- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:CCOI

Cogent Communications Holdings (NASDAQ:CCOI) Has Announced That It Will Be Increasing Its Dividend To US$0.81

Cogent Communications Holdings, Inc. (NASDAQ:CCOI) will increase its dividend on the 3rd of September to US$0.81. This takes the annual payment to 3.9% of the current stock price, which unfortunately is below what the industry is paying.

Check out our latest analysis for Cogent Communications Holdings

Cogent Communications Holdings Doesn't Earn Enough To Cover Its Payments

If it is predictable over a long period, even low dividend yields can be attractive. Before making this announcement, the company's dividend was much higher than its earnings. Without profits and cash flows increasing, it would be difficult for the company to continue paying the dividend at this level.

Over the next year, EPS is forecast to grow rapidly. If the dividend continues growing along recent trends, we estimate the payout ratio could reach 346%, which is unsustainable.

Cogent Communications Holdings' Dividend Has Lacked Consistency

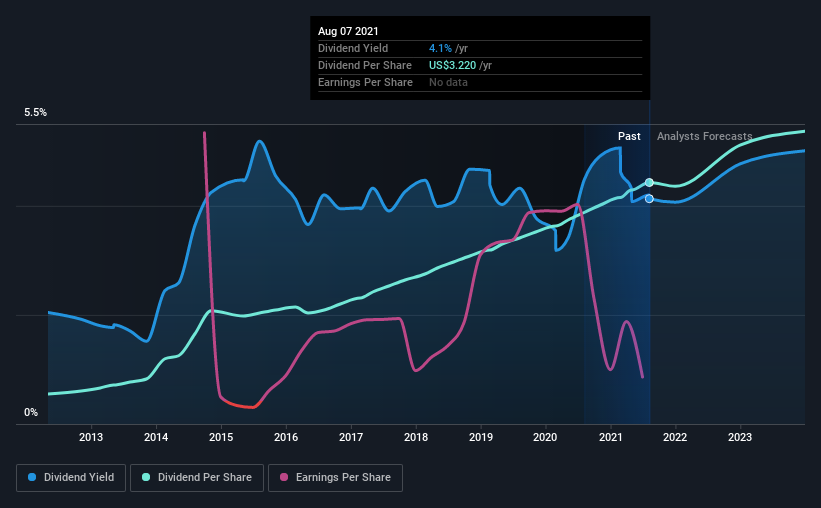

It's comforting to see that Cogent Communications Holdings has been paying a dividend for a number of years now, however it has been cut at least once in that time. Due to this, we are a little bit cautious about the dividend consistency over a full economic cycle. The first annual payment during the last 9 years was US$0.40 in 2012, and the most recent fiscal year payment was US$3.22. This implies that the company grew its distributions at a yearly rate of about 26% over that duration. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

Dividend Growth Potential Is Shaky

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Cogent Communications Holdings' earnings per share has shrunk at 19% a year over the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

Cogent Communications Holdings' Dividend Doesn't Look Great

Overall, while the dividend being raised can be good, there are some concerns about its long term sustainability. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. We don't think that this is a great candidate to be an income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Just as an example, we've come across 6 warning signs for Cogent Communications Holdings you should be aware of, and 3 of them are a bit concerning. We have also put together a list of global stocks with a solid dividend.

When trading Cogent Communications Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:CCOI

Cogent Communications Holdings

Through its subsidiaries, provides high-speed Internet access, private network, and data center colocation space services in North America, South America, Europe, Oceania, and Africa.

Second-rate dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives