- United States

- /

- Wireless Telecom

- /

- NasdaqGM:UCL

Is uCloudlink Group (NASDAQ:UCL) Using Too Much Debt?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that uCloudlink Group Inc. (NASDAQ:UCL) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for uCloudlink Group

How Much Debt Does uCloudlink Group Carry?

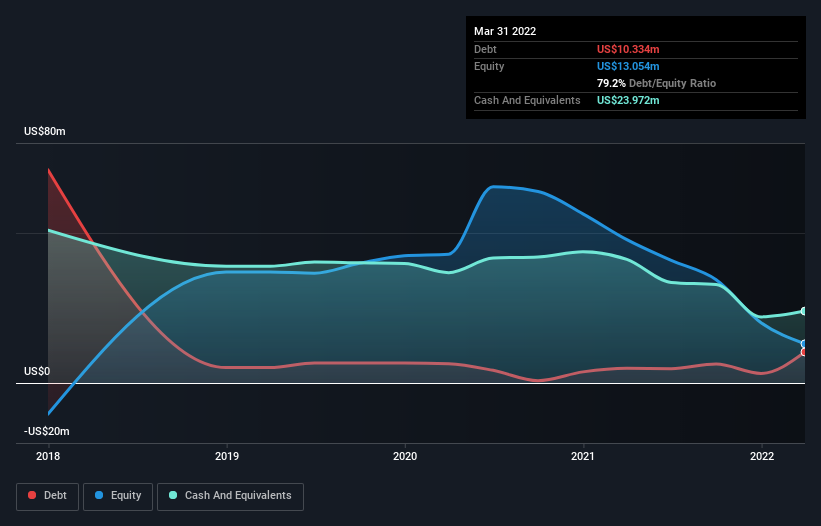

You can click the graphic below for the historical numbers, but it shows that as of March 2022 uCloudlink Group had US$10.3m of debt, an increase on US$4.90m, over one year. However, its balance sheet shows it holds US$24.0m in cash, so it actually has US$13.6m net cash.

A Look At uCloudlink Group's Liabilities

We can see from the most recent balance sheet that uCloudlink Group had liabilities of US$51.3m falling due within a year, and liabilities of US$248.0k due beyond that. Offsetting these obligations, it had cash of US$24.0m as well as receivables valued at US$15.7m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$11.9m.

While this might seem like a lot, it is not so bad since uCloudlink Group has a market capitalization of US$42.3m, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt. While it does have liabilities worth noting, uCloudlink Group also has more cash than debt, so we're pretty confident it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine uCloudlink Group's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year uCloudlink Group had a loss before interest and tax, and actually shrunk its revenue by 2.7%, to US$72m. That's not what we would hope to see.

So How Risky Is uCloudlink Group?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year uCloudlink Group had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through US$20m of cash and made a loss of US$39m. With only US$13.6m on the balance sheet, it would appear that its going to need to raise capital again soon. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 4 warning signs for uCloudlink Group you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if uCloudlink Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:UCL

uCloudlink Group

Operates as a mobile data traffic sharing marketplace in the telecommunications industry.

Outstanding track record with adequate balance sheet.

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

EU#5 - From Industrial Giant to the Digital Operating System of the Real World

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Sleeping Giant" Stumbles, Then Wakes Up

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.