- United States

- /

- Wireless Telecom

- /

- NasdaqGS:GOGO

What Gogo (GOGO)'s Advanced Antenna Rollout Means for Its In-Flight Connectivity Ambitions

Reviewed by Sasha Jovanovic

- Hughes Network Systems, together with Gogo, recently celebrated key milestones in their partnership to advance in-flight connectivity, including on-time delivery of Gogo's new half-duplex and full-duplex electronically steerable antenna terminals and securing FAA-approved Supplemental Type Certificates for business jet platforms.

- This partnership enables Gogo to expand high-speed, low-latency connectivity to a greater number of business jets by leveraging innovative antenna technology that is designed for easier integration and maintenance across varied aircraft types.

- We'll examine how on-time delivery of Gogo's advanced antenna terminals could influence the company's investment narrative and market opportunity.

Find companies with promising cash flow potential yet trading below their fair value.

Gogo Investment Narrative Recap

To be a Gogo shareholder, you need to believe in the company's ability to capitalize on the untapped market for in-flight broadband connectivity, especially as only a fraction of business jets globally have high-speed internet on board. The recent successful, on-time delivery of Gogo's advanced antenna terminals with Hughes Network Systems supports a critical short-term catalyst, broader adoption of Galileo terminals, though it does not eliminate the ongoing risk from competitive pressures, notably Starlink's expansion in the sector.

Of Gogo’s recent announcements, the FAA approval for the full-duplex Galileo FDX terminal stands out as highly relevant to this partnership milestone. This approval broadens the addressable market for Gogo’s Galileo product line and reinforces the potential for the new antenna technology to unlock new revenue streams from higher-performance and international platforms.

However, despite these achievements, investors should be aware that if competitive threats continue to intensify...

Read the full narrative on Gogo (it's free!)

Gogo's narrative projects $1.1 billion revenue and $160.2 million earnings by 2028. This requires 17.0% yearly revenue growth and a $152.9 million increase in earnings from the current $7.3 million.

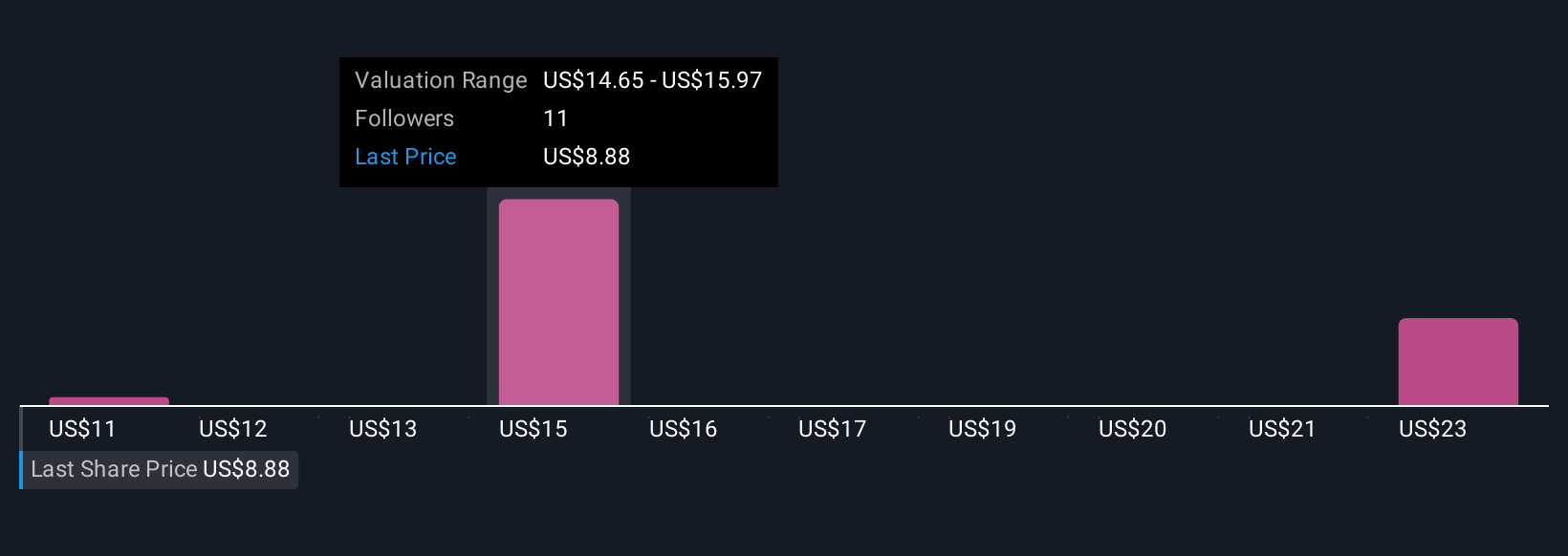

Uncover how Gogo's forecasts yield a $15.50 fair value, a 66% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community provided fair value estimates for Gogo stock ranging from US$10.69 to US$23.88. While some see significant upside, keep in mind that competitive risks could affect future market share and returns, so it’s worth considering a range of views before making decisions.

Explore 3 other fair value estimates on Gogo - why the stock might be worth just $10.69!

Build Your Own Gogo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gogo research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Gogo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gogo's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOGO

Gogo

Provides broadband connectivity services to the aviation industry in the United States and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives