- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:FYBR

Frontier Communications (FYBR): Evaluating the Stock’s Valuation After Recent Gains

Reviewed by Simply Wall St

Frontier Communications Parent (FYBR) has drawn attention among investors thanks to steady returns over the past month and strong multi-year performance. Its recent share movement offers investors another reason to review the company’s underlying growth story.

See our latest analysis for Frontier Communications Parent.

Shares of Frontier Communications Parent have steadily climbed this year, with an 8.2% year-to-date share price return highlighting momentum as investors grow more optimistic about its growth prospects. The 5.5% total shareholder return over the past year, as well as an impressive 77% total return over three years, point to value building well beyond short-term moves.

If you’re interested in casting a wider net beyond steady performers like Frontier, now is a great opportunity to explore fast growing stocks with high insider ownership.

But with shares near their analyst price target and only a modest discount to intrinsic value, the pressing question is whether there is still room for upside or if the market has already priced in Frontier’s growth story.

Price-to-Sales Ratio of 1.5x: Is it justified?

Frontier Communications Parent currently trades at a price-to-sales ratio of 1.5x, placing it above both its industry peers and the estimated fair value multiple. At a last close price of $37.69, this premium signals that the market expects more from Frontier than its sector rivals.

The price-to-sales (P/S) ratio measures the company’s market value relative to its annual revenue, helping investors gauge how much they are paying for each dollar of sales generated. For Frontier, this metric is particularly important because the telecom sector often uses revenue-based multiples given the challenges around profitability and large infrastructure costs.

However, Frontier’s P/S ratio of 1.5x is notably higher than the US Telecom industry average of 1.2x and also exceeds the estimated fair P/S multiple of 1.2x. This means investors are paying a steeper price for each dollar of Frontier’s sales than both the wider sector and what fundamentals may suggest is justified. The market may be overestimating future growth, placing Frontier at a valuation level that could potentially be corrected should company performance not meet high expectations.

Explore the SWS fair ratio for Frontier Communications Parent

Result: Price-to-Sales Ratio of 1.5x (OVERVALUED)

However, sluggish revenue growth and persistent net losses could undermine Frontier’s valuation if operational improvements or sector tailwinds do not materialize as expected.

Find out about the key risks to this Frontier Communications Parent narrative.

Another View: What Does the SWS DCF Model Say?

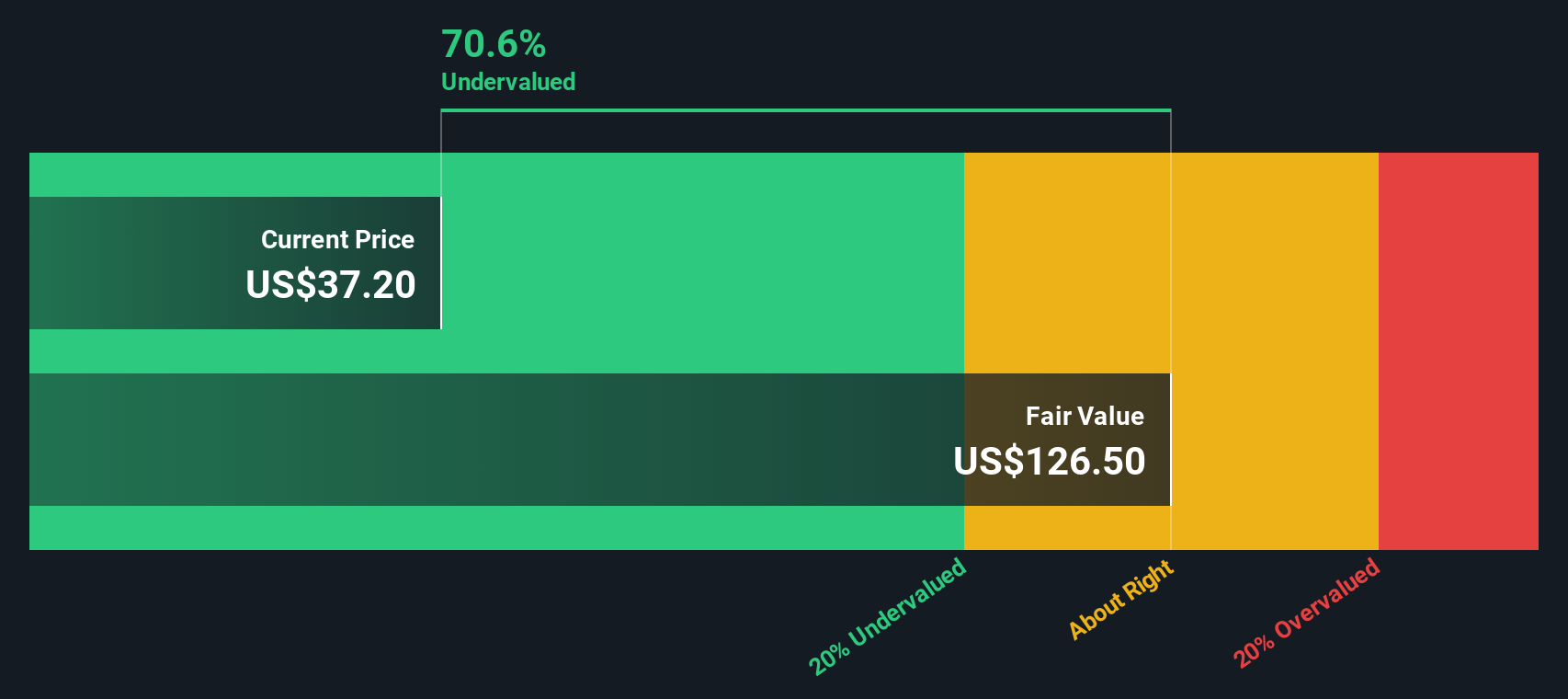

While Frontier’s price-to-sales ratio looks high compared to peers, our DCF model provides a different perspective. It estimates the company’s fair value to be $116.67 per share, suggesting the stock could be significantly undervalued at its recent price. What explains the disconnect between market multiples and the DCF outlook?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Frontier Communications Parent for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 831 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Frontier Communications Parent Narrative

If you prefer to dig into the numbers on your own terms or see things differently, you can quickly build your own perspective and Do it your way.

A great starting point for your Frontier Communications Parent research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit yourself to just one stock when you can make smarter picks? Get ahead now by researching emerging winners you might otherwise miss.

- Spot income opportunities early and grow your portfolio with these 24 dividend stocks with yields > 3%, which offers reliable yields above 3%.

- Tap into powerful trends and shape your strategy with these 26 AI penny stocks, where artificial intelligence is transforming industries.

- Position yourself for the next wave of innovation by evaluating these 28 quantum computing stocks, at the forefront of computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FYBR

Frontier Communications Parent

Provides communications and technology services for consumer and business customers in the United States.

Slightly overvalued with very low risk.

Similar Companies

Market Insights

Community Narratives