- United States

- /

- Wireless Telecom

- /

- NYSE:AD

Is Array Digital Infrastructure (AD) Fairly Valued After Strong Multi Year Share Price Gains

Reviewed by Bailey Pemberton

- If you are wondering whether Array Digital Infrastructure is still fairly priced after its recent run, this article walks through what the current share price could imply about the company's value.

- The stock last closed at US$56.55, with returns of 5.4% over 7 days, 9.0% over 30 days, 4.7% year to date and 28.5% over 1 year, plus a very large 3 year gain and a 136.8% return over 5 years.

- Recent news coverage has focused on Array Digital Infrastructure's position in digital infrastructure and data focused telecom services, which has helped keep attention on the stock as investors reassess potential growth drivers. Headlines have also highlighted how sector wide interest in connectivity and data capacity is feeding into sentiment around companies like Array Digital Infrastructure.

- On our checks, Array Digital Infrastructure scores 3 out of 6 on undervaluation tests, giving it a valuation score of 3. Next we will walk through what different valuation approaches say about that number, before finishing with a way to think about value that goes beyond the usual ratios.

Approach 1: Array Digital Infrastructure Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model takes estimates of a company’s future cash flows and discounts them back to today’s dollars, aiming to translate long term expectations into a single present value per share.

For Array Digital Infrastructure, the latest twelve month Free Cash Flow is a loss of $129.50 million. Analysts provide detailed Free Cash Flow estimates out to 2030, with Simply Wall St extending the projections to 2035 using its 2 Stage Free Cash Flow to Equity model. For example, projected Free Cash Flow in 2030 is $273 million, with intermediate years such as 2026 and 2027 sitting at $199 million and $207 million respectively, and later extrapolated years rising into the low $300 million range.

After discounting these projected cash flows back to today, the model arrives at an estimated intrinsic value of $77.66 per share. Compared with the recent share price of $56.55, this suggests the shares trade at about a 27.2% discount, which indicates the stock is undervalued on this DCF view.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Array Digital Infrastructure is undervalued by 27.2%. Track this in your watchlist or portfolio, or discover 877 more undervalued stocks based on cash flows.

Approach 2: Array Digital Infrastructure Price vs Earnings

For profitable businesses, the P/E ratio is a useful gut check because it ties the share price directly to the earnings that support it. Investors usually expect companies with stronger growth outlooks and lower perceived risks to justify a higher P/E, while slower growth or higher uncertainty tends to align with a lower, more conservative P/E.

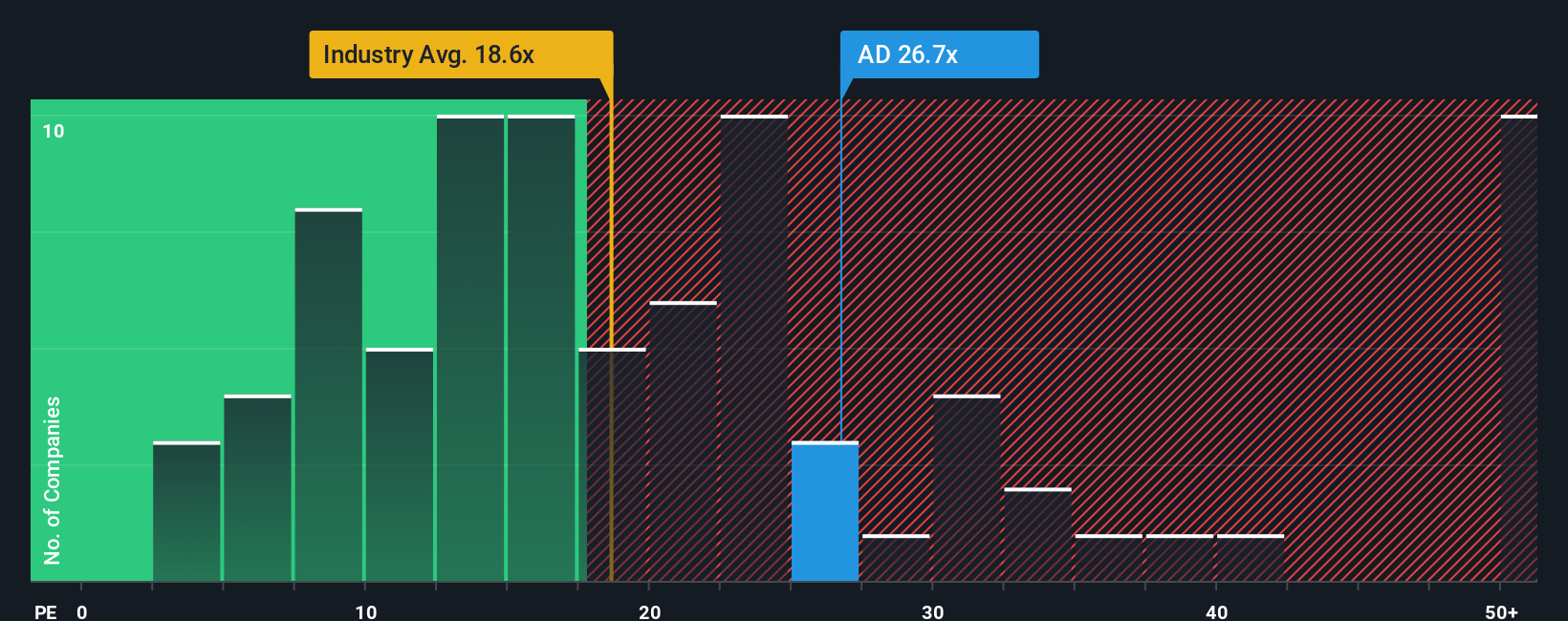

Array Digital Infrastructure currently trades on a P/E of 26.14x. That sits above the Wireless Telecom industry average of 18.59x and below the peer group average of 31.21x. Simply comparing to those benchmarks gives you a rough range, but it does not tell you what is reasonable for this specific company.

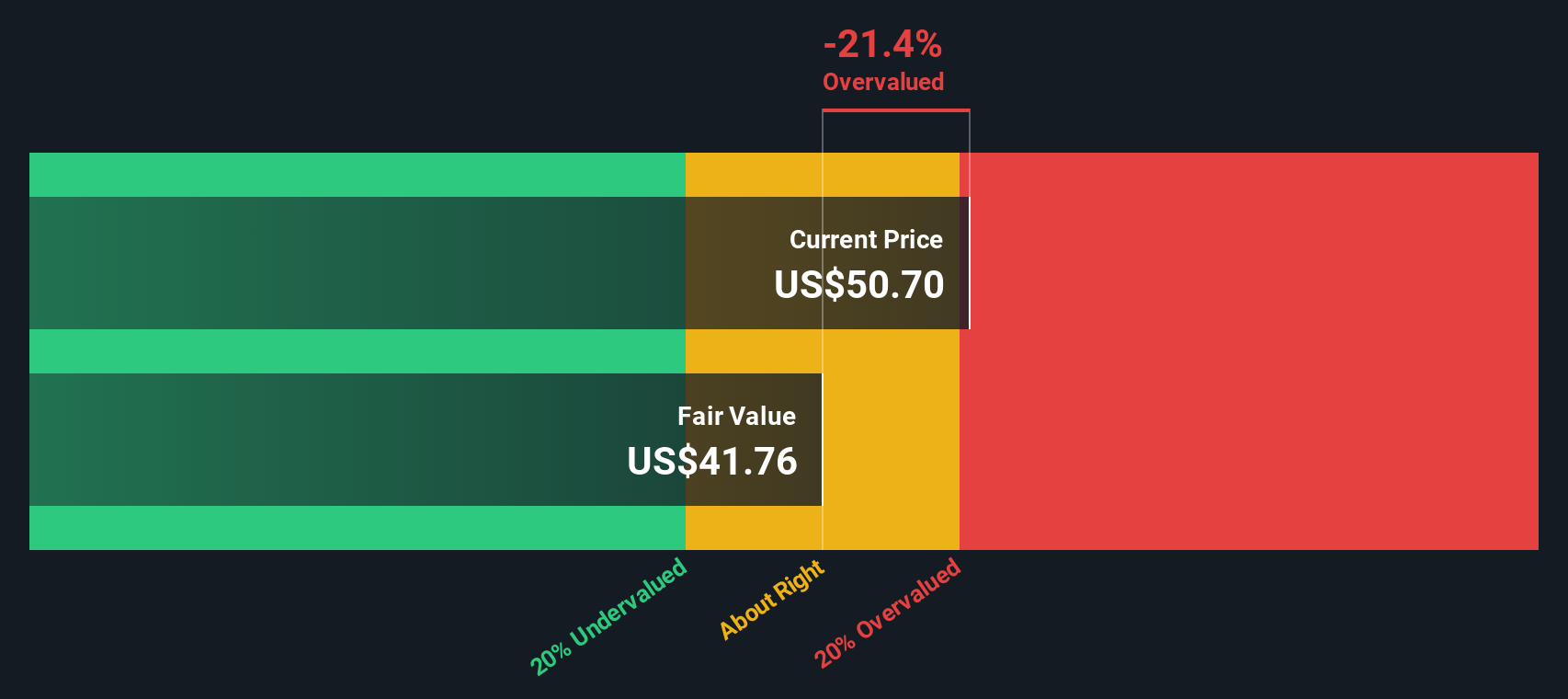

That is where Simply Wall St's Fair Ratio comes in. The Fair Ratio of 13.28x is a proprietary estimate of the P/E that might be appropriate given factors such as earnings growth, profit margins, industry, market cap and company specific risks. Because it blends these company level inputs instead of just lining Array Digital Infrastructure up against broad industry or peer averages, it can provide a more tailored anchor. With the current P/E of 26.14x sitting well above the Fair Ratio of 13.28x, the shares appear expensive on this multiple based view.

Result: OVERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Array Digital Infrastructure Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about a company, backed up by your own view of fair value and your expectations for future revenue, earnings and margins. On Simply Wall St, used by millions of investors, Narratives on the Community page connect that story to a full forecast and then to a fair value estimate, so you can quickly compare it with the current share price to help decide whether the gap between value and price is large enough for you to act. Narratives are not static; they update when fresh information such as news or earnings is added, so your story stays aligned with the latest data. For Array Digital Infrastructure, one Narrative might assume a relatively cautious fair value while another assumes a much higher fair value, yet both sit side by side so you can see how different investors interpret the same company.

Do you think there's more to the story for Array Digital Infrastructure? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AD

Array Digital Infrastructure

Provides wireless telecommunications services in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

M&A machine with a relentless focus on operational excellence

Britam Holdings will navigate a 2.43 fair value journey to growth

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion