- United States

- /

- Wireless Telecom

- /

- NasdaqCM:VEON

It's A Story Of Risk Vs Reward With VEON Ltd. (NASDAQ:VEON)

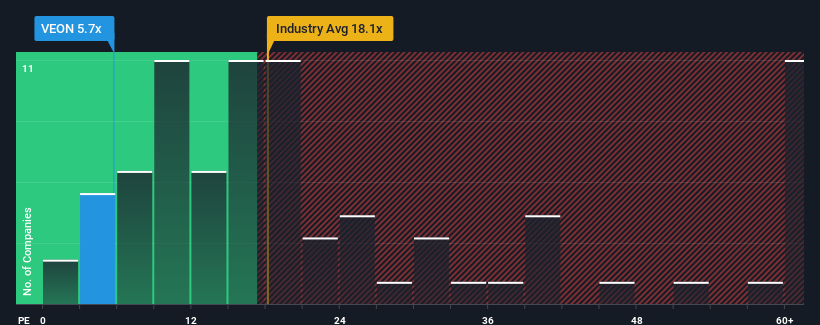

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 17x, you may consider VEON Ltd. (NASDAQ:VEON) as a highly attractive investment with its 5.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

For instance, VEON's receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for VEON

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like VEON's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 47%. Still, the latest three year period has seen an excellent 401% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Comparing that to the market, which is only predicted to deliver 12% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we find it odd that VEON is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of VEON revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

There are also other vital risk factors to consider and we've discovered 2 warning signs for VEON (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

If you're unsure about the strength of VEON's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:VEON

VEON

A digital operator, provides telecommunications and digital services to corporate and individual customers in Pakistan, Ukraine, Kazakhstan, Uzbekistan, and Bangladesh.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success