- United States

- /

- Wireless Telecom

- /

- NasdaqGS:TMUS

T-Mobile (TMUS): Assessing Valuation After CEO Srini Gopalan’s Notable Insider Stock Purchase

Reviewed by Simply Wall St

Recent filings revealed that President and CEO Srini Gopalan purchased 9,800 shares of T-Mobile US (TMUS) stock, a move frequently seen as leadership showing belief in the company's future direction.

See our latest analysis for T-Mobile US.

T-Mobile US has certainly grabbed attention with a flurry of recent milestones, including major advances in emergency connectivity, the launch of SuperMobile for CNN’s field reporting, and new rewards for customers through its Capital One credit card partnership. While these positive headlines helped build optimism, the share price has seen some swings. Despite a 1-day return of 0.7% and a strong three-year total shareholder return of nearly 50%, 2025 has brought more muted results, with year-to-date share price return down 1.6% and a 12-month total shareholder return of -7%. Overall, long-term investors have still enjoyed meaningful gains, but momentum has faded this year as the market reassesses the balance between growth potential and near-term risks.

If you’re exploring what’s next in the broader communications and tech sectors, why not broaden your investing search and discover fast growing stocks with high insider ownership?

Given the executive show of confidence and the company’s history of outperformance, the key question is whether T-Mobile US remains undervalued at current levels, or if the market has already priced in all its future growth potential.

Most Popular Narrative: 21.5% Undervalued

With T-Mobile US closing at $216.08 and the narrative's fair value set at $275.19, analysts see the company's shares trading well below what its fundamentals justify. This disconnect between market price and narrative valuation builds a case for significant potential upside, as long as the company's growth themes play out as anticipated.

Innovations such as the rollout of 5G Advanced and T-Satellite, alongside enhancements in digital platforms like T-Life, signal operational improvements that could drive margin expansion and future earnings growth.

Want to unravel what's fueling this valuation gap? The key assumptions behind this target include far-reaching changes in subscriber growth, cutting-edge tech adoption, and a future profit multiple that is rare in this industry. Curious which surprising numbers power these projections? Discover what really drives the fair value call.

Result: Fair Value of $275.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising industry competition and the possibility of higher handset tariffs could put pressure on T-Mobile's margins and slow subscriber growth momentum.

Find out about the key risks to this T-Mobile US narrative.

Another View: Market Ratios Signal Caution

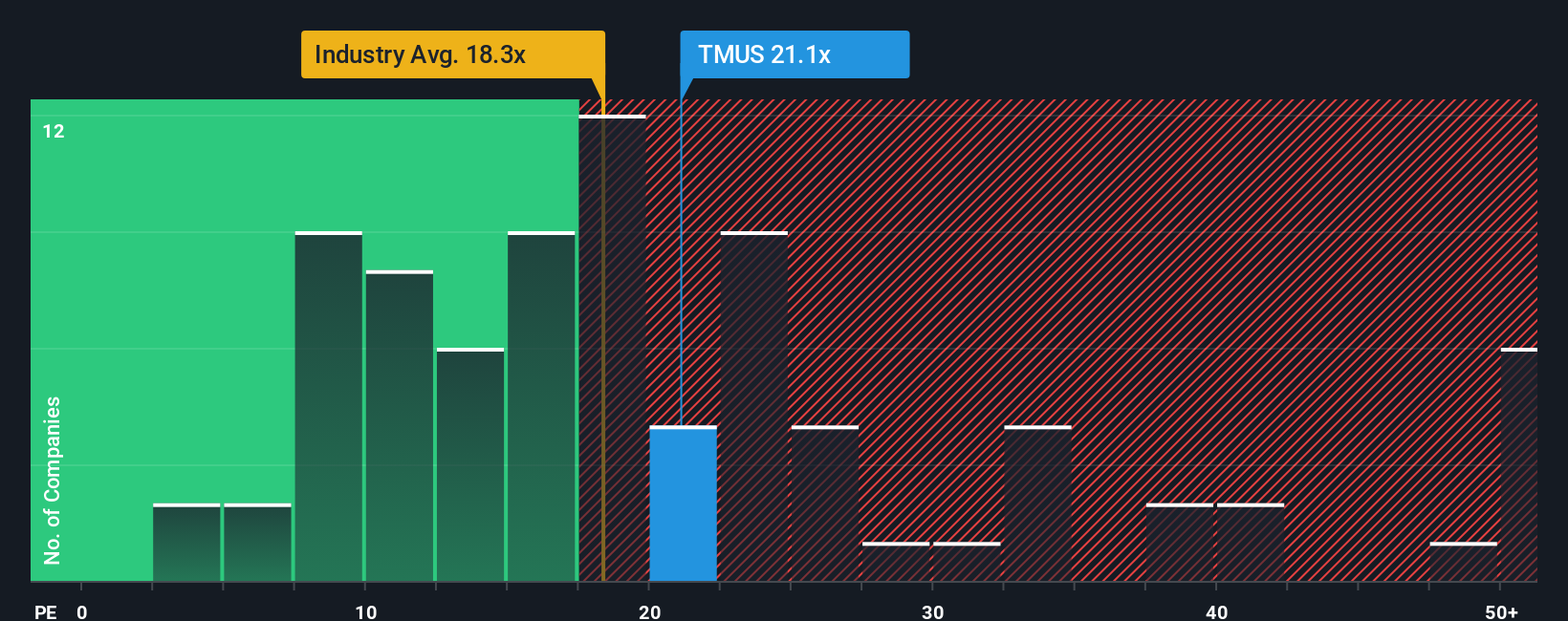

While the fair value narrative points to significant undervaluation, a look at T-Mobile US's price-to-earnings ratio tells a different story. At 20.4x, it is well above both peer (7.4x) and global industry averages (18.2x), and even above our calculated fair ratio of 16.5x. This suggests the market could be overestimating future growth, with valuation risk if expectations are not fully met. Which view is closer to the real story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own T-Mobile US Narrative

If you see these results differently or would rather run your own numbers, you can quickly shape a personalized view of T-Mobile US in just a few minutes. Do it your way.

A great starting point for your T-Mobile US research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit their options. For exciting new opportunities, check out these hand-picked ideas from the Simply Wall Street Screener that could supercharge your portfolio. Missing out is not an option.

- Spot high-yield potential by tapping into these 16 dividend stocks with yields > 3% for companies delivering attractive income with proven, stable returns.

- Jump ahead on innovation with these 25 AI penny stocks, featuring businesses creating the technology that is transforming entire industries right now.

- Catch market mispricings and find tomorrow’s bargains using these 879 undervalued stocks based on cash flows, where undervalued stocks wait for sharp investors to take notice.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if T-Mobile US might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TMUS

T-Mobile US

Provides wireless communications services in the United States, Puerto Rico, and the United States Virgin Islands.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives