- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:ASTS

Assessing AST SpaceMobile After 156% Surge Amid Broadband From Space Ambitions

Reviewed by Bailey Pemberton

- Wondering if AST SpaceMobile’s recent hype means the stock is a bargain or riding high on speculation? You are not alone. Figuring out real value is more important than ever with this kind of momentum.

- With shares up 156.6% year-to-date and showing a 138.4% gain over the last 12 months, AST SpaceMobile is drawing a lot of attention, even as the stock dipped 4.3% in the past week and 30.1% over the last month.

- The rollercoaster in price comes as investors digest a wave of headlines about the company’s ambitious plans to provide broadband-from-space, as well as industry partnerships and regulatory milestones. This recent news highlights both the enthusiasm and uncertainty surrounding how quickly the company can execute its vision.

- Currently, AST SpaceMobile scores a 2 out of 6 on our valuation checks. From a traditional perspective, plenty of questions remain. We will break down how we arrive at this number using popular valuation approaches, and at the end of the article, introduce an even smarter way to understand what fair value means for this stock.

AST SpaceMobile scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: AST SpaceMobile Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model extrapolates a company’s future cash flows and discounts them back to today’s value, providing an estimate of the business's fundamental worth. For AST SpaceMobile, a two-stage Free Cash Flow to Equity approach is used to compute its intrinsic value.

Currently, AST SpaceMobile’s Free Cash Flow is negative, at -$1,078 million over the last twelve months. Looking ahead, analysts forecast that the company will continue to operate at a loss for several more years. However, Free Cash Flow is expected to improve to positive $769 million in 2029. Further projections based on Simply Wall St's extrapolation estimate this figure could grow to over $4.3 billion by 2035, reflecting aggressive long-term growth expectations.

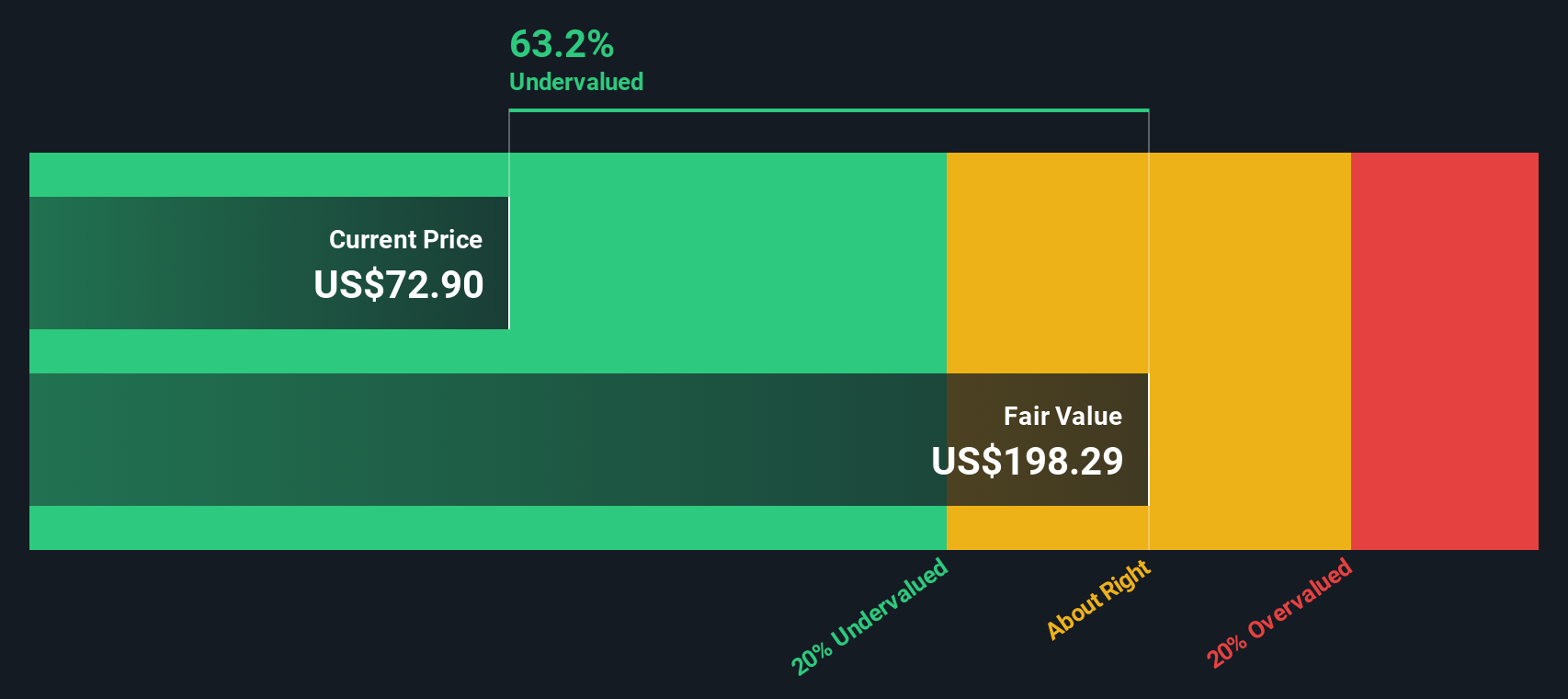

Based on these projections, the DCF model estimates AST SpaceMobile’s intrinsic fair value at $196.12 per share. This indicates the stock is currently trading at a 71.7% discount to its fair value, suggesting it is significantly undervalued according to this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AST SpaceMobile is undervalued by 71.7%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

Approach 2: AST SpaceMobile Price vs Book

The Price-to-Book (PB) ratio is a widely used valuation tool for companies where profits are not yet stable or where future earnings are hard to predict, like AST SpaceMobile. PB is particularly helpful for evaluating early-stage or asset-heavy businesses because it compares the market value of a company to its net assets.

Growth expectations and risk also play a key role in what qualifies as a "normal" or "fair" multiple. Companies with higher expected growth or unique assets often trade at higher PB ratios, while additional risks or lagging performance can warrant a lower figure.

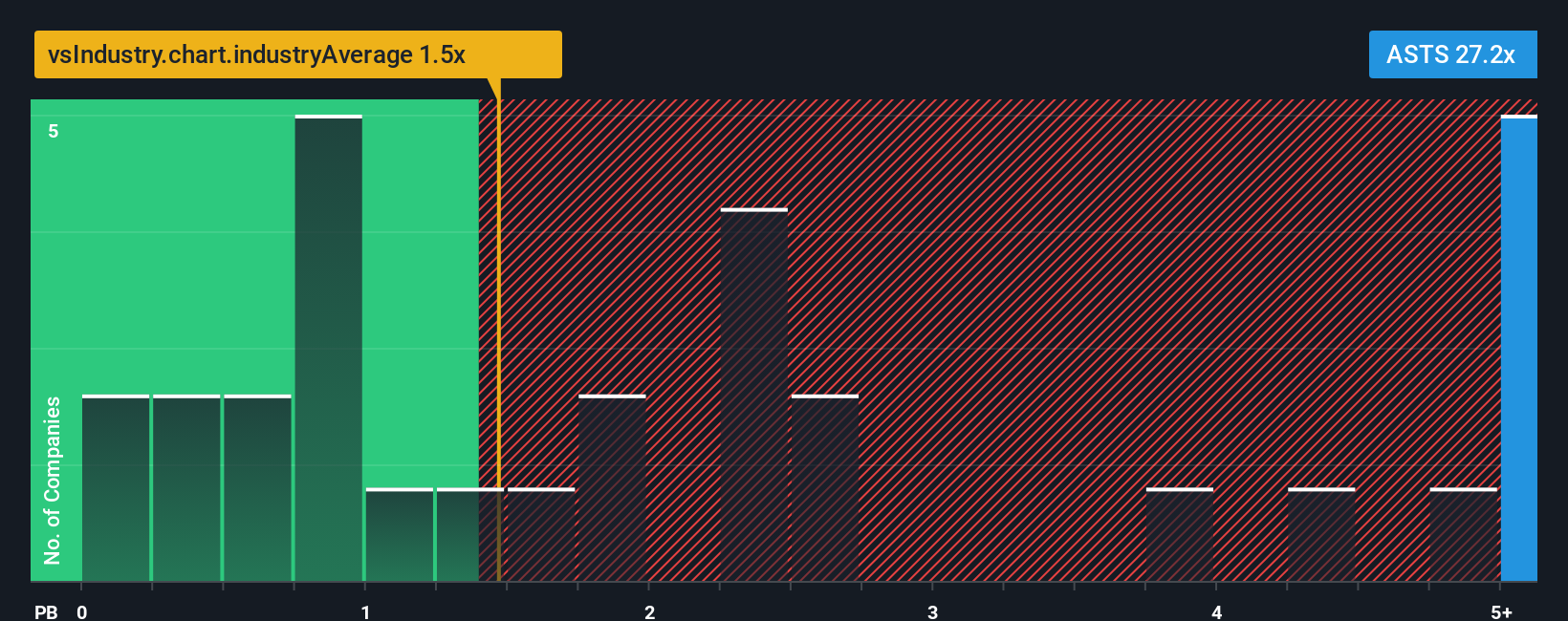

Right now, AST SpaceMobile is trading at a PB ratio of 12.43x. For context, the average PB in the Telecom industry is just 1.22x, and its close peers average around 6.27x. These comparisons suggest AST SpaceMobile is valued well above both peers and the broader sector average.

To dig deeper, Simply Wall St’s "Fair Ratio" evaluates what PB multiple would actually be justified for AST SpaceMobile, taking into account its growth prospects, margin outlook, market cap, and sector risks. This proprietary measure is designed to adjust for what really matters to investors, not just trailing numbers from similar companies or industry averages, making it a more reliable way to assess value in context.

Comparing the Fair Ratio to AST SpaceMobile’s current multiple, the difference is greater than 0.10, indicating that the stock is trading at a premium relative to its justified valuation.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AST SpaceMobile Narrative

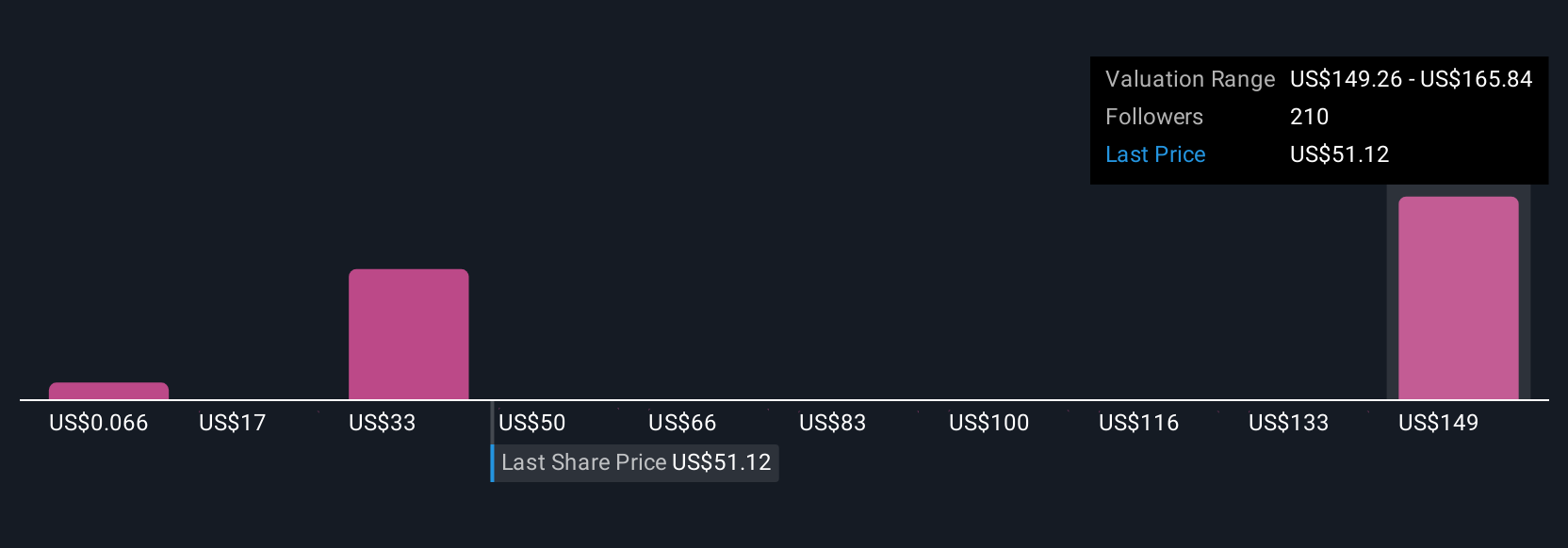

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative connects the story you believe about a company, including your outlook on its future revenue, earnings, and margins, directly to a financial forecast and an estimated fair value. This approach helps you see not just the numbers, but the reasoning behind them, making investment decisions feel more relatable and informed.

Narratives are an easy, accessible tool available to everyone on Simply Wall St's Community page. Millions of investors use them to make buy or sell decisions by directly comparing fair value estimates to the current price. This means you are always weighing your view of the company against what the market thinks. Best of all, Narratives update automatically when news, earnings, or market changes happen, so your view stays current without any extra work.

With AST SpaceMobile, for instance, one investor might see massive upside based on their optimistic revenue growth assumptions, while another sets a far lower fair value because they expect slower progress. Narratives let you choose and update your own investment story as the data and your perspective evolve.

Do you think there's more to the story for AST SpaceMobile? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASTS

AST SpaceMobile

Designs and develops the constellation of BlueBird satellites in the United States.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success