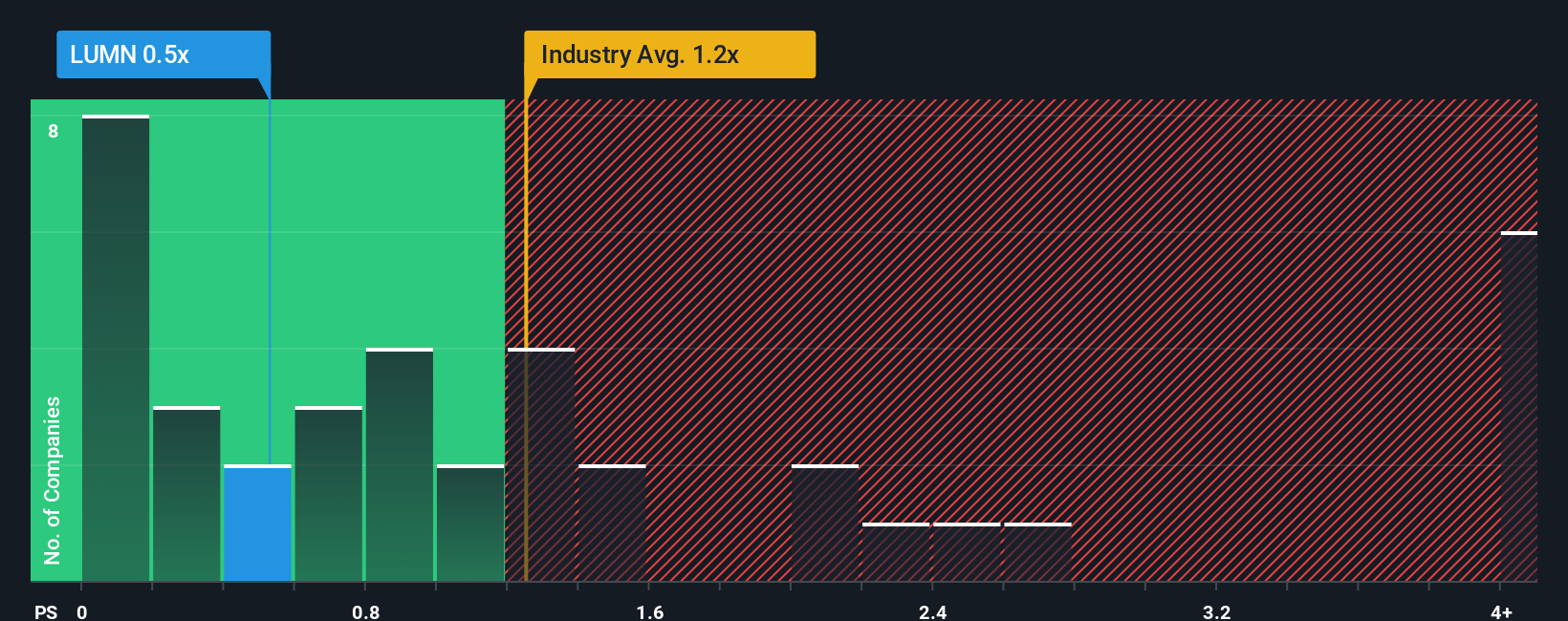

Approach 2: Lumen Technologies Price vs Sales

The Price-to-Sales (P/S) ratio is often considered a reliable valuation multiple for companies that may not have steady profits, such as Lumen Technologies. Since it compares the company’s market capitalization to its revenue, the P/S ratio is especially useful in judging value for telecom companies, where accounting losses or volatile profits can distort traditional earnings multiples.

Higher growth expectations and lower perceived risk typically justify a higher “normal” or “fair” P/S ratio. In contrast, lower growth or greater risk brings that figure down. Industry averages and peer comparisons offer helpful context but can miss important company-specific factors.

Lumen Technologies currently trades at a P/S ratio of 0.85x. This is noticeably below the Telecom industry average of 1.20x and the peer group average of 6.28x. By these simple comparisons, the stock may look undervalued.

However, Simply Wall St's proprietary “Fair Ratio” takes a more nuanced approach. By factoring in not just industry conditions but also Lumen's revenue growth, profit margins, risks, and company size, the Fair Ratio for Lumen comes to 1.03x. This method reduces the risk of drawing misleading conclusions from over-generalized benchmarks and delivers a more tailored assessment for each company.

Comparing the Fair Ratio of 1.03x with Lumen’s actual P/S of 0.85x, the difference is greater than 0.10. This suggests that Lumen is trading somewhat below its justified valuation on this metric.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lumen Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story behind a stock. It allows you to combine what you know about a company’s business, industry changes, and opportunities with your own assumptions about future revenue, earnings, and margins, tying everything together into a clear forecast and fair value.

Unlike static numbers, Narratives connect the dots between what is happening at Lumen Technologies and how those events could shape its future, making investment decisions more dynamic and personal. Narratives are easily accessible for millions on Simply Wall St’s Community page, empowering you to follow existing storylines or craft your own with just a few clicks. They help you decide when to buy or sell by showing if a stock's Fair Value (based on your Narrative) is above or below the current Price, and they automatically update as new news, earnings, or business developments occur.

For example, the most bullish Lumen Technologies Narrative currently assumes the company will resolve its legacy challenges and deliver recurring growth, setting a price target of $8.33 per share. The most cautious Narrative expects ongoing debt and competitive risks to persist, with a target of just $2.00. No matter your perspective, Narratives make it simple to see how your expectations line up with others’ and what a fair price truly means for you.

Do you think there's more to the story for Lumen Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUMN

Lumen Technologies

A networking company, provides integrated products and services to business and mass customers in the United States and internationally.

Undervalued with low risk.

Similar Companies

Market Insights

Community Narratives