- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:ASTS

AST SpaceMobile (NasdaqGS:ASTS) Showcases Tactical Satellite Breakthrough & Files US$503M Equity Offering

Reviewed by Simply Wall St

AST SpaceMobile (NasdaqGS:ASTS) recently showcased a groundbreaking Non-Terrestrial Network communication field demonstration, alongside filing a substantial Follow-on Equity Offering of approximately $503 million. These significant developments in defense and financial activities likely correlated with the company’s extraordinary share price increase of 107% over the last month. The market, by comparison, saw a 1.7% rise weekly and a 12% annual gain. Given the scale of AST SpaceMobile's advancements in tech and finance, these events may have lent positive momentum to its stock, highlighting the company's role in enhancing global connectivity.

AST SpaceMobile's shares have exhibited a substantial total return of over 680% over the past three years. This long-term surge underscores the company's aggressive growth initiative, particularly evident in their recent developments and substantial equity offerings. While AST SpaceMobile's short-term share price has outperformed both the Telecom industry and the broader U.S. market over the past year, it is essential to consider these outcomes within the broader context of the company's ambitious technological advancements and strategic partnerships.

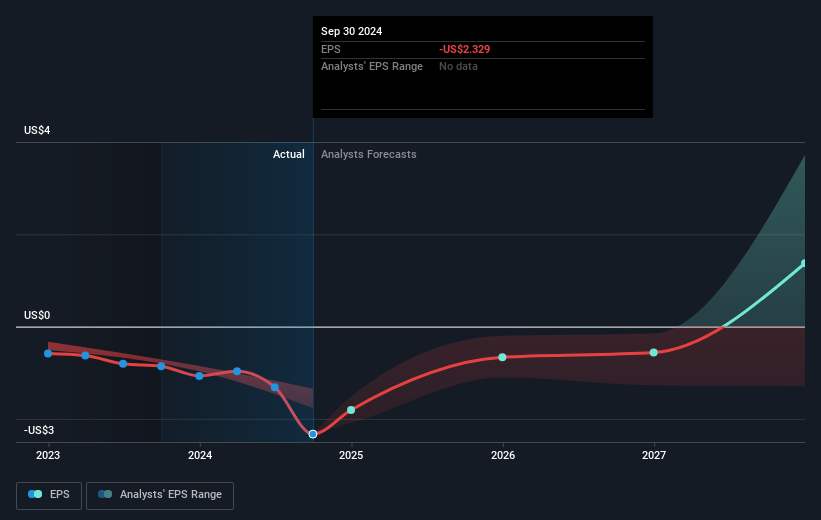

These developments could potentially bolster revenue and earnings forecasts, despite the company's current unprofitable status and negative earnings. However, with the current share price aligning closely with the target price of US$45.34, as derived from consensus analyst estimates, further upward movement may be limited in the absence of tangible improvement in the company's financial performance. The insights regarding AST SpaceMobile's continued investment in NTN communications, partnerships, and ongoing challenges such as shareholder dilution and executive changes, may substantially influence future revenue growth and profitability.

Our valuation report unveils the possibility AST SpaceMobile's shares may be trading at a premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASTS

AST SpaceMobile

Designs and develops the constellation of BlueBird satellites in the United States.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives