- United States

- /

- Communications

- /

- OTCPK:BDRL

Imagine Owning Blonder Tongue Laboratories (NYSEMKT:BDR) And Wondering If The 47% Share Price Slide Is Justified

Blonder Tongue Laboratories, Inc. (NYSEMKT:BDR) shareholders should be happy to see the share price up 26% in the last month. But if you look at the last five years the returns have not been good. You would have done a lot better buying an index fund, since the stock has dropped 47% in that half decade.

See our latest analysis for Blonder Tongue Laboratories

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

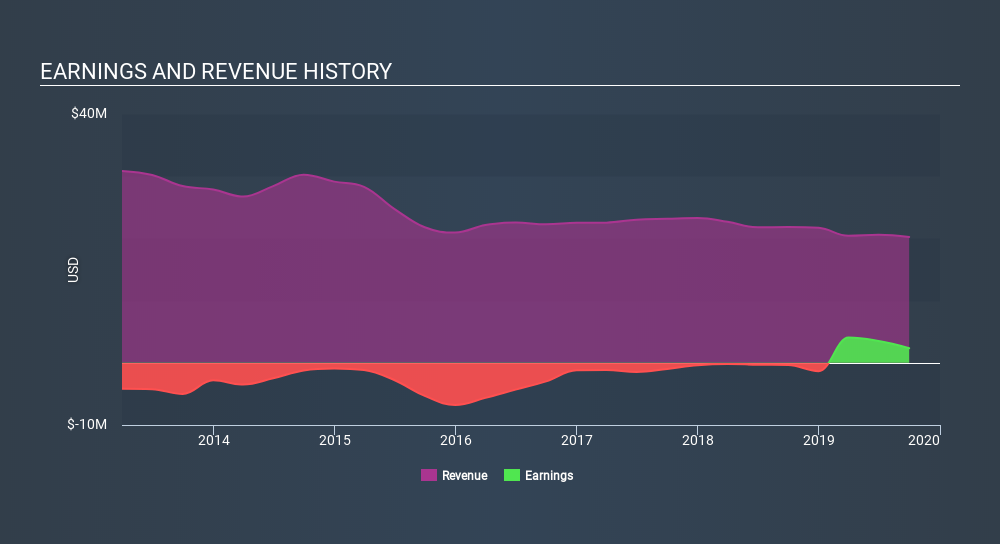

During five years of share price growth, Blonder Tongue Laboratories moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

It could be that the revenue decline of 5.6% per year is viewed as evidence that Blonder Tongue Laboratories is shrinking. That could explain the weak share price.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Blonder Tongue Laboratories stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Investors in Blonder Tongue Laboratories had a tough year, with a total loss of 20%, against a market gain of about 25%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Blonder Tongue Laboratories better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with Blonder Tongue Laboratories (including 2 which is are potentially serious) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OTCPK:BDRL

Blonder Tongue Laboratories

A technology-development and manufacturing company, provides television (TV) signal encoding, transcoding, digital transport, and broadband product solutions in the United States.

Low with weak fundamentals.

Similar Companies

Market Insights

Community Narratives