- United States

- /

- Wireless Telecom

- /

- NYSE:AD

Is Verizon Tower Deal Reshaping The Investment Case For Array Digital Infrastructure (AD)?

Reviewed by Sasha Jovanovic

- Earlier this month, Verizon Communications Inc. and Array Digital Infrastructure, Inc. announced a multi-year partnership allowing Verizon to use Array’s nationwide portfolio of 4,400 towers to enhance its 5G network, with rights to colocate on many new sites under a streamlined pricing structure.

- This agreement not only deepens Array’s role as a tower-focused infrastructure provider after exiting its wireless operations, but also embeds recurring, contracted tower leasing revenue potential from a major national carrier.

- We’ll now examine how this long-term Verizon tower leasing deal could reshape Array Digital Infrastructure’s investment narrative and future cash-flow profile.

Find companies with promising cash flow potential yet trading below their fair value.

Array Digital Infrastructure Investment Narrative Recap

To own Array Digital Infrastructure, you need to believe in its pivot from a regional wireless operator to a focused tower and digital infrastructure landlord, with recurring leasing contracts at the core. The new multi year Verizon tower agreement directly supports that thesis by expanding committed 5G colocation demand, which could reinforce the near term catalyst of growing third party tower revenue while partly balancing the key risk that proceeds from the T Mobile transaction remain subject to timing and regulatory uncertainty.

Among recent developments, the appointment of Anthony Carlson as CEO and President in November 2025 is especially relevant here, because he is now responsible for executing the tower centric strategy that includes the Verizon partnership. His mandate spans the 4,400 site portfolio, remaining spectrum and partnerships, so investors may watch how effectively management converts headline colocation agreements into durable occupancy, disciplined capital allocation and progress on the broader transformation program.

Yet even with Verizon on board, investors should be aware of how dependent Array still is on the timely completion of the T Mobile transaction and related approvals...

Read the full narrative on Array Digital Infrastructure (it's free!)

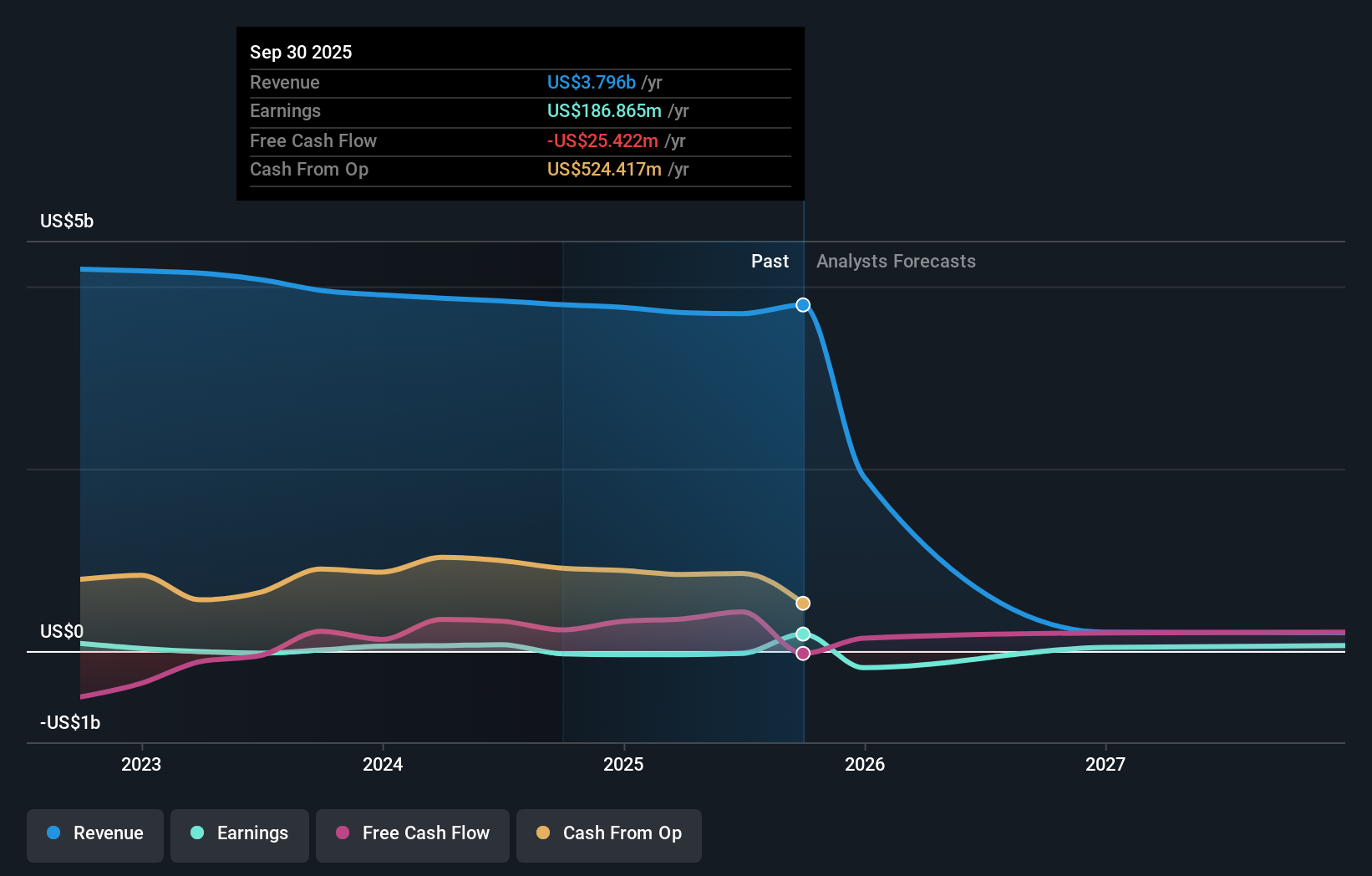

Array Digital Infrastructure's narrative projects $3.6 billion revenue and $173.7 million earnings by 2028. This requires a 0.8% yearly revenue decline and a $212.7 million earnings increase from -$39.0 million today.

Uncover how Array Digital Infrastructure's forecasts yield a $54.50 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community valuations cluster between US$54.50 and US$59.32, underlining how differently private investors can value Array’s tower pivot. You can contrast those views with the reliance on a single large T Mobile transaction that still introduces timing and cash flow uncertainty for the business.

Explore 2 other fair value estimates on Array Digital Infrastructure - why the stock might be worth as much as 15% more than the current price!

Build Your Own Array Digital Infrastructure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Array Digital Infrastructure research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Array Digital Infrastructure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Array Digital Infrastructure's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 34 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AD

Array Digital Infrastructure

Provides wireless telecommunications services in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion