IDT (IDT): Evaluating Valuation After Recent Share Price Volatility and Long-Term Gains

Reviewed by Simply Wall St

See our latest analysis for IDT.

Zooming out, IDT’s 1-year total shareholder return is essentially flat; however, longer-term holders have seen big wins, with an 88.8% total return over three years and a massive 333.9% over five years. Despite short-term volatility, this mix of recent dips and more robust long-term gains could signal that momentum is cooling for now, but the bigger picture still reflects substantial value creation for patient investors.

If you’re looking to widen your search beyond IDT, now is a great chance to discover fast growing stocks with high insider ownership

With the stock trading well below many analyst price targets and mixed recent performance, the big question now is whether IDT is undervalued with future growth still to come, or if the market already reflects its full potential.

Most Popular Narrative: 37.5% Undervalued

Compared to the last close at $49.97, the most widely followed narrative sees IDT’s fair value much higher. This sets the stage for significant upside potential and fuels ongoing debate about whether the market is overlooking crucial growth drivers.

"IDT's NRS segment is launching new features and functionalities, which are expected to deepen market penetration and drive revenue growth in the independent retailer market. This is anticipated to bolster recurring revenue and adjusted EBITDA."

Want to uncover the secret math behind this bullish outlook? Analysts are considering a powerful combination of expanding margins, a major earnings milestone, and a future earnings multiple that attracts attention. Curious about what’s fueling such a confident narrative? Read on to reveal the hidden catalysts before everyone else.

Result: Fair Value of $80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, IDT's dependence on steady cash flow from BOSS Money and exposure to foreign currency fluctuations could challenge this optimistic outlook if trends shift unexpectedly.

Find out about the key risks to this IDT narrative.

Another View: Multiples Tell a Cautionary Tale

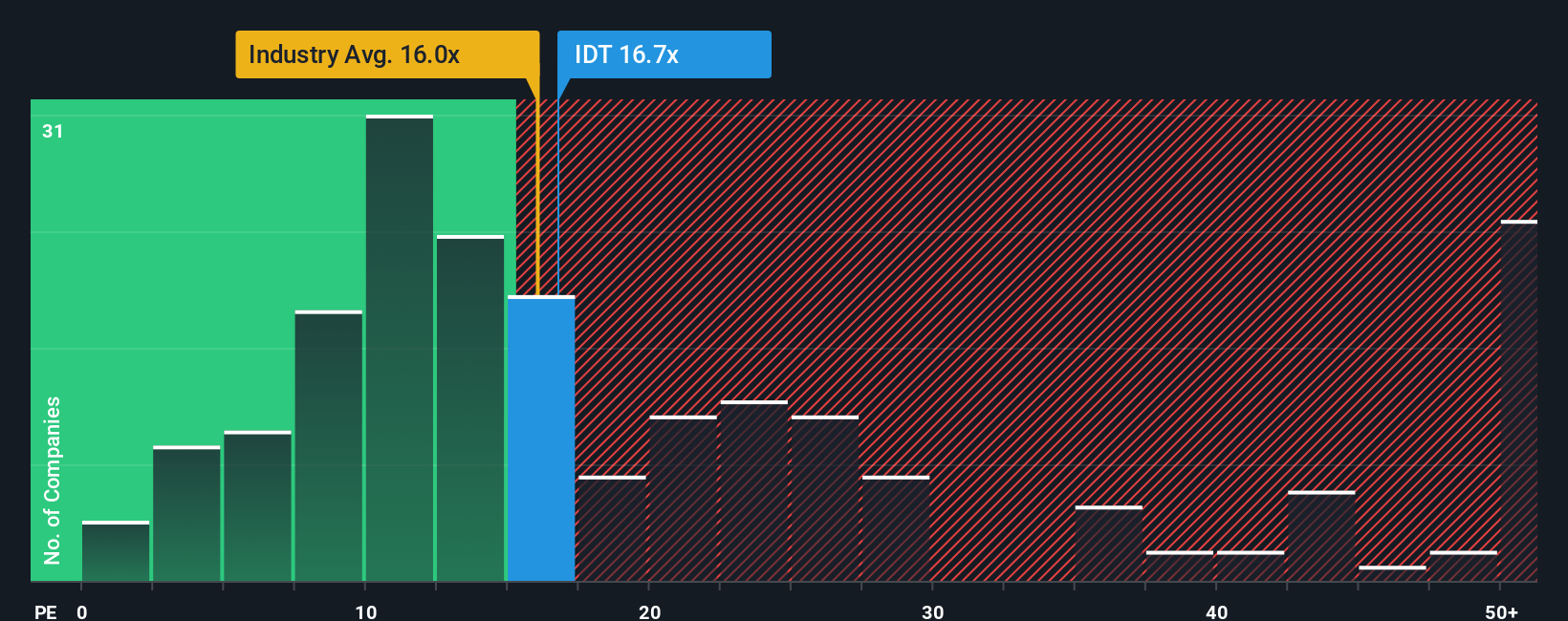

Looking at where IDT trades compared to its industry shows a different story. Its price-to-earnings ratio is 16.6x, slightly above the global telecom industry average of 16.1x and more than double its peer average of just 7x. Even against a fair ratio of 13.6x, IDT looks pricey. This gap could signal higher valuation risk if future growth falls short. Could the market be too optimistic, or is something unique justifying the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own IDT Narrative

If you have a different perspective or want to dig into the details firsthand, shaping your own narrative only takes a couple of minutes. Do it your way

A great starting point for your IDT research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your next winner slip by. Take your strategy to the next level with stocks that match your goals and investing style. The market moves fast, so make the most of your research today with these top picks:

- Target high potential with strong financials by checking out these 3588 penny stocks with strong financials, where emerging opportunities can lead to outsized gains.

- Unlock passive income streams as you scan these 18 dividend stocks with yields > 3% featuring reliable companies offering attractive yields above 3%.

- Catch the artificial intelligence wave before it peaks and review these 27 AI penny stocks focused on companies pushing the boundaries of what is possible.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IDT

IDT

Provides communications and payment services in the United States, the United Kingdom, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives