- United States

- /

- Telecom Services and Carriers

- /

- NasdaqCM:SIFY

Sify Technologies Limited (NASDAQ:SIFY) Just Reported, And Analysts Assigned A US$3.00 Price Target

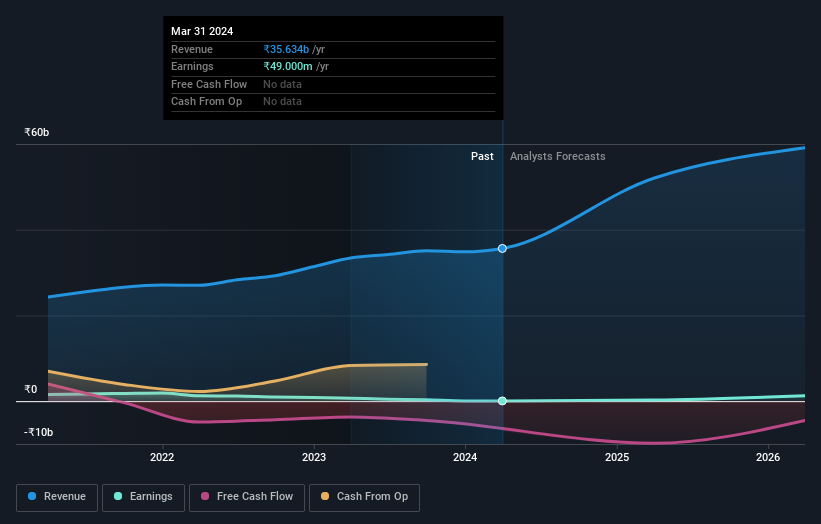

Sify Technologies Limited (NASDAQ:SIFY) shareholders are probably feeling a little disappointed, since its shares fell 4.8% to US$1.19 in the week after its latest full-year results. Revenues fell badly short of expectations, with revenue of ₹36b, missing analyst estimates by 22%. Earnings are an important time for investors, as they can track a company's performance, look at what the analyst is forecasting for next year, and see if there's been a change in sentiment towards the company. With this in mind, we've gathered the latest statutory forecasts to see what the analyst is expecting for next year.

Check out our latest analysis for Sify Technologies

Taking into account the latest results, the most recent consensus for Sify Technologies from solitary analyst is for revenues of ₹52.0b in 2025. If met, it would imply a sizeable 46% increase on its revenue over the past 12 months. Before this earnings report, the analyst had been forecasting revenues of ₹52.6b and break-even in 2025. Overall, while the analyst has reconfirmed their revenue estimates, the consensus now no longer provides an EPS estimate. This implies that the market believes revenue is more important after these latest results.

The average price target fell 57% to US$3.00, withthe analyst clearly having become less optimistic about Sify Technologies'prospects following its latest earnings.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's clear from the latest estimates that Sify Technologies' rate of growth is expected to accelerate meaningfully, with the forecast 46% annualised revenue growth to the end of 2025 noticeably faster than its historical growth of 11% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 1.9% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analyst also expect Sify Technologies to grow faster than the wider industry.

The Bottom Line

The clear take away from these updates is that the analyst made no change to their revenue estimates for next year, with the business apparently performing in line with their models. Happily, there were no major changes to revenue forecasts, with the business still expected to grow faster than the wider industry. Furthermore, the analyst also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

One Sify Technologies broker/analyst has provided estimates out to 2026, which can be seen for free on our platform here.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Sify Technologies (1 is a bit concerning!) that you need to be mindful of.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SIFY

Sify Technologies

Offers information and communication technology solutions and services in India and internationally.

High growth potential with worrying balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

EU#5 - From Industrial Giant to the Digital Operating System of the Real World

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.