- United States

- /

- Wireless Telecom

- /

- NasdaqGS:TMUS

T-Mobile (TMUS): Exploring Valuation After Recent Share Price Decline

Reviewed by Kshitija Bhandaru

T-Mobile US (TMUS) shares have seen a slight move recently, prompting some investors to take a closer look at the company’s underlying performance. Over the past month, TMUS stock has declined by 9%, and it remains up 12% over the last year.

See our latest analysis for T-Mobile US.

T-Mobile’s steady 12% total shareholder return over the past year suggests momentum is still on its side, despite a recent dip in its share price. While the one-month share price return has softened, the longer-term performance indicates investors have generally been rewarded for their patience. This hints at underlying growth potential and ongoing confidence in the business.

If you’re curious to see what else could spark your portfolio’s growth, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading below analyst price targets and the company showing solid annual growth, the question now is whether T-Mobile remains undervalued or if the market has already accounted for future gains in the current price.

Most Popular Narrative: 15% Undervalued

T-Mobile's widely followed narrative indicates a fair value well above the recent closing price of $230.27. This points to a sizable gap between what the market pays and what the narrative projects, setting the stage for a deeper dive into what is driving such a strong valuation call.

*Innovations such as the rollout of 5G Advanced and T-Satellite, along with enhancements in digital platforms like T-Life, signal operational improvements that could drive margin expansion and future earnings growth. Escalating postpaid ARPA expectations and targeted price optimizations could lead to a rise in average revenue per user, enhancing revenue and gross margins.*

Curious what big financial levers justify this potential upside? The narrative pins its optimism on aggressive revenue targets and higher margins, combined with a bold future multiple that rivals industry standouts. Want to see what assumptions really drive this bullish take?

Result: Fair Value of $272.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential headwinds remain, such as heightened industry churn or tariffs on handsets. Either of these factors could impact T-Mobile’s growth and valuation outlook.

Find out about the key risks to this T-Mobile US narrative.

Another View: Looking at the Numbers Through a Different Lens

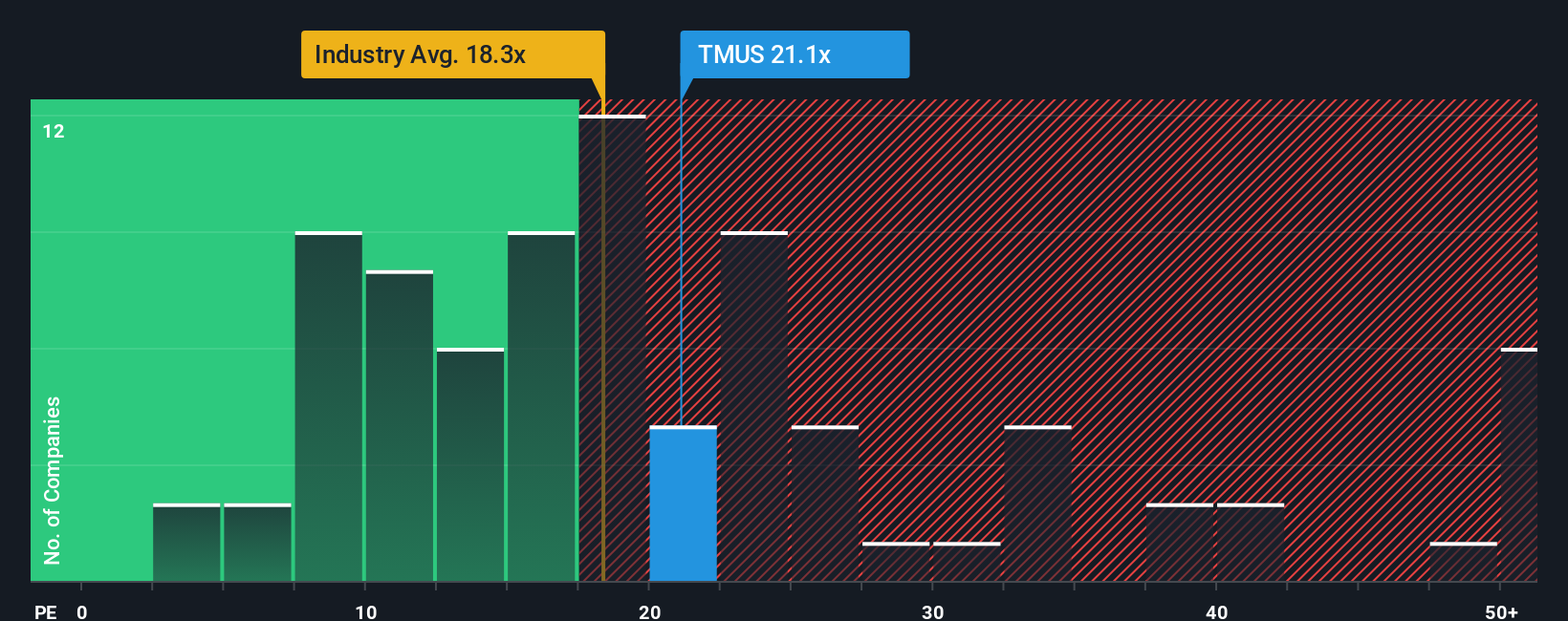

While analyst models suggest T-Mobile is undervalued, the market’s price-to-earnings ratio of 21.2x tells a different story. That is higher than both global industry peers at 18.2x and the fair ratio of 17.5x, hinting at valuation risk if the market reverts. Could optimism be overdone?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own T-Mobile US Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own view in just a few minutes with Do it your way

A great starting point for your T-Mobile US research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t miss out on the next wave of potential winners. Use these handpicked shortcuts to unlock unique stock ideas that could add real momentum to your portfolio:

- Boost your passive income by checking out these 19 dividend stocks with yields > 3% with yields over 3% to support your long-term wealth goals.

- Spot untapped tech front-runners and get ahead of trends by browsing these 24 AI penny stocks for breakthroughs in artificial intelligence.

- Capitalize on market mispricing by uncovering value with these 884 undervalued stocks based on cash flows that stand out based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if T-Mobile US might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TMUS

T-Mobile US

Provides wireless communications services in the United States, Puerto Rico, and the United States Virgin Islands.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026