- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:UNIT

Unity Group (UNIT) Surges 22% Over The Past Week

Unity Group (UNIT) experienced a significant share price increase of 22% over the past week. While specific latest events impacting the company were not detailed, this surge occurred amidst a broad market trend where the S&P 500 and Nasdaq reached all-time highs, supported by positive economic indicators such as a lower Producer Price Index. The company's price gain outpaced the broader market's 1% rise, suggesting additional factors may have influenced Unity Group specifically. Despite this impressive performance, the exact reasons behind the notable price movement remain undetermined without specified events or news tied directly to the company.

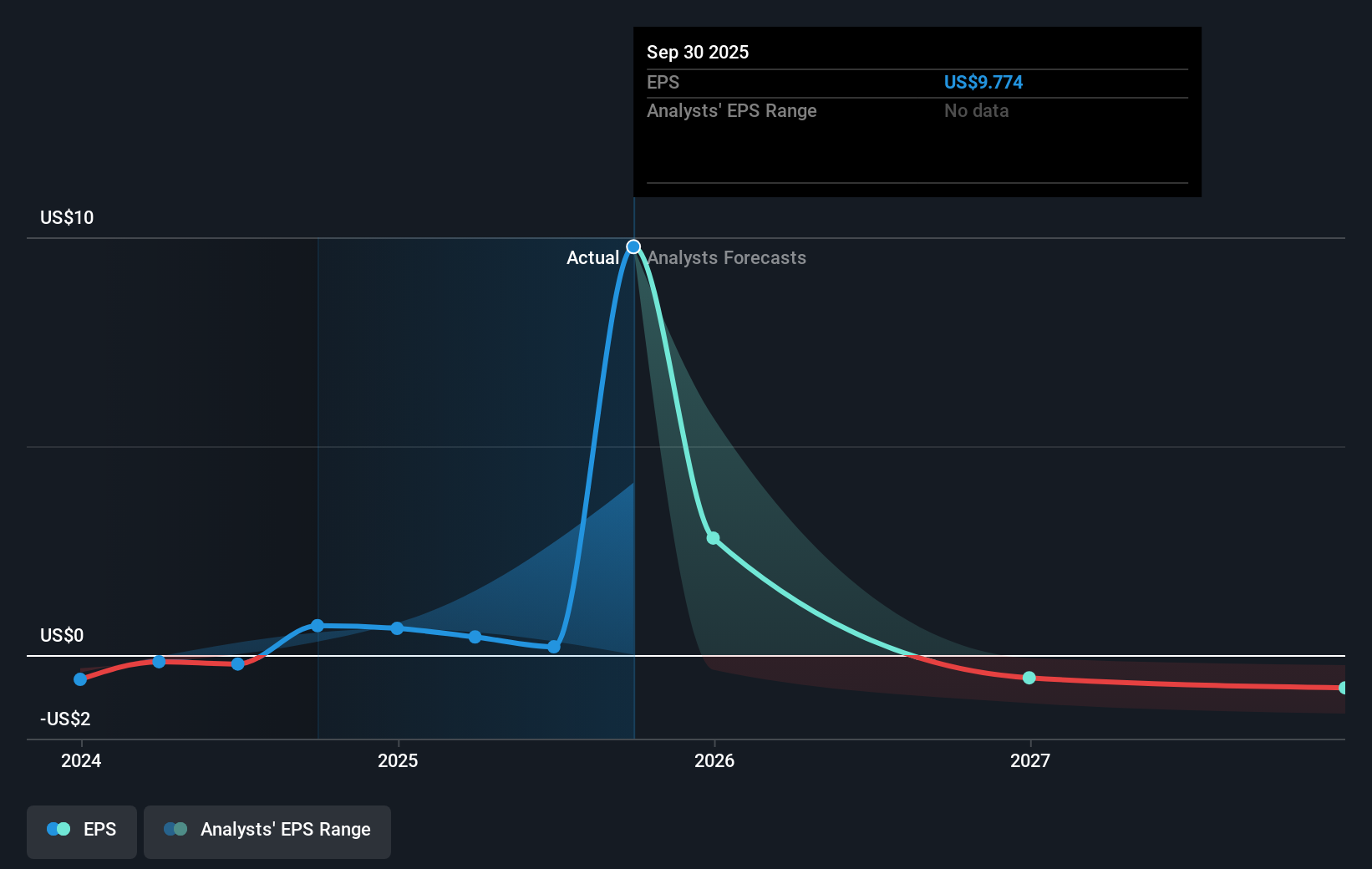

The recent surge in Unity Group's share price, while not directly linked to any specific event, could have repercussions on the broader narrative. This increase aligns with a market uptrend where indices like the S&P 500 and Nasdaq hit record levels. However, the jump outpacing the market indicates potential underlying factors specific to Unity that may affect future revenue and earnings forecasts. Given the company's focus on expanding fiber infrastructure and its financial projections, this upward movement might reflect investor optimism about Unity's long-term growth potential, despite existing risks.

Looking at the longer-term performance, Unity Group experienced a total return of 17.38% decline over the past year, highlighting a challenging period. Despite the recent boost, the company underperformed both the US Telecom industry, which saw a 16.4% gain, and the overall US Market, which recorded a 20.5% gain during the same timeframe. This underperformance suggests that while short-term gains are promising, sustained improvements are needed to bring long-term returns in line with broader market performance.

The recent price movement brings the current share price to $7.14, moving closer to the analyst consensus price target of $8.25. With the shares trading at a 15.55% discount to this target, it suggests there is still a belief among analysts of potential upside. The forecasted revenue growth and revised earnings projections, which assume continued emphasis on fiber, are crucial for achieving the targeted share price. As Unity Group continues to navigate high leverage and capital expenditure needed for expansion, future price movements will likely reflect the execution of these growth initiatives and their impact on financial performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UNIT

Uniti Group

Uniti (NASDAQ: UNIT) is a premier insurgent fiber provider dedicated to enabling mission-critical connectivity across the United States.

Proven track record with slight risk.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Spotify - A Fundamental and Historical Valuation

Very Bullish

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.