Stock Analysis

- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:LBTY.A

Investors in Liberty Global (NASDAQ:LBTY.A) from five years ago are still down 31%, even after 4.6% gain this past week

While it may not be enough for some shareholders, we think it is good to see the Liberty Global Ltd. (NASDAQ:LBTY.A) share price up 17% in a single quarter. But over the last half decade, the stock has not performed well. After all, the share price is down 31% in that time, significantly under-performing the market.

While the last five years has been tough for Liberty Global shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

View our latest analysis for Liberty Global

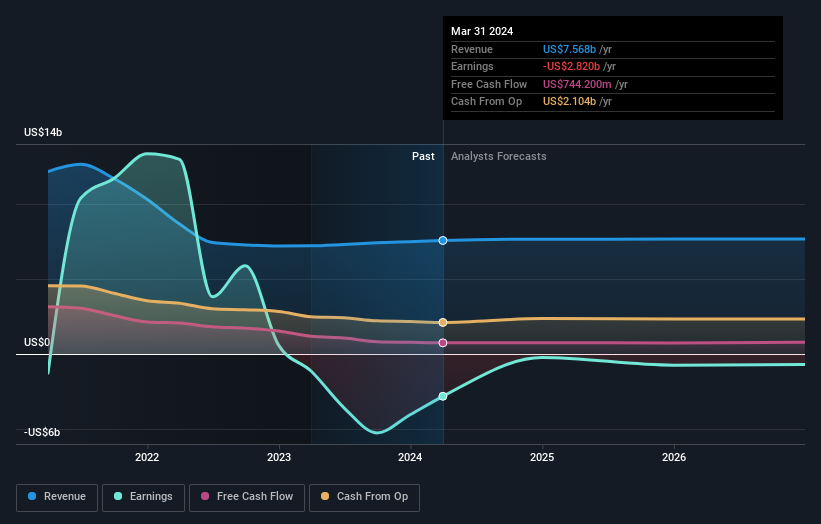

Given that Liberty Global didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over half a decade Liberty Global reduced its trailing twelve month revenue by 12% for each year. That puts it in an unattractive cohort, to put it mildly. On the face of it we'd posit the share price fall of 6% compound, over five years is well justified by the fundamental deterioration. We doubt many shareholders are delighted with this share price performance. It is possible for businesses to bounce back but as Buffett says, 'turnarounds seldom turn'.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Liberty Global is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Liberty Global will earn in the future (free analyst consensus estimates)

A Different Perspective

Liberty Global provided a TSR of 3.4% over the last twelve months. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 6% per year, over five years. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand Liberty Global better, we need to consider many other factors. For instance, we've identified 1 warning sign for Liberty Global that you should be aware of.

We will like Liberty Global better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Liberty Global is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Liberty Global is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LBTY.A

Liberty Global

Provides broadband internet, video, fixed-line telephony, and mobile communications services to residential and business customers.

Undervalued with imperfect balance sheet.