- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:ASTS

AST SpaceMobile (ASTS): Revisiting Valuation After BlueBird 6 Launch Optimism and New Commercial Commitments

Reviewed by Simply Wall St

AST SpaceMobile (ASTS) is back in the spotlight after investor interest jumped ahead of its BlueBird 6 launch, a key test of whether the company can turn its space based mobile network into a real commercial business.

See our latest analysis for AST SpaceMobile.

The Christmas Eve BlueBird 6 launch has become the focal point for AST SpaceMobile, with the 1 day share price return of 15.03 percent adding to a 250.46 percent year to date share price return and a massive 1 year total shareholder return of 226.19 percent, suggesting momentum is clearly building as investors reassess the company’s long term rollout and execution risks.

If this kind of speculative momentum has your attention, it might also be worth scanning other high growth tech and satellite names via high growth tech and AI stocks for fresh ideas.

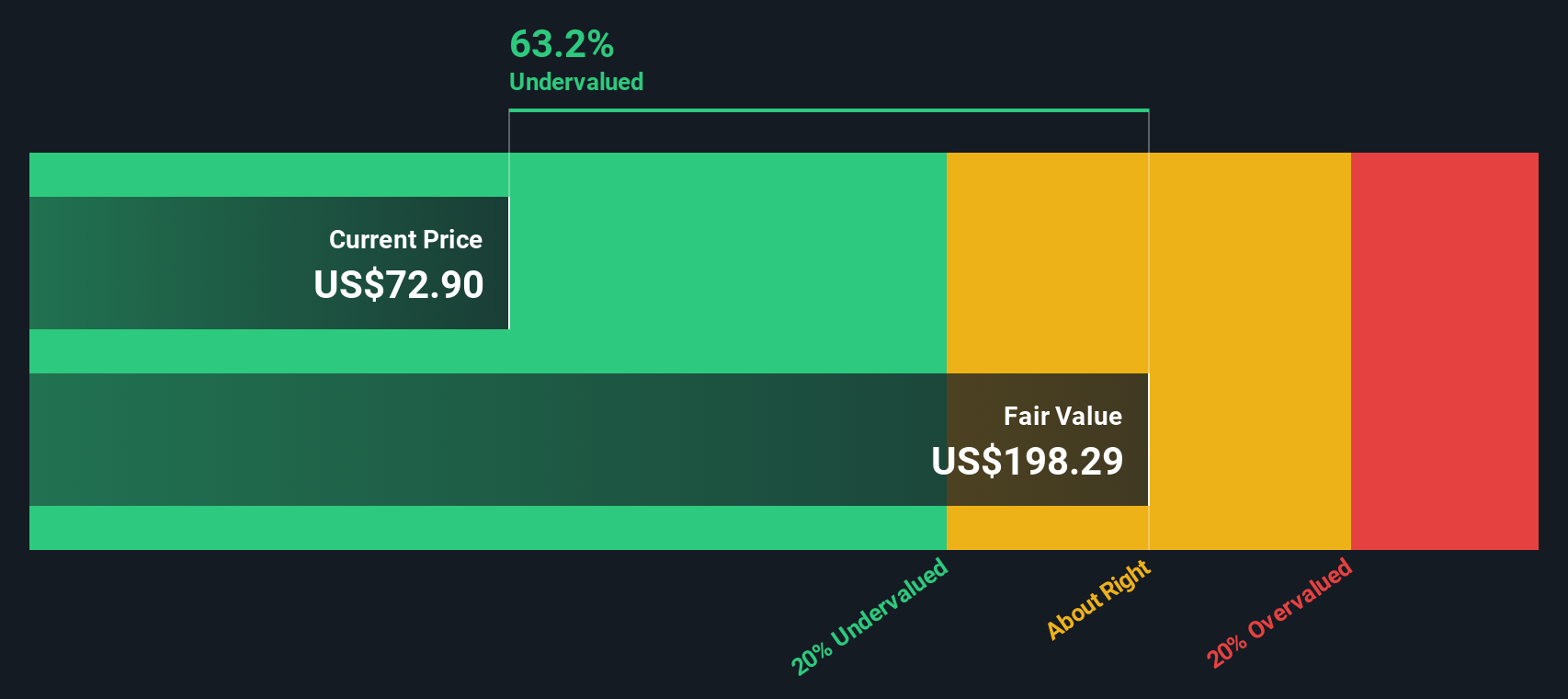

Yet with AST SpaceMobile trading above consensus price targets but still showing a hefty intrinsic discount, the real question is whether this launch fueled rally leaves upside on the table or already incorporates the growth story.

Price to Book of 17.2x, Is it Justified?

AST SpaceMobile trades at a steep premium to peers on a price to book basis, with the last close reflecting a richly valued balance sheet story.

The price to book ratio compares the company’s market value to its net assets, a useful lens for asset heavy, capital intensive telecom and satellite players. For AST SpaceMobile, this multiple signals that investors are paying far more than the accounting value of equity, effectively front loading expectations for future growth, profitability and returns on capital.

That optimism stands out when set against the wider US telecom space, where the average price to book multiple sits near 1.1 times. This highlights how stretched AST SpaceMobile’s 17.2 times figure appears. Against more direct peers, the stock still screens expensive versus a 6.3 times peer average, which underlines that the current valuation assumes the company will grow into a far more profitable, higher return profile than its sector.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Book of 17.2x (OVERVALUED)

However, execution risk around BlueBird deployment and ongoing cash burn, given negative net income, could quickly reverse sentiment if launches or partnerships disappoint.

Find out about the key risks to this AST SpaceMobile narrative.

Another View, Cash Flows Tell a Different Story

While the price to book ratio appears expensive, our DCF model presents a different view and suggests that AST SpaceMobile is trading about 61 percent below its estimated fair value of $194.42 per share. Is the market overpaying for assets yet underpricing future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AST SpaceMobile for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 910 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AST SpaceMobile Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly build a personalized view of AST SpaceMobile, Do it your way.

A great starting point for your AST SpaceMobile research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one stock. Use the Simply Wall St Screener today to spot overlooked opportunities before the crowd and keep your portfolio one step ahead.

- Capture mispriced opportunities by targeting companies trading at attractive valuations through these 910 undervalued stocks based on cash flows. This may give you a head start on potential turnaround stories.

- Capitalize on breakthrough innovation by tracking fast moving names in artificial intelligence using these 24 AI penny stocks. This can help you stay informed about emerging trends.

- Strengthen your income stream by reviewing reliable payers via these 12 dividend stocks with yields > 3%. This can support a portfolio focused on regular income every quarter.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASTS

AST SpaceMobile

Designs and develops the constellation of BlueBird satellites in the United States.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion