- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:ASTS

Why AST SpaceMobile (ASTS) Is Up After FCC Clears 20 Satellites and BlueBird 6 Advances

Reviewed by Simply Wall St

- AST SpaceMobile announced that its first Block 2 BlueBird satellite, BlueBird 6, is now fully assembled and undergoing final testing ahead of shipment, while 20 of its satellites have received conditional launch approval from the FCC as of early September 2025.

- This milestone marks tangible progress toward building a space-based mobile network, advancing AST SpaceMobile’s plans to expand connectivity through space-based direct-to-mobile technology.

- We’ll examine how FCC approval for launching 20 satellites shapes AST SpaceMobile’s investment story and future connectivity ambitions.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is AST SpaceMobile's Investment Narrative?

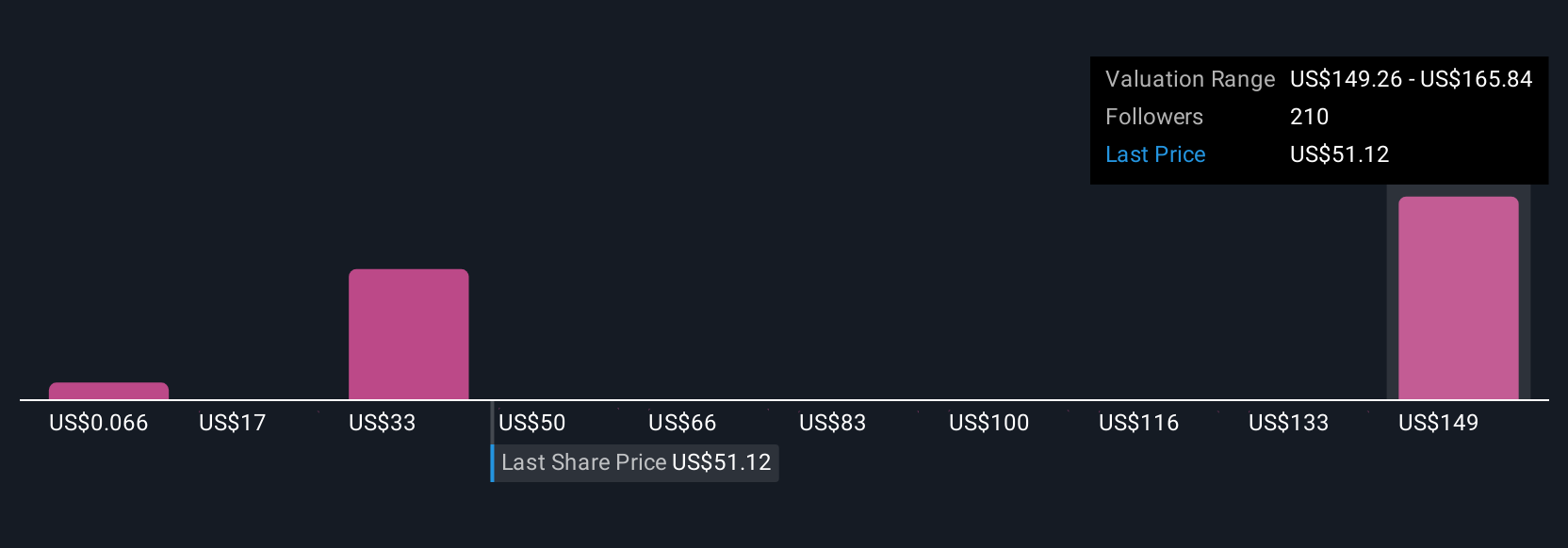

Owning AST SpaceMobile stock hinges on believing in its vision to build the world’s first space-based, direct-to-mobile network, a goal that relies on successfully launching and monetizing its growing satellite fleet. With the FCC now conditionally approving 20 satellites for launch and the first Block 2 BlueBird satellite fully assembled, the technical roadmap appears to be advancing, making this milestone the most concrete progress yet toward revenue-generating operations. While this news may serve as a near-term catalyst and inject renewed optimism about the company’s ability to execute, investors must balance this against persistent risks: high ongoing losses, repeated equity issuances, and costly build-out plans mean dilution and funding challenges remain front and center. The recent price moves suggest the market's optimism is guarded, signaling that execution and financial discipline will remain under scrutiny as deployments ramp up. The conditional nature of FCC approval may temper the immediate financial impact until launches translate into actual coverage and customer growth.

On the other hand, not all investors are pricing in the risks around ongoing losses and dilution.

Exploring Other Perspectives

Explore 51 other fair value estimates on AST SpaceMobile - why the stock might be worth over 4x more than the current price!

Build Your Own AST SpaceMobile Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AST SpaceMobile research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free AST SpaceMobile research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AST SpaceMobile's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASTS

AST SpaceMobile

Designs and develops the constellation of BlueBird satellites in the United States.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives