- United States

- /

- Communications

- /

- OTCPK:WSTL

Ispire Technology Leads The Pack With 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

The U.S. stock market has been experiencing a rollercoaster ride, with recent gains driven by shifts in trade policy and a strong rally in the technology sector. Amid these fluctuations, investors are exploring opportunities beyond the well-known giants, turning their attention to penny stocks—smaller or newer companies that can offer surprising value despite their vintage name. In this article, we highlight three penny stocks that stand out for their financial strength and potential for long-term success, offering a compelling mix of value and growth often overlooked by larger firms.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Perfect (NYSE:PERF) | $1.81 | $184.35M | ✅ 3 ⚠️ 0 View Analysis > |

| WM Technology (NasdaqGS:MAPS) | $1.01 | $169.86M | ✅ 4 ⚠️ 1 View Analysis > |

| Puma Biotechnology (NasdaqGS:PBYI) | $3.235 | $160.58M | ✅ 3 ⚠️ 1 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $2.74 | $364.62M | ✅ 4 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.78 | $95.67M | ✅ 4 ⚠️ 2 View Analysis > |

| Table Trac (OTCPK:TBTC) | $4.70 | $21.81M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.8283 | $6.02M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.22 | $72.17M | ✅ 3 ⚠️ 2 View Analysis > |

| New Horizon Aircraft (NasdaqCM:HOVR) | $0.922 | $28.94M | ✅ 3 ⚠️ 5 View Analysis > |

| Greenland Technologies Holding (NasdaqCM:GTEC) | $2.06 | $35.83M | ✅ 2 ⚠️ 5 View Analysis > |

Click here to see the full list of 731 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Ispire Technology (NasdaqCM:ISPR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ispire Technology Inc. is involved in the research, development, design, commercialization, sales, marketing, and distribution of e-cigarettes and cannabis vaping products globally with a market cap of $154.11 million.

Operations: The company's revenue is primarily derived from its cigarette manufacturers segment, totaling $144.70 million.

Market Cap: $154.11M

Ispire Technology Inc. is navigating the penny stock landscape with a focus on innovation and expansion, despite ongoing challenges. The company recently received a unique interim license in Malaysia for nicotine manufacturing, enhancing its global footprint. However, financial performance remains a concern; recent earnings reports show increasing net losses and declining sales compared to last year. Management changes are underway with the appointment of Jie Jay Yu as CFO, potentially signaling strategic shifts. Ispire's cash position is strong relative to debt, providing some stability amid volatility and unprofitability concerns in its operations.

- Dive into the specifics of Ispire Technology here with our thorough balance sheet health report.

- Understand Ispire Technology's earnings outlook by examining our growth report.

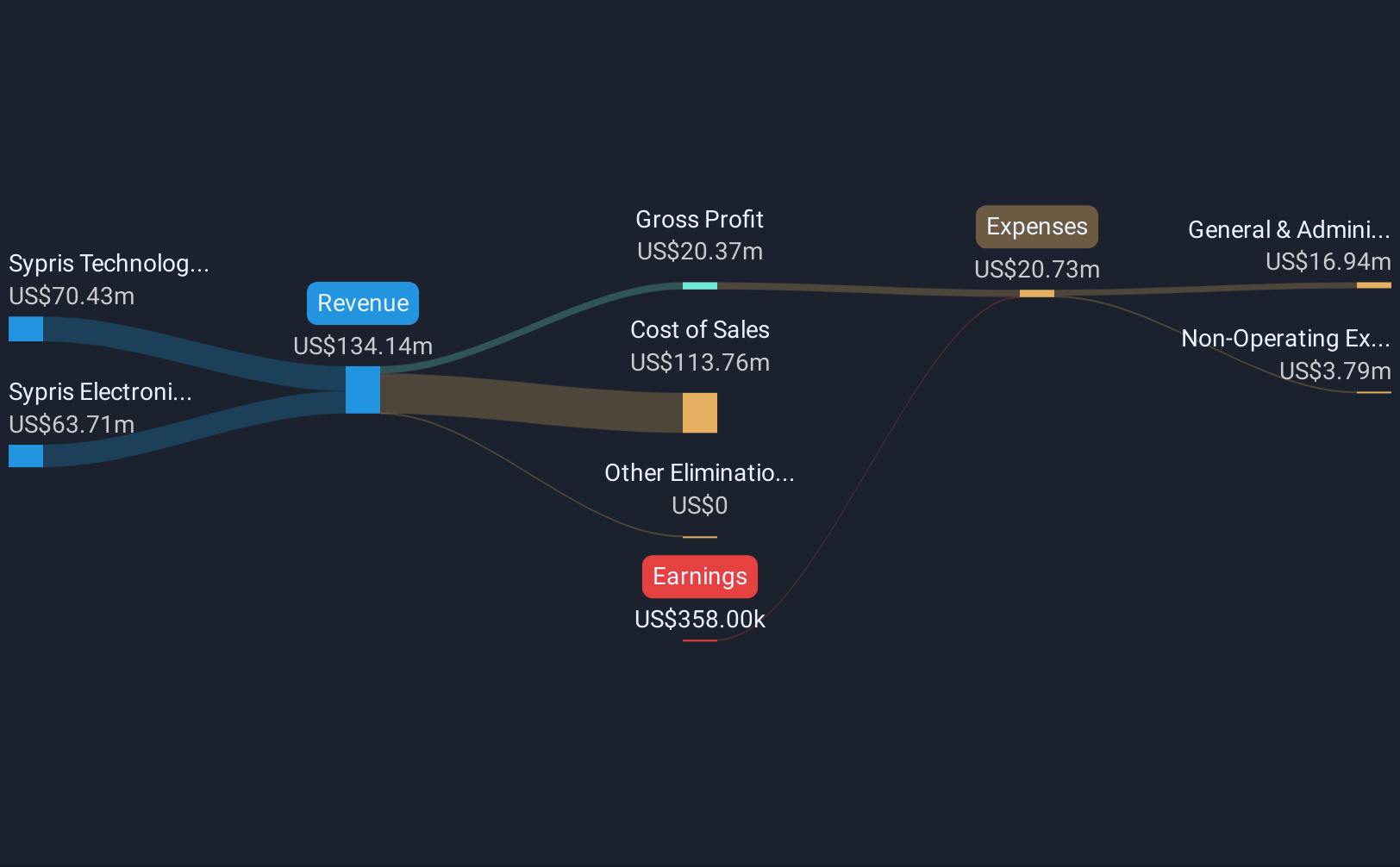

Sypris Solutions (NasdaqGM:SYPR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sypris Solutions, Inc. provides truck components, oil and gas and water pipeline components, and aerospace and defense electronics primarily in North America and Mexico, with a market cap of $44.35 million.

Operations: The company generates revenue from two main segments: Sypris Electronics, contributing $63.71 million, and Sypris Technologies, accounting for $70.43 million.

Market Cap: $44.35M

Sypris Solutions faces challenges typical of penny stocks, with recent earnings showing a decline in sales to US$29.51 million for Q1 2025 and a net loss of US$0.899 million. The company has withdrawn its 2025 guidance due to macroeconomic uncertainties, including potential new tariffs. Despite being unprofitable, Sypris maintains sufficient cash runway for over a year and has manageable debt levels with a satisfactory net debt to equity ratio of 37.5%. Its seasoned board and management team add stability, though the firm’s historical earnings have declined significantly over the past five years.

- Take a closer look at Sypris Solutions' potential here in our financial health report.

- Examine Sypris Solutions' past performance report to understand how it has performed in prior years.

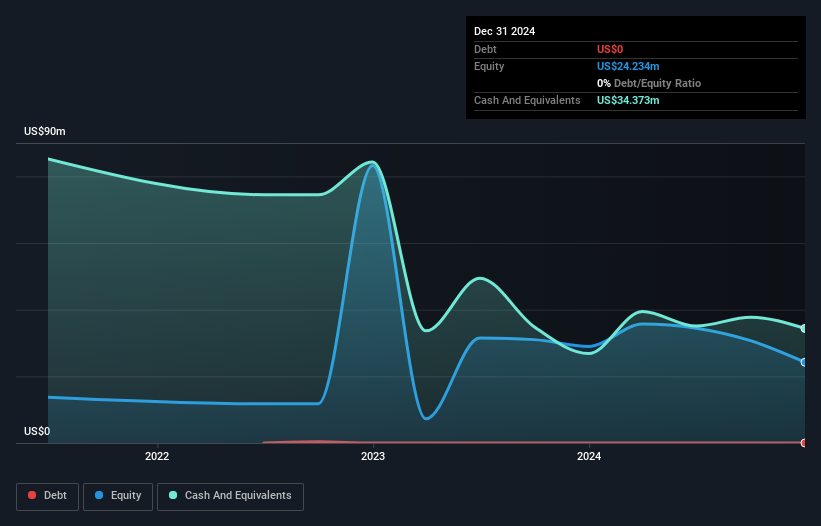

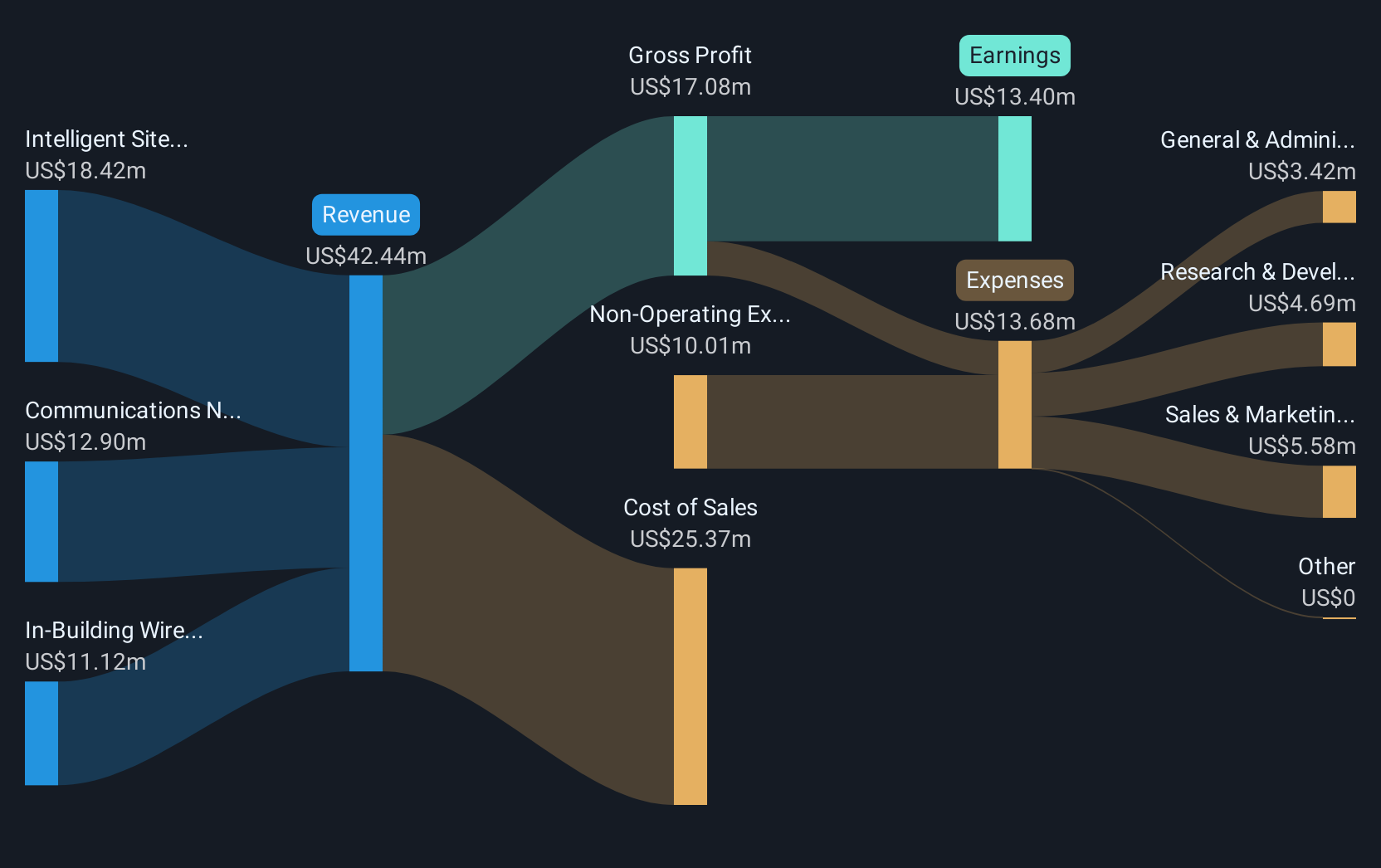

Westell Technologies (OTCPK:WSTL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Westell Technologies, Inc., through its subsidiary, designs, manufactures, and distributes telecommunications solutions to telephone companies in the United States and has a market cap of $31.17 million.

Operations: The company generates revenue through three segments: In-Building Wireless ($11.38 million), Intelligent Site Management ($12.51 million), and Communications Network Solutions ($11.40 million).

Market Cap: $31.17M

Westell Technologies, with a market cap of US$31.17 million, operates across three revenue-generating segments: In-Building Wireless (US$11.38 million), Intelligent Site Management (US$12.51 million), and Communications Network Solutions (US$11.40 million). The company is debt-free and has ample short-term assets (US$40.3M) to cover both short-term liabilities (US$7.3M) and long-term obligations (US$544K). Despite negative earnings growth over the past year, Westell has achieved profitability over five years with high-quality earnings, though current net profit margins have decreased from 6.2% to 4.4%. The board's experience adds governance stability amidst stable weekly volatility at 12%.

- Click here and access our complete financial health analysis report to understand the dynamics of Westell Technologies.

- Gain insights into Westell Technologies' past trends and performance with our report on the company's historical track record.

Taking Advantage

- Click here to access our complete index of 731 US Penny Stocks.

- Interested In Other Possibilities? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 28 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Westell Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:WSTL

Westell Technologies

Through its subsidiary, designs, manufactures, and distributes telecommunications solutions to telephone companies in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)