- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:CCOI

Cogent Communications (CCOI): Exploring Valuation After Recent Volatility and Market Sentiment Shift

Reviewed by Simply Wall St

Cogent Communications Holdings (CCOI) is coming off a mixed stretch for its stock, with shares down 6% over the past week but showing a nearly 5% gain for the month. Investors may be weighing these short-term swings against the company’s recent financial performance.

See our latest analysis for Cogent Communications Holdings.

Momentum in Cogent’s stock has faded considerably, with a 1-year total shareholder return of -45.95% and further declines seen recently. This comes despite its earlier monthly bounce and reflects a shift in investor sentiment, possibly as the market reassesses the company’s growth outlook and risk profile.

If these moves have you rethinking your next step, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading nearly 22% below analysts' price targets, investors may be wondering if recent declines present a discounted entry or if the market already reflects Cogent's future growth prospects. Is there value left to unlock?

Most Popular Narrative: 15.8% Undervalued

Compared to the last close of $40.21, the most widely followed narrative places Cogent Communication Holdings’ fair value at $47.73, indicating a substantial pricing gap. This sets the scene for a deeper exploration into the drivers behind this narrative’s forecast.

Cogent is seeing rising demand for high-capacity data connectivity driven by surging global internet traffic from video streaming, AI, and cloud computing. This is evidenced by strong growth in NetCentric/wavelength revenues (27% sequential, 150% YoY) and a large wavelength opportunity pipeline (4,687 opportunities). These factors are expected to accelerate top-line revenue growth as the company captures more of the North American wavelength market.

Curious how analysts get to that punchy price target? There is a secret recipe of ambitious growth forecasts and margin expansion. Want to know which bold financial moves fuel this valuation? It is all in the details of their assumptions, only found in the full narrative.

Result: Fair Value of $47.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent price declines for bandwidth services or ongoing delays in monetizing noncore assets could present challenges to the bullish outlook and impact future growth.

Find out about the key risks to this Cogent Communications Holdings narrative.

Another View: Market Multiples Tell a Different Story

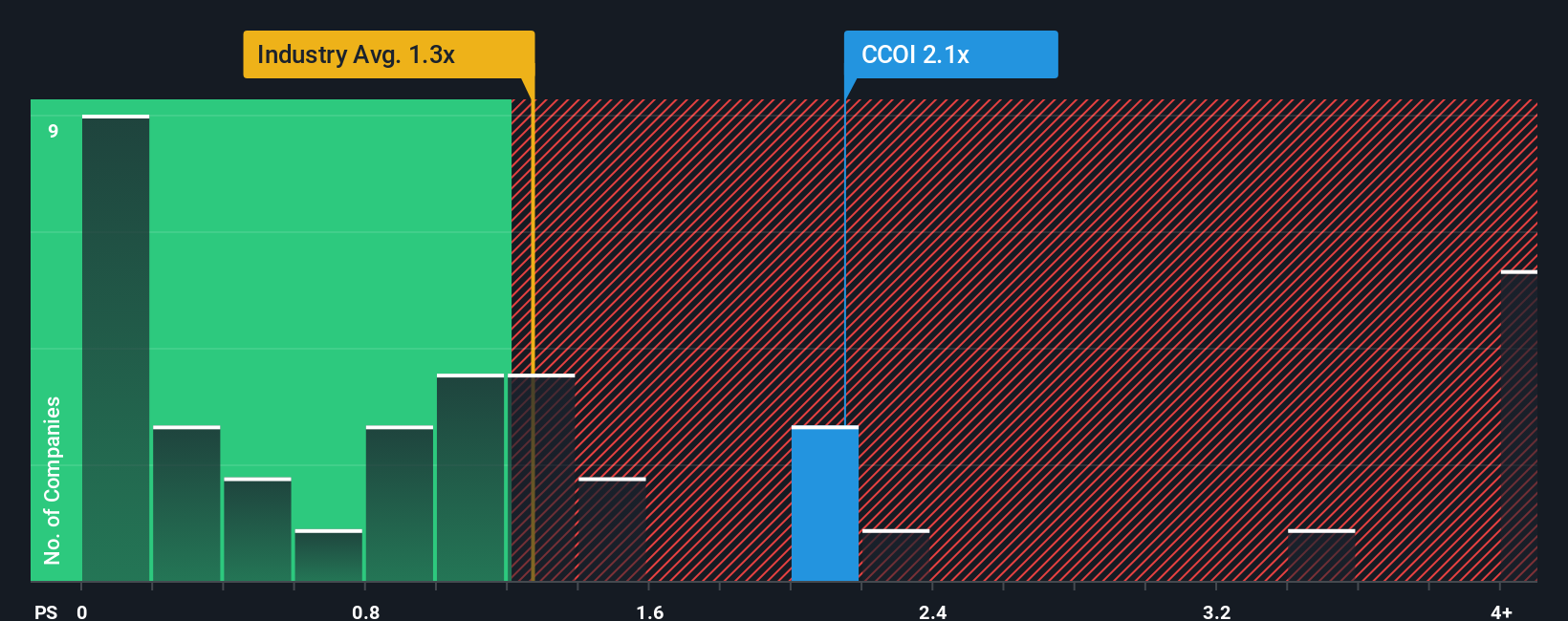

Shifting focus to how the market values Cogent compared to its peers, the price-to-sales ratio stands at 2.1x. This is notably higher than the US Telecom industry average of 1.2x and also above the calculated fair ratio of 0.9x. While this could mean Cogent is seen as a premium play, it also raises questions about possible overvaluation risks if investor expectations change. Could the market be pricing in more than fundamentals support?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cogent Communications Holdings Narrative

If you want to challenge the consensus or dive deeper into the numbers, shaping your own view takes just minutes. Ready to give it a try? Do it your way

A great starting point for your Cogent Communications Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make your next move count by spotting smart opportunities in rising sectors and hidden gems. If you want to get ahead, don't miss out on these tailored stock ideas:

- Boost your income potential with these 24 dividend stocks with yields > 3% offering robust yields over 3% and steady financials for reliable returns.

- Seize the chance to invest early in the technology wave with these 26 AI penny stocks leading advancements in artificial intelligence across industries.

- Uncover companies trading below fair value and maximize upside with these 834 undervalued stocks based on cash flows that meet strict cash flow criteria.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCOI

Cogent Communications Holdings

Through its subsidiaries, provides high-speed Internet access, private network, and data center colocation space services in North America, South America, Europe, Oceania, and Africa.

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives