- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:IRDM

It's Down 29% But Iridium Communications Inc. (NASDAQ:IRDM) Could Be Riskier Than It Looks

To the annoyance of some shareholders, Iridium Communications Inc. (NASDAQ:IRDM) shares are down a considerable 29% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 44% share price drop.

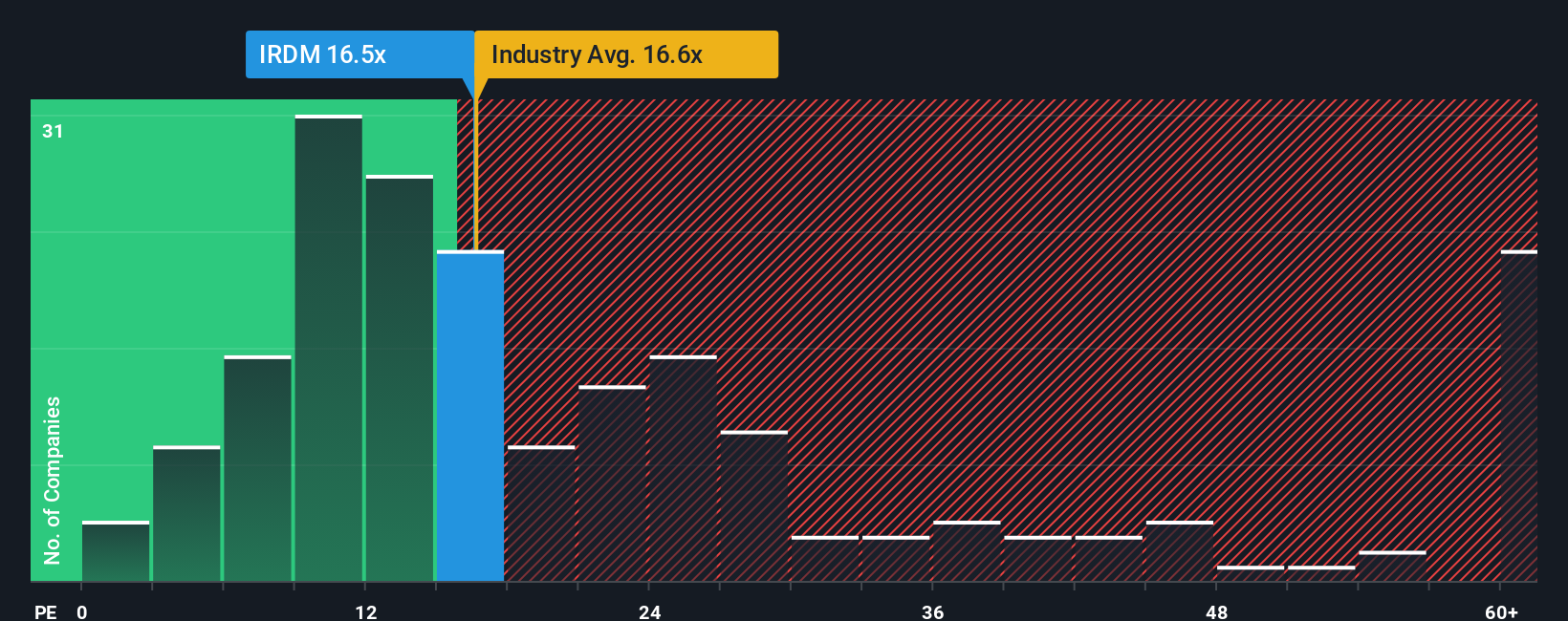

Even after such a large drop in price, Iridium Communications' price-to-earnings (or "P/E") ratio of 16.5x might still make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 20x and even P/E's above 34x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been advantageous for Iridium Communications as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Iridium Communications

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Iridium Communications would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 41%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 25% per annum as estimated by the nine analysts watching the company. With the market only predicted to deliver 11% per annum, the company is positioned for a stronger earnings result.

With this information, we find it odd that Iridium Communications is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

The softening of Iridium Communications' shares means its P/E is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Iridium Communications' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Before you take the next step, you should know about the 1 warning sign for Iridium Communications that we have uncovered.

If you're unsure about the strength of Iridium Communications' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:IRDM

Iridium Communications

Provides mobile voice and data communications services and products to businesses, the United States and international governments, non-governmental organizations, and consumers worldwide.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives