- United States

- /

- Wireless Telecom

- /

- NasdaqGS:KYIV

Is It Too Late To Consider Kyivstar Group After Its 51% 2025 Rally?

Reviewed by Bailey Pemberton

- If you are wondering whether Kyivstar Group is still good value after its recent run up, or if you have already missed the boat, this breakdown will help you decide whether the current price makes sense.

- The stock has climbed 5.7% over the last week, 32.7% over the past month, and is now up roughly 51.0% year to date, which indicates that sentiment has shifted quickly.

- That momentum has come as investors refocus on Ukraine's critical digital infrastructure and the role Kyivstar plays in keeping mobile and data services running, alongside improving risk appetite for select frontier market telecom names. At the same time, ongoing geopolitical uncertainty and regulatory headlines mean the market is still trying to price in both the upside from rebuilding and the downside from operating in a high risk environment.

- On our framework, Kyivstar Group scores a 3/6 valuation check, which suggests it looks undervalued on some measures but not all. We will walk through those different approaches next, then finish with a more holistic way to judge what the stock is really worth.

Approach 1: Kyivstar Group Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today in $ terms. For Kyivstar Group, the 2 Stage Free Cash Flow to Equity model starts from last twelve months free cash flow of roughly $280.4 Million and builds up a picture of how that might grow over time.

Analysts expect free cash flow to rise into the mid to high $200 Million range in the next few years, with Simply Wall St extrapolating that trend further out. By 2029, projected free cash flow reaches about $429.5 Million, with additional growth assumed through 2035 as the company scales its network and services. All of those future cash flows are then discounted back to today to account for risk and the time value of money.

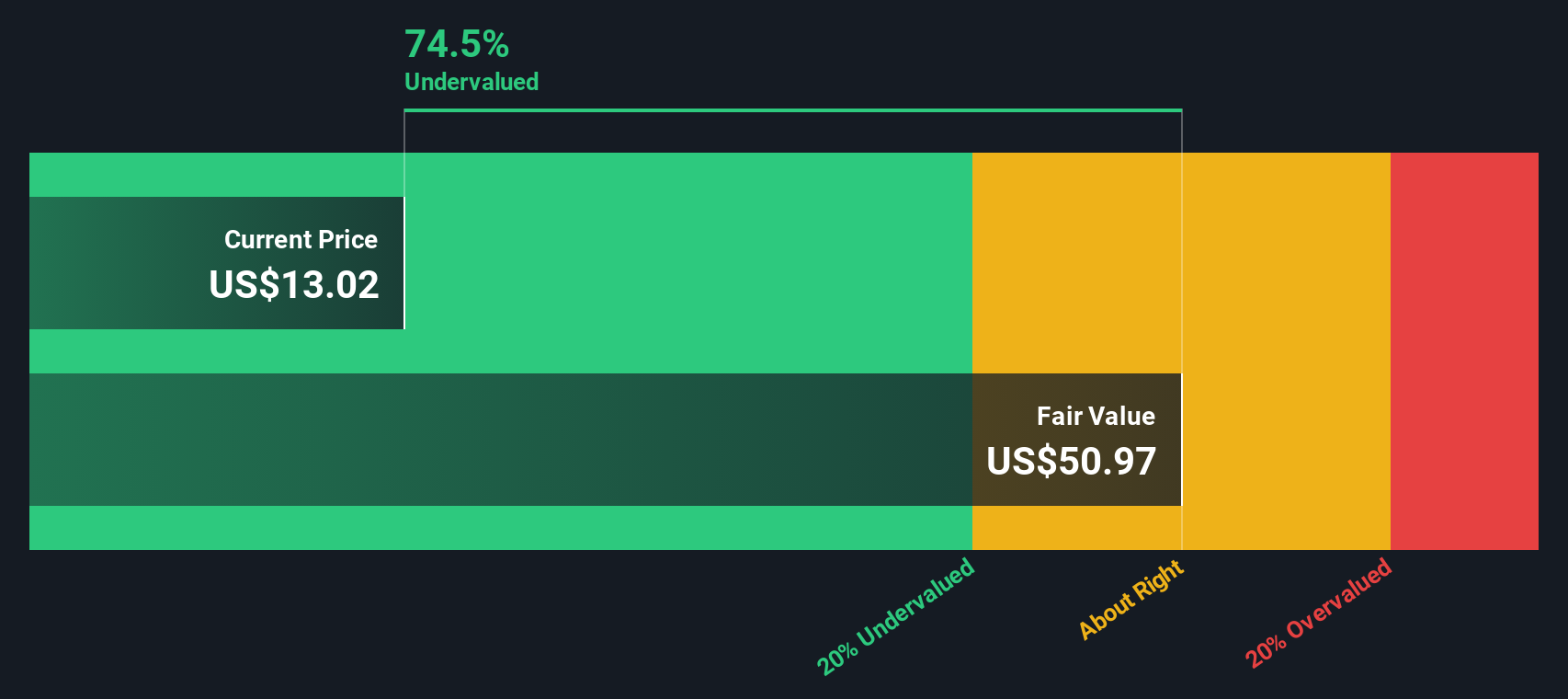

On this basis, the DCF model estimates an intrinsic value of around $46.24 per share, implying the stock trades at roughly a 67.3% discount to fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kyivstar Group is undervalued by 67.3%. Track this in your watchlist or portfolio, or discover 909 more undervalued stocks based on cash flows.

Approach 2: Kyivstar Group Price vs Earnings

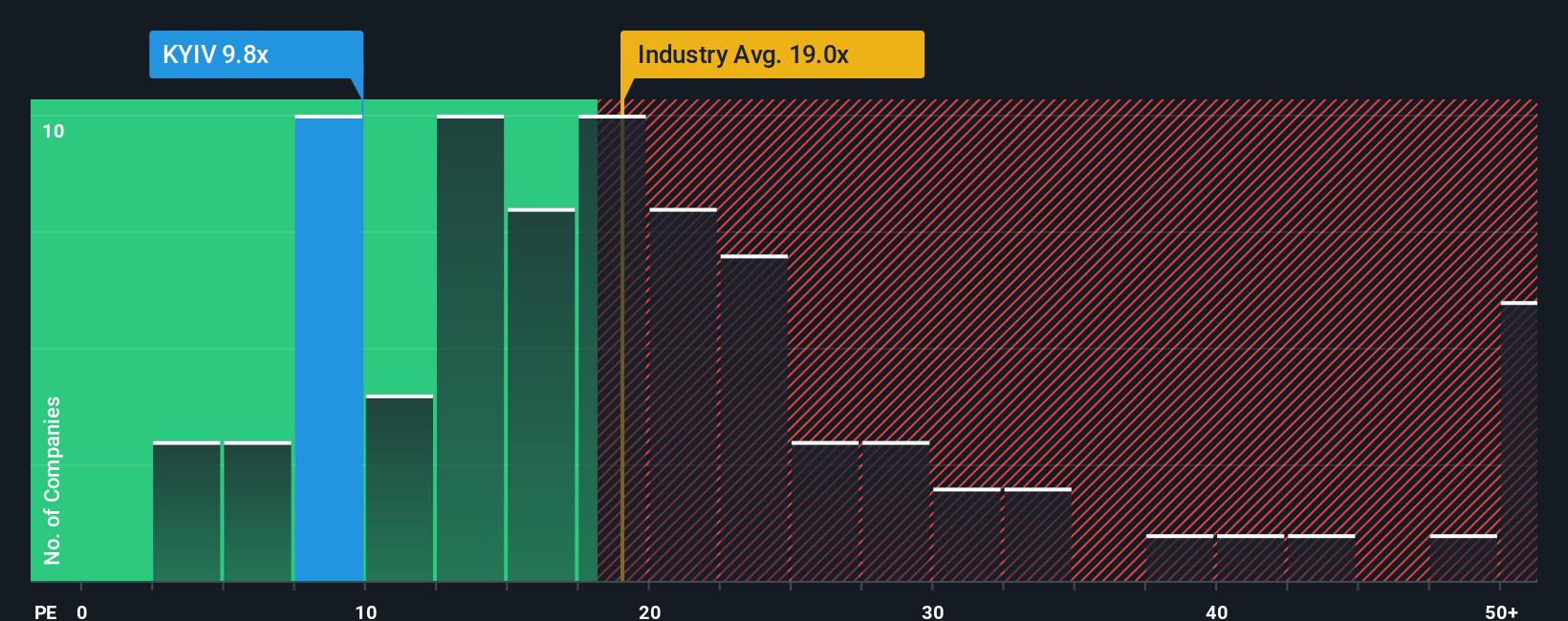

For profitable companies like Kyivstar Group, the price to earnings ratio, or PE, is a useful way to gauge value because it directly links what investors pay today to the profits the business is already generating. In general, faster growing and lower risk companies tend to justify higher PE ratios, while slower growth or higher uncertainty should translate into lower, more conservative multiples.

Kyivstar Group currently trades on a PE of about 27.1x, which is slightly below the average of its closest peers at 28.7x, but notably above the broader Wireless Telecom industry average of roughly 17.6x. To move beyond these broad comparisons, Simply Wall St also calculates a proprietary Fair Ratio, which estimates what PE the stock should trade on given its earnings growth outlook, profitability, size, sector and risk profile. Because this Fair Ratio incorporates Kyivstar’s specific fundamentals and risk, it is a more tailored benchmark than simply lining it up against peers or the sector.

For Kyivstar Group, the Fair Ratio sits at around 18.3x, meaning the current 27.1x PE looks high relative to what its fundamentals warrant.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kyivstar Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you attach a clear story to your numbers by defining your view on a company’s future revenue, earnings and margins, and then translating that into a fair value. A Narrative connects three pieces together: what you believe about the business, the financial forecast that follows from those beliefs, and the fair value that falls out of that forecast, so you can see exactly why your estimate differs from the market price. On Simply Wall St, millions of investors build and explore Narratives on each company’s Community page, where it is easy to adjust assumptions and instantly see how your fair value changes, helping you decide when a stock looks worth buying, holding or selling based on the gap between Fair Value and Price. Narratives also update dynamically as new news, earnings releases or guidance come in, keeping your estimates current. For example, one Kyivstar Group Narrative might see rapid post war network expansion justifying a much higher fair value, while another assumes prolonged geopolitical stress and assigns a far lower one.

Do you think there's more to the story for Kyivstar Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kyivstar Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KYIV

Kyivstar Group

Provides a range of mobile communication and home Internet services in Ukraine.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)