- United States

- /

- Wireless Telecom

- /

- NasdaqGS:TMUS

T-Mobile US (TMUS) Valuation in Focus as Leadership Transition Reinforces Growth and Tech Strategy

Reviewed by Kshitija Bhandaru

Big changes are coming to T-Mobile US (TMUS), and if you’re following the story, this might be a moment to pause and rethink your plans for the stock. The company just confirmed that Chief Operating Officer Srini Gopalan will soon take the CEO seat, while current CEO Mike Sievert shifts to a new Vice Chairman role. Alongside this, Deutsche Telekom’s Chief Technology Officer, Abdurazak Mudesir, is joining the T-Mobile Board. All these moves are the result of a clear, staged leadership succession plan, designed not to shake up the strategy but to double down on growth and technology direction.

Even as competition stays heated across the wireless landscape, T-Mobile’s focus on seamless management transition and tech expertise has kept optimism alive among investors. Over the past year, TMUS has delivered a gain of 17%, with steady growth extending out to a striking 82% total return over three years. That kind of momentum suggests the market still sees long-term potential, especially given T-Mobile’s success in expanding its 5G reach, consumer base, and network innovations.

After these leadership updates and the recent stretch of market gains, it’s worth asking whether T-Mobile’s future has already been priced in, or if there is still a buying window left open for patient investors.

Most Popular Narrative: 17.7% Overvalued

According to the narrative by WallStreetWontons, T-Mobile US (TMUS) is currently viewed as trading above its calculated fair value, which may indicate a potential premium for investors considering new positions.

“T-Mobile’s aggressive rollout of its 5G network is a major growth driver. The company has been leading in 5G coverage and performance, which attracts more customers and increases service revenues.”

What is fueling this bold valuation? There are some fascinating growth stories and financial forecasts underneath, especially around future earnings and margin improvements. Is T-Mobile’s 5G dominance enough to justify the premium price, or are there hidden assumptions that could change the story? The narrative teases some big numbers, but the real intrigue is in the details you have not seen yet.

Result: Fair Value of $201.69 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, significant risks remain, including fierce competition from AT&T and Verizon, as well as potential setbacks if projected cost savings from the Sprint merger do not materialize.

Find out about the key risks to this T-Mobile US narrative.Another View: Discounted Cash Flow Paints a Different Picture

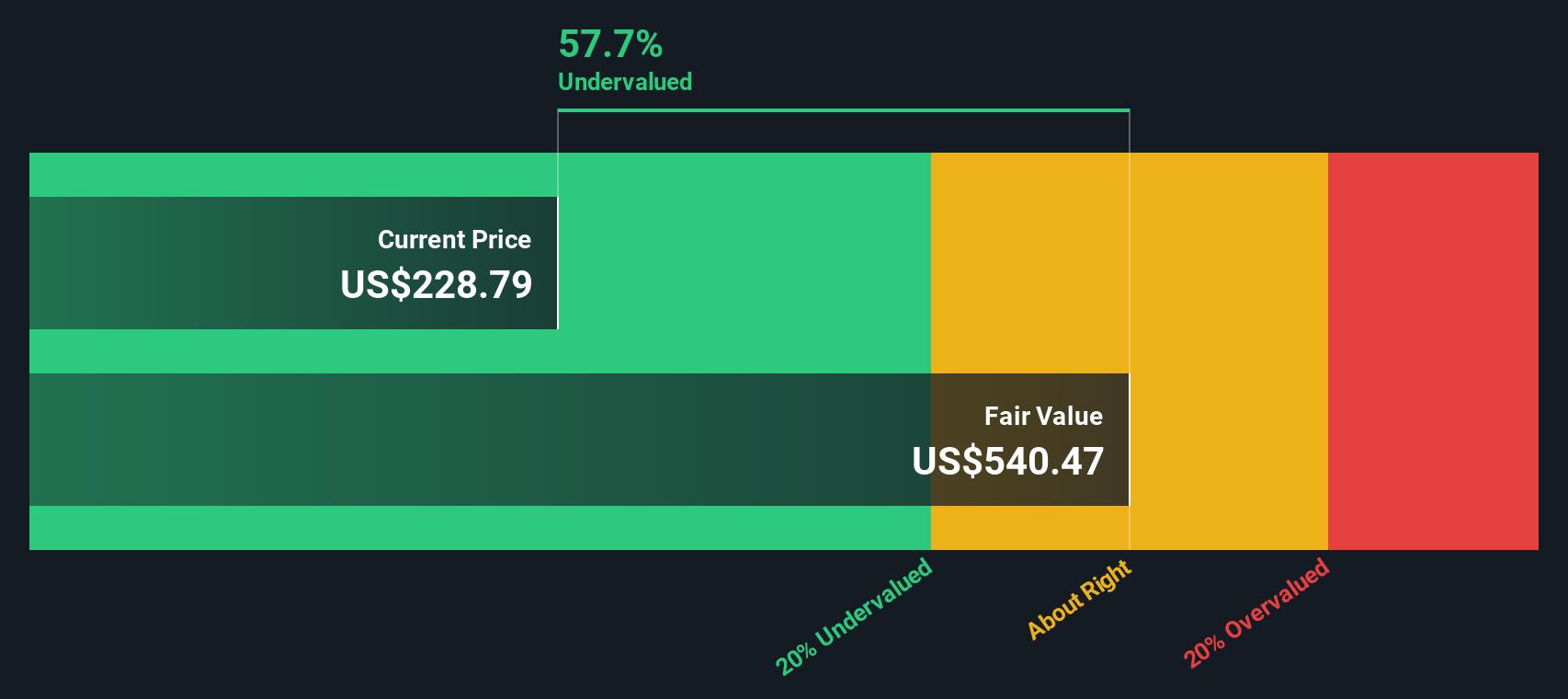

Taking a second look using our DCF model, the perspective shifts. This time, T-Mobile comes out looking undervalued, not expensive. Which forecast holds true when you put the two methods side by side?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own T-Mobile US Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can easily build your own T-Mobile story in just a few minutes. Do it your way

A great starting point for your T-Mobile US research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t leave your next big opportunity to chance. Open doors to exceptional companies with unique strengths by checking out these handpicked strategies you won’t want to miss:

- Uncover potential in the AI sector by tapping into tomorrow’s disruptors with our powerful selection of AI penny stocks.

- Target reliable income streams and strengthen your portfolio with market-proven picks using dividend stocks with yields > 3%.

- Find undervalued gems set for growth by unlocking stocks that stand out on cash flow fundamentals with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if T-Mobile US might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TMUS

T-Mobile US

Provides wireless communications services in the United States, Puerto Rico, and the United States Virgin Islands.

Good value with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion