Stock Analysis

- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:BAND

Bandwidth (NASDAQ:BAND investor three-year losses grow to 86% as the stock sheds US$67m this past week

As an investor, mistakes are inevitable. But you have a problem if you face massive losses more than once in a while. So spare a thought for the long term shareholders of Bandwidth Inc. (NASDAQ:BAND); the share price is down a whopping 86% in the last three years. That would certainly shake our confidence in the decision to own the stock. Unfortunately the share price momentum is still quite negative, with prices down 15% in thirty days. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

After losing 12% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Bandwidth

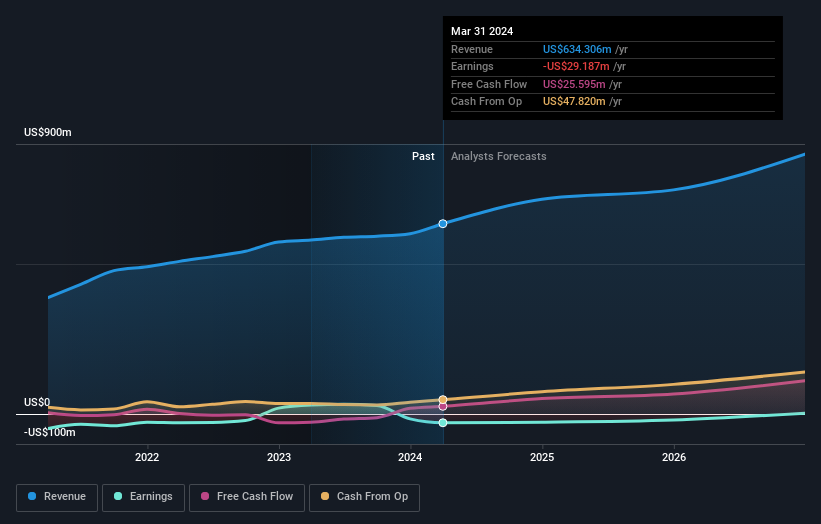

Bandwidth isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over three years, Bandwidth grew revenue at 13% per year. That's a fairly respectable growth rate. So it seems unlikely the 23% share price drop (each year) is entirely about the revenue. It could be that the losses were much larger than expected. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Bandwidth's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Bandwidth shareholders have received a total shareholder return of 25% over one year. There's no doubt those recent returns are much better than the TSR loss of 12% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 3 warning signs we've spotted with Bandwidth .

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Bandwidth is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Bandwidth is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BAND

Bandwidth

Operates as a cloud-based software-powered communications platform-as-a-service (CPaaS) provider in North America and internationally.

Undervalued with mediocre balance sheet.