- United States

- /

- Wireless Telecom

- /

- NYSE:AD

A Look At Array Digital Infrastructure (AD) Valuation After US$1.018b Spectrum Sale And Special Dividend

Reviewed by Simply Wall St

Array Digital Infrastructure (AD) is back in focus after closing a US$1.018b sale of spectrum licenses to AT&T and declaring a US$10.25 per share special cash dividend tied to that transaction.

See our latest analysis for Array Digital Infrastructure.

The AT&T spectrum deal and special dividend have arrived alongside a 17.38% 90 day share price return and a 29.40% 1 year total shareholder return, while the 3 year total shareholder return above 250% suggests recent momentum rather than fading performance.

If this kind of corporate action has you thinking more broadly about telecom and infrastructure opportunities, it could be a good moment to scan fast growing stocks with high insider ownership for other ideas gaining attention.

With the special dividend, a US$1.018b cash inflow and an intrinsic value estimate implying a 26% discount, the key question is simple: is Array still mispriced or is the market already baking in future growth?

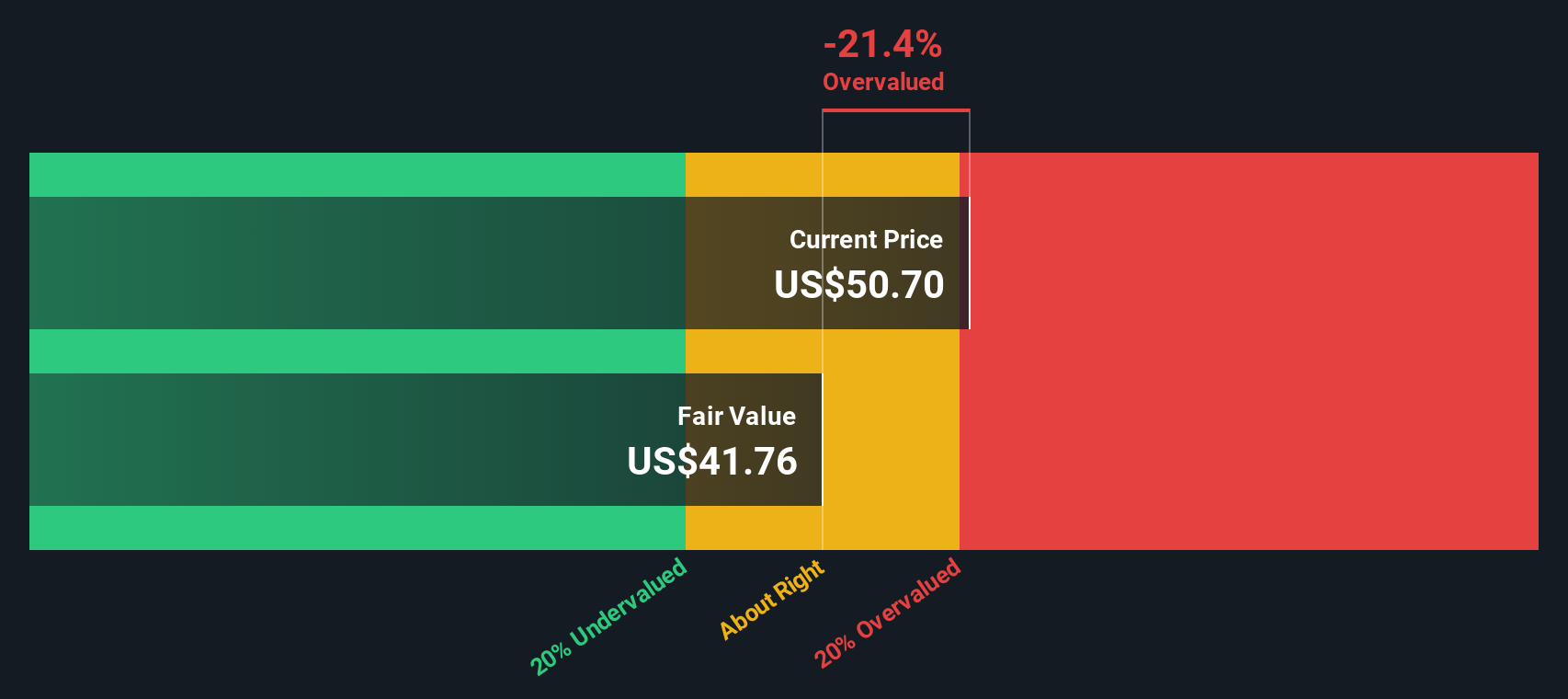

Most Popular Narrative: 6.1% Overvalued

At a last close of US$57.80 versus a narrative fair value of US$54.50, the current price sits modestly above that fair value anchor, which hinges on very specific long term assumptions about revenue, margins and the earnings multiple.

The analysts have a consensus price target of $80.75 for United States Cellular based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $85.0, and the most bearish reporting a price target of just $72.0.

Curious what has to happen to revenue, profit margins and the future P/E to justify that higher fair value? The narrative leans heavily on a sharp earnings swing and a premium multiple that is usually reserved for faster growing sectors. If you want to see exactly how those assumptions stack up over the next few years, the full narrative lays the numbers out in black and white.

Result: Fair Value of $54.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the whole story could change if regulatory approvals for pending transactions stall or if competitive pressure from larger carriers continues to weigh on service revenues.

Find out about the key risks to this Array Digital Infrastructure narrative.

Another Take: DCF Points the Other Way

While the narrative model points to a 6.1% premium to its US$54.50 fair value, our DCF model tells a different story. In this view, Array Digital Infrastructure at US$57.80 trades about 25.6% below a US$77.66 fair value, raising the question of which set of assumptions you trust more.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Array Digital Infrastructure for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Array Digital Infrastructure Narrative

If you look at these numbers and reach a different conclusion, or prefer to test your own assumptions directly, you can build a tailored thesis in a few minutes using Do it your way.

A great starting point for your Array Digital Infrastructure research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If Array has sharpened your thinking, do not stop here, let the Simply Wall St Screener surface fresh opportunities that match the way you like to invest.

- Target potential mispricings by scanning these 876 undervalued stocks based on cash flows that line up with your own expectations on cash flow strength and pricing.

- Ride the growth of AI by reviewing these 24 AI penny stocks that could benefit from rising demand for data, automation and computing power.

- Tap into long term income themes by checking these 12 dividend stocks with yields > 3% that might suit a portfolio focused on regular cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AD

Array Digital Infrastructure

Provides wireless telecommunications services in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Very Bullish

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Very Bullish

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026