- United States

- /

- Wireless Telecom

- /

- NasdaqGS:GOGO

A Fresh Look at Gogo (GOGO) Valuation Following Major In-Flight Connectivity Milestones

Reviewed by Simply Wall St

Gogo (GOGO) and its partner Hughes Network Systems just reached some important milestones. They announced the on-time delivery of advanced electronically steerable antenna terminals and secured key FAA approvals for their in-flight connectivity solutions.

See our latest analysis for Gogo.

Gogo’s momentum has shifted noticeably lately, with the stock clawing back some ground after a volatile stretch. After a steep decline over the last quarter, recent milestones around its in-flight connectivity solutions have sparked renewed optimism. This has led to a year-to-date share price return of 9.88%. For those who held on, the 1-year total shareholder return is an impressive 31.79%, showing there is still real potential on the runway for long-term investors.

If this kind of rebound makes you curious about other dynamic players, now is a perfect time to discover fast growing stocks with high insider ownership

With so much positive momentum behind Gogo’s technology and a stock that remains well below analyst price targets, the key question is whether the current valuation leaves room for further upside or if the market has already priced in these growth prospects.

Most Popular Narrative: 41% Undervalued

Gogo’s most widely tracked narrative presents a fair value well above the recent closing price of $9.12. This suggests a significant disconnect between analyst assumptions and where the market is currently trading, prompting close scrutiny of what’s driving that optimistic outlook.

Gogo is betting on the growth of broadband in-flight connectivity, with only 36% of the world's business jets currently equipped. They aim to increase revenue by addressing the untapped market of 12,000 jets and turboprops lacking broadband solutions, particularly outside North America.

Want a look behind the curtain? This narrative relies on major shifts in demand and a margin trajectory that challenges past trends. Curious about which key assumptions are boosting Gogo’s valuation? Discover the full story behind this ambitious price forecast.

Result: Fair Value of $15.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays to new technology or increased competitive pressure could quickly challenge the bullish case and put Gogo's growth prospects at risk.

Find out about the key risks to this Gogo narrative.

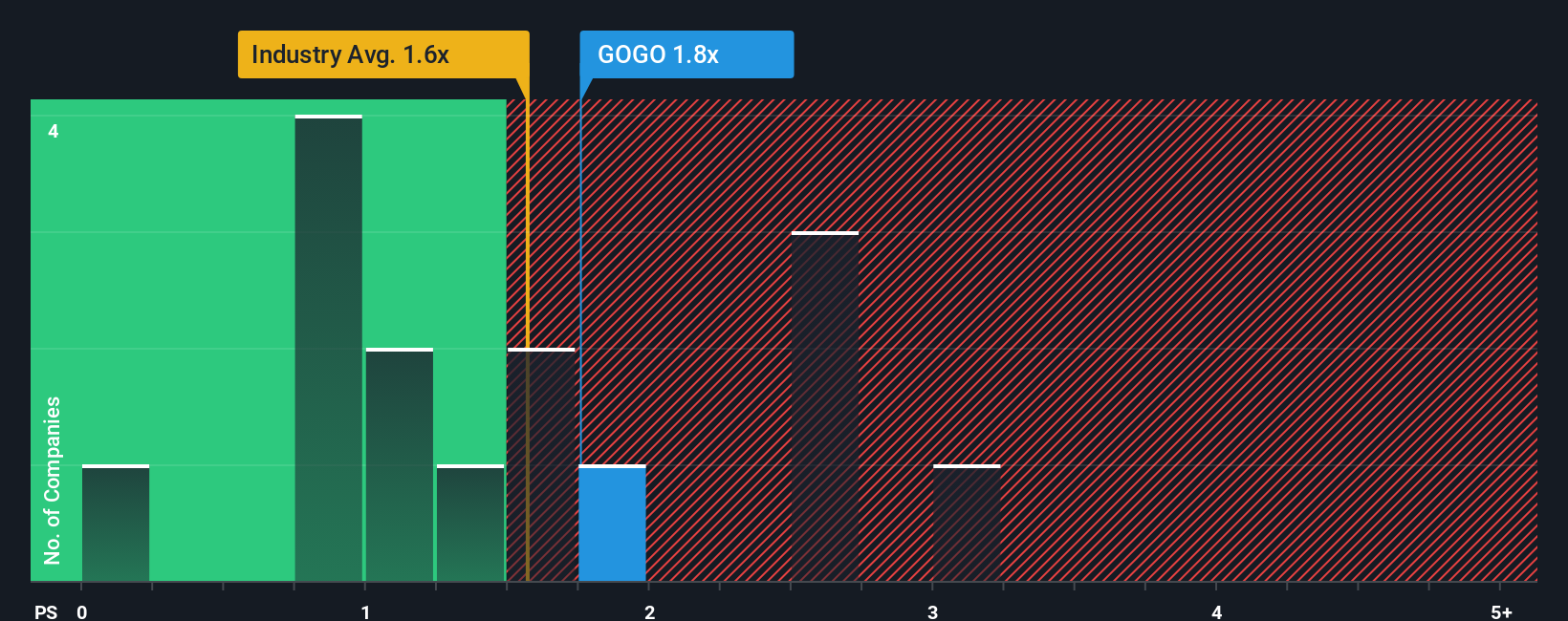

Another View: Multiples Suggest Caution

Looking beyond analyst forecasts, market-based multiples raise a red flag. Gogo is trading at a price-to-sales ratio of 1.8x. This is not only higher than the Global Wireless Telecom industry average of 1.6x, but also 50% above its own fair ratio of 1.2x. This suggests the market is already factoring in high expectations for future growth, leaving less margin for error if results disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Gogo Narrative

If you think there’s more to the story or want to dig into the numbers yourself, you can shape your own take in just a few minutes, Do it your way

A great starting point for your Gogo research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your investing edge by checking out high-potential stocks tapped by our expert screeners. Miss these, and you could miss your next big winner.

- Capitalize on market inefficiencies and pursue greater returns through these 875 undervalued stocks based on cash flows, which are primed for a re-rating.

- Grow your portfolio’s income potential by reviewing these 17 dividend stocks with yields > 3%, which offer consistently strong yields for shareholders.

- Jump on pioneering innovation with these 26 quantum computing stocks, which are at the forefront of breakthrough computing technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOGO

Gogo

Provides broadband connectivity services to the aviation industry in the United States and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives