Return to Profitability and Raised Guidance Might Change the Case for Investing in IHS Holding (IHS)

Reviewed by Sasha Jovanovic

- IHS Holding Limited recently reported third quarter results, showing a shift from a net loss of US$204.1 million to net income of US$151 million year-over-year, and raised its full-year 2025 revenue guidance to a projected US$1.72 billion to US$1.75 billion.

- The company’s updated outlook highlights strong organic revenue growth, aided by resilient demand for mobile data services and improved operational performance, despite currency pressures and fluctuations in diesel prices.

- We'll now explore how the raised earnings guidance and return to profitability could influence IHS Holding's investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

IHS Holding Investment Narrative Recap

To be an IHS Holding shareholder, one must believe in the ongoing demand for mobile data across key African and Latin American markets, which underpins the company’s tower leasing growth. The recent return to profitability and raised full-year guidance may strengthen the case for further organic expansion, although the biggest short term catalyst, tenancy and lease amendments, remains driven by carrier investment trends. The main near-term risk continues to be currency fluctuation, which has not been materially resolved by this latest news.

Among recent company announcements, the Q3 earnings report stands out. Transitioning from a net loss to a net income of US$151 million, paired with sales growth, confirms operational improvements and supports management’s optimism on revenue momentum, directly connecting to the announced guidance raise. Investors focused on growth catalysts linked to rising data usage may view this combination as a sign of positive traction.

However, currency uncertainty, especially regarding Nigeria’s Naira, remains a factor that investors should be aware of if they are considering the stock...

Read the full narrative on IHS Holding (it's free!)

IHS Holding's narrative projects $2.0 billion in revenue and $268.3 million in earnings by 2028. This requires 4.1% yearly revenue growth and a $157.4 million increase in earnings from the current $110.9 million.

Uncover how IHS Holding's forecasts yield a $9.66 fair value, a 53% upside to its current price.

Exploring Other Perspectives

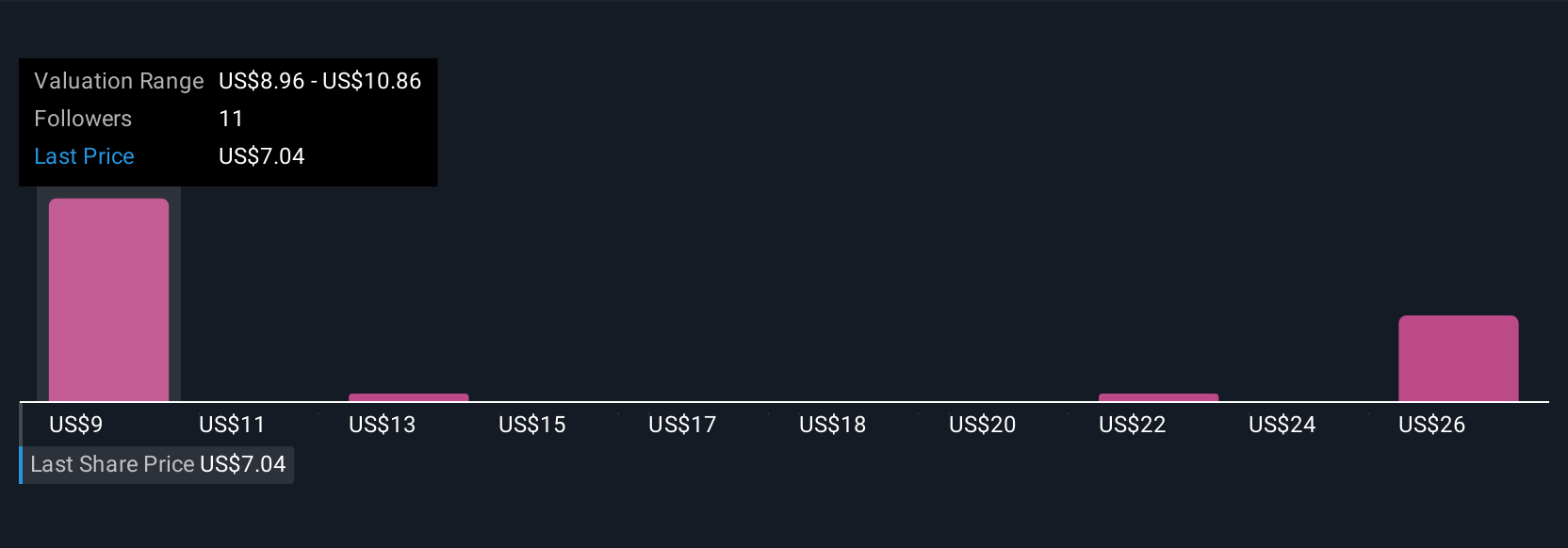

Six community members valued IHS between US$9.59 and US$23.94 per share, reflecting a wide spread in fair value opinions. At the same time, persistent FX volatility continues to test revenue stability, shaping how you might interpret the company’s future potential.

Explore 6 other fair value estimates on IHS Holding - why the stock might be worth over 3x more than the current price!

Build Your Own IHS Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IHS Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free IHS Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IHS Holding's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IHS

IHS Holding

Develops, owns, and operates shared communications infrastructure in Nigeria, Sub-Saharan Africa, the Middle East and North Africa, and Latin America.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives