- United States

- /

- Telecom Services and Carriers

- /

- NasdaqCM:SIFY

Sify Technologies Reports Full Year 2025 Earnings

Sify Technologies (NASDAQ:SIFY) Full Year 2025 Results

Key Financial Results

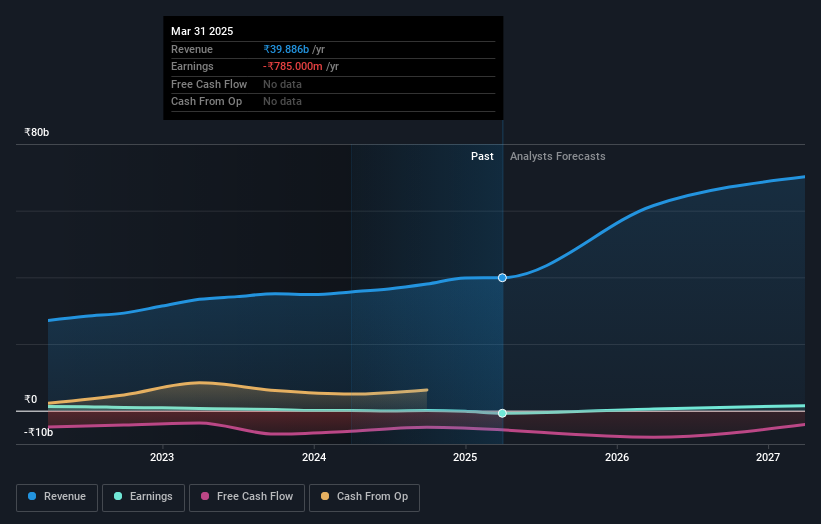

- Revenue: ₹39.9b (up 12% from FY 2024).

- Net loss: ₹785.0m (down from ₹48.9m profit in FY 2024).

All figures shown in the chart above are for the trailing 12 month (TTM) period

Sify Technologies Earnings Insights

Looking ahead, revenue is forecast to grow 26% p.a. on average during the next 2 years, compared to a 2.9% growth forecast for the Telecom industry in the US.

Performance of the American Telecom industry.

The company's share price is broadly unchanged from a week ago.

Risk Analysis

You should always think about risks. Case in point, we've spotted 2 warning signs for Sify Technologies you should be aware of.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SIFY

Sify Technologies

Offers information and communication technology solutions and services in India and internationally.

High growth potential with very low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Trending Discussion

The margins for companies in the power sector are expected to improve over time. Currently, the industry is highly competitive, offering limited return on investment for shareholders. However, once more dormant plants are brought online and contribute to the national grid, we can look forward to reaping the rewards. NO NATION CAN HAVE THE DEVELOPMENT IT SEEKS WITHOUT POWER PLAYING A MASSIVE ROLE.